13 November 2019

By portermathewsblog

via reiwa.com.au

Residential master bedroom designed by Meli Studio

Downsizing is a part of life, as well as part of your property journey. But, just because you are moving into a smaller space, doesn’t mean you have to downgrade on the visual appeal.

We spoke with interior design expert, Julie Ockerby of Meli Studio who specialises in sophisticated living for seniors nationwide, who said downsizing is the perfect opportunity to design your ‘forever home’ exactly the way you want it.

Here are Julie’s 10 tips to help you downsize in style, while making the most out of your smaller space.

1. Only keep the things you love

Downsizing gives the perfect opportunity to give away or even sell anything in your life that doesn’t make your heart sing.

It may well be that you’ll need to buy smaller furniture items anyway, so consider this as an opportunity to let go of tired old pieces and replace them with the furniture that you’ve always wanted, especially when you don’t have to worry about pleasing anyone but yourself!

2. Don’t be afraid to be bold

When picking fabrics for any new furniture, throws, bedspreads, curtains or cushions, don’t be afraid to go bold with colours and textures, as this can help bring smaller spaces to life.

To really future-proof your new abode, pick fabrics that are stain resistant and with waterproof backing.

3. Height matters

Make sure that any new furniture is at a height that suits you. Ensure your bed is not too low or too high, while sofas and armchairs should not be too low, for ease of access as you get a little older.

4. Give yourself space

To create a home you can live in for as long as possible, space is essential.

This may seem counter-intuitive when downsizing, but even though you’re probably losing two or even three bedrooms, make sure your rooms are not too small to allow good access around your bed, dining table, chairs and sofas. You’ll be especially thankful for this if you or your friends end up needing a walking stick.

Julie Ockerby holding the fabric collection of her new range

Julie Ockerby holding the fabric collection of her new range

5. Deck the walls

One area you might need to edit a bit, but don’t need to cull dramatically, is your artwork.

Create a dramatic feature wall by covering one wall with your favourite pieces, potentially combining art from several rooms in your old house.

6. Avoid clutter

Clutter is the enemy of good interior design and easy living. Cluttered tables and shelves are harder to keep clean, easier to mess up or knock over, and can actually be confusing on the eye and thus the mind.

You’ll appreciate and enjoy having just your favourite trinkets on display – even if you have to rotate them every now and again.

7. Don’t slip up

Use non-slip tiles wherever possible. Definitely use them in the bathroom, but also consider the kitchen and laundry, where spills can quickly become just as much of a hazard as a wet bathroom floor.

8. Light up your life

Good lighting, especially in often neglected areas like the shower or the dressing space in front of your wardrobes, can make a huge difference to the functionality, aesthetics and safety of essential areas that are used daily.

9. Say no to sharp corners

This applies to all ages and can give you more room to move without worrying about bumping into any nasty corners. It’s also an especially handy tip for when visiting grandchildren are toddling around.

10. Spoil yourself

Finally, splash out a with just a bit of the financial equity you hopefully free up when downsizing on an interior feature you’ve always dreamt of but could never quite afford.

Perhaps it’s a top-of-the-line steam oven, his and hers vanities or a stunning statement piece of art.

Are you looking to downsize in Perth? See what’s for sale.

Comments (0)

08 October 2018

By portermathewsblog

via therealestateconversation.com.au

Almost one in five Aussies are missing out on bargains because they are scared off by auctions.

Source: Real estate insiders

Buyers are throwing great property bargains onto the scrapheap before they have even seen them because they’re scared off by auctions, experts say.

Universal Buyers Agent property expert Darren Piper said buyers are missing out on bargains of up to 25 per cent because they are frightened off by auction sales.

“It can be daunting if you don’t know what you’re doing,” Mr Piper said.

“With television shows turning up the theatre and adrenaline of an auction it can cause buyers quite a lot of anxiety.

“But for those who aren’t put off it can be a great way to get in the door and find a real bargain.”

A recent survey by finder.com.au found one in five Aussies are “terrified” of auctions with many buyers passing over listings with an auction process.

Although the process can be intimidating Mr Piper said professional buyers agents can help to do the heavy lifting for buyers by attending auctions, making bids and finding properties worth inspecting.

“The first reaction many people have when they see a listing set as an auction is to give it a miss.

“We cut through the smoke and mirrors and ask the hard questions to determine if the auction if worth pursuing and just what kind of bargain you could get.

Mr Piper said a client had discounted a listing at 27 Cowper Street, Bulimba believing the auction listing was likely out of their price range.

But after enquiring with the estate agent and working out the value the client was able to secure the property at auction for $50k less than their max price range.

Mr Piper said it is also worth finding out how many bidders are expected to manage expectations and avoid falling into a price war.

“Most buyers turn to water at the thought of standing in a public place staring down other buyers and engaging with a boisterous auctioneer.

“We make the process less scary so buyers have the choice of handing over bidding to an expert and ensuring they get the best deal possible.

“There’s nothing worse than being out bid after you’ve spent time and money on a property, but with the right help you can snap up a real bargain.”

Comments (0)

04 September 2018

By portermathewsblog

via therealestateconversation.com.au

Jon Bahen, director of Abel Property – Cottesloe told WILLIAMS MEDIA about building inspection reports in Western Australia, including what they are, why you need one, and what they cover.

What is a building inspection report? And do you need one?

For most people purchasing a property is one of the biggest financial decisions they will make in their life and it is always important to ensure due diligence on the home has been done. A building inspection report can be part of this process and is a great way to protect your interests and peace of mind.

In most circumstances, a building inspection report is included as a condition of the Contract for Sale. The investigation for this report needs to be carried out by a qualified building inspector, surveyor or builder and the cost for this report is borne by the buyer.

There are a number of different types of building reports with different cost structures. For example, a basic structural inspection can be obtained for $280 for a single level three bed, two bath, brick and tile/metal home with slab on the ground, while a premium inspection which is usually used is around $495. This expenditure is a wise investment considering the potential cost of buying a property that needs extensive unexpected restoration and repairs.

What does a building inspection report look like?

The report will include photos and address of the property, name of the applicant, the time and date and the age of the home. It also lists the name, contact details, and qualifications of the inspector, including their WA Builders Registration number.

Next, a summary of the significant findings will be highlighted to ensure the prospective buyer can easily see what necessary or immediate repairs are required.

The report will contain explanations of the definitions used by the inspector to record the condition of the property and any disclaimers and information about what is not reported on.

The remainder of the pages will contain photos and detailed room-by-room information on the condition of the floors, walls, ceilings, doors, and all fixtures including bathroom and kitchen appliances.

What does a building inspection report cover?

The inspection covers a visual assessment of the property and provides an opinion regarding its general condition. An estimate of the cost to repair the defects is not within the scope of the Australian Standard and does not form part of a report. If the property is part of strata or company title, the inspection does not cover common property, only the immediate interior and exterior.

The electrical and plumbing systems are only checked for basic functioning. If the buyer requires a more detailed report on these systems, they will need to employ licensed professional plumbers or electricians.

Comments (0)

20 August 2018

By portermathewsblog

via www.therealestateconversation.com.au

Reaching the 25 million population milestone should be the catalyst for the creation of productive, vibrant and liveable cities that will underpin Australia’s future prosperity.

Source: Reiwa

Source: Reiwa

Australia’s future rests overwhelmingly with our cities and their ability to become high amenity, high liveability engines of our economy,” said Ken Morrison, Chief Executive of the Property Council of Australia.

“Our population is growing strongly and most of that growth is occurring in our cities. We need to redouble our focus on policies that support investment, planning and collaboration to create the great Australian cities of the future.

“Population targets, decentralisation policies or adjusting immigration rates can’t allow us to take our eyes off the main game which must be our ability to create great cities for current and future generations of Australians.

“The growth of our cities is part of an international trend for cities to be a magnet for people, business, investment and economic and cultural activity.

“We’re not alone in needing to plan, invest and manage for change as the worldwide trends towards urbanisation gathers pace in this ‘metropolitan century’,” Mr Morrison said.

The drivers of urban growth were set out in the ‘Creating Great Australian Cities’ research published by the Property Council earlier this year.

It highlighted the growing economic importance of cities around the world, and set out a series of principles and recommendations based on the experience of other fast growing cities of similar size to Australia’s. These cities are capturing an expanding share of business, immigration, visitors, talent and capital flow.

The report found that Australian cities had strengths, including their economic performance investment attraction, higher education and natural environment but they were performing poorly in several key areas critical to success in the metropolitan century, including issues such as transport congestion, fragmented systems of governance, infrastructure investment and limited institutions at a metropolitan scale to manage growth.

“Our cities are at the heart of Australia’s economic, social and cultural life, attracting people, investment and services that drive innovation, creativity and enterprise,” Mr Morrison said.

“Any population policy that doesn’t strengthen Australia’s ability to create great cities of the future is completely missing the mark.

“Our cities are already a great competitive advantage for Australia, bringing together the people, services and infrastructure to drive our economic competitiveness.

“We need to keep investing in the right infrastructure, plan for a growing future and put in place smarter systems of metropolitan governance to capture the full potential of the metropolitan century while sustaining the quality of life and access to services that Australians value.

“We need to take on both the challenges and opportunities of the ‘metropolitan century’ and not run away from the reality that growing cities can be successful cities and great places for people to live and work.

“With the right planning, policies and ambition, we can create truly great cities for a growing Australia,” Mr Morrison said.

Comments (0)

13 August 2018

By portermathewsblog

via therealestateconversation.com.au

As we head into 2018, I believe this year will be one of market transition across the country.

It will also be a year of finance, with those who can secure it likely to be the ultimate winners. It’s no great surprise that Sydney and Melbourne are transitioning out of the strong price growth they’ve experienced over recent years.

However, that doesn’t necessarily mean they’re going backwards. Instead, their growth may fall back to one or two per cent annually. That market transition will be driven by reduced consumer confidence, which is a reflection of the price of money as well as how easy it is to secure finance. Confidence also usually wanes when the media starts speculating about softer market conditions.

It’s clear that Sydney’s market has already come off the boil and Melbourne’s is likely to follow suit but in a more moderate way.

Positive transition

It’s important to realise that transitions happen in both directions, with some markets slowing while others are strengthening. I believe this will certainly be the case for Brisbane, which is on track to transition to stronger market conditions.

That said, Brisbane is a city of different markets with the inner-city in the midst of it’s well-publicised new unit oversupply. It is Brisbane’s outer suburbs that represent good value and cash flow, as well as attractive lifestyle drivers, that will experience the most improvement in my opinion.

Of course, there are already increasing numbers of interstate migrants into Queensland given it’s housing affordability as well as it’s many attractive lifestyle opportunities.

SA and WA back in the game

I also believe it will be a year of positive transition for South Australia and Western Australia. South Australia always seems to lag behind other capital cities and by the time most investors realise what’s happening it’s too late. The truth is that South Australia’s transition is already happening.

In Adelaide, however, it’s only the 15-minute ring around the CBD as well as areas like Christies Beach that are worth considering. We all know WA has been woeful over recent years, but this could be the year it finally turns a corner. The State Government has been concentrating on jobs growth, with employment numbers reportedly starting to improve. If locals start spending money because they’re more confident about their livelihoods, then, that in turn will stimulate the market.

However, when I say WA, I mean Perth and select areas within the city as well. If interest rates increase, even if only by a blip, those green shoots of confidence might evaporate as fast as they appeared. Tasmania will continue to percolate until cash flow doesn’t look as attractive as other areas, such as Brisbane. I remain skeptical about Tasmania’s growth because it’s mainly being driven by investors chasing investors purely because of affordability.

Owner-occupiers aren’t the ones who are pushing up prices.

I believe it may lurch from under-supply to over-supply pretty quickly – and then you’ll probably have 10 years of no price growth at all.

A question of money

We’re now into our third calendar year of lending restrictions and I don’t believe they’re going anywhere anytime soon. Investor numbers have only recently started to slow so there will need to be more evidence before APRA loosens it’s grip on investment lending. Banks might want more flexibility but it’s unlikely to happen. So 2018 will be a year of market transition but it will also be a year of finance. The price of money remains cheap but it’s availability continues to be constrained.

That’s why I believe it will be the sophisticated investors who know which markets are transitioning to the positive – and who can secure finance – who will be the property victors by the end of the year.

Comments (0)

10 August 2018

By portermathewsblog

via popsugar.com.au

Image Source: Studio McGee

Image Source: Studio McGee

Wouldn’t it be so nice to know what an interior designer actually notices in your home? Having this information would make it that much easier when you clean or decorate new spaces, or even when you decide what to renovate and what to leave as is. It can be somewhat difficult to take a critical eye to your own space that you see consistently day after day, but knowing where to place your focus and creative energy would certainly help to take out some of that guesswork, so we decided to reach out to design professional Shelly Gerritsma from Canter Lane Interiors instead. Read on to learn the five design elements she always notices first and wants you to focus on first as well.

Flooring

Image Source: A Beautiful Mess

Image Source: A Beautiful Mess

As soon as she steps into your home, Shelly notices what’s beneath her feet. “Flooring is a major item. If carpet is dated/worn/sagging/etc, it really devalues the home,” Shelly says. So, instead of using that area rug that has probably seen better days, opt for a brand new design in a fun print, or if you want to really get creative, try adding hardwoods in a funky colour. Shelly will notice!

Wall Colour & Finish

Image Source: Inspired by Charm

Once she’s assessed the flooring, Shelly is onto your wall colour and finishes. She advises that “using the proper paint finish for spaces is huge. Do not use a semi-gloss or a gloss paint finish on main living walls as it cheapens the space and looks too harsh. Stick with a flat or matte finish.” She also reminds us that nothing draws negative attention quicker than sloppy paint lines, so always ensure that those appear neat and finished.

Ceilings

Image Source: A Beautiful Mess

Image Source: A Beautiful Mess

Another foundational element that will draw major attention from Shelly is your ceiling. Whether you want to modernise the appearance of your ceiling or you just need to open up the space a bit, this is one area that you won’t regret putting some time into. Shelly confirms that “smoothing out popcorn ceilings is a great way to add home value and to make spaces feel larger due to the shadows cast by this dated finish.”

Scale-Appropriate Furniture

Image Source: Studio McGee

Image Source: Studio McGee

Properly scaled furnishings are key when it comes to creating a harmonious flow that’s sure to get noticed in your home. Shelly says, “Make sure that your furniture is not overwhelmingly large or so small that it looks out of balance in the space.” A huge sectional that is crammed into a space or a dainty nightstand displayed in an oversize master bedroom will do nothing but draw negative attention.

Clutter!

Image Source: Studio McGee

Image Source: Studio McGee

And lastly, we finish up with none other than that attention-grabbing eyesore: clutter. Yes, clutter! Shelly promises, “Keeping spaces clean and clutter to a minimum is a huge plus. Our spaces truly affect our well being, and spaces that are messy and dirty can have major psychological and physical impact.” Plus, not only will your guests appreciate your clutter-free home but you too will benefit from your Zen space.

Comments (0)

07 August 2018

By portermathewsblog

via https://www.therealestateconversation.com.au

Property prices in Perth have strengthened during the June 2018 quarter, according to fresh research from the Real Estate Institute of Western Australia (REIWA).

Simon McGrath, principal of Abel McGrath in Perth told WILLIAMS MEDIA now is the time to “be strategic and make a committment to securing a property in that location you’ve always wanted”, as data from the Real Estate Institute of Western Australia reveals property prices in Perth are strengthening.

REIWA President, Hayden Groves told WILLIAMS MEDIA the data indicates Perth’s median house price would settle at around $520,000 for the June 2018 quarter, which was up one per cent compared to the March 2018 quarter and two per cent compared to the June 2017 quarter.

“In addition, Perth’s median unit price is expected to lift by 4.9 per cent to $419,500 for the June 2018 quarter, which is 2.3 per cent higher than the same time last year,” Mr Groves said.

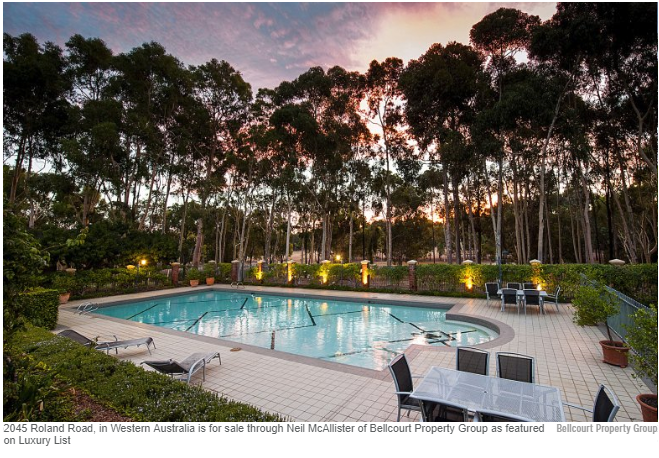

2045 Roland Road, in Western Australia is for sale through Neil McAllister of Bellcourt Property Group as featured on Luxury List

2045 Roland Road, in Western Australia is for sale through Neil McAllister of Bellcourt Property Group as featured on Luxury List

“After declining during the March quarter, it is pleasing to see prices rebound strongly this quarter. With the worst of the market downturn appearing over, the improvement in house and unit prices this quarter suggests buyer confidence is returning which should bode well for sellers as we move into spring,” Mr Groves said.

Mr McGrath’s advice to those looking to enter the market is to act now.

“At times like these, properties become available that would generally not be available. That is the big gift in this market,” McGrath said.

Overall, Mr McGrath says the market is “okay, but not great”.

“Perth is nothing but a big mining town. The flow-on effect from the mining industry affects Perth’s real estate market, so you’ve got a real upswing. Behind the scenes there is plenty of optimism.

“There is still plenty of caution in the market, prices aren’t shooting up. It is a very stoic market.

“We are seeing reasonable numbers at home opens, but it can be very spasmodic. Some home openings will be fantastic, others very quiet – there is no rhyme or reason to it,” Mr McGrath continued.

With 6,900 sales recorded during the June 2018 quarter, sales volumes declined during the June quarter. Mr Groves said the onset of winter likely contributed to subdued activity levels.

“It’s not uncommon for activity to drop off this time of year. Traditionally, activity tends to slow during the winter months before picking up again in spring,” Mr Groves said.

2045 Roland Road, in Western Australia is for sale through Neil McAllister of Bellcourt Property Group as featured on Luxury List

2045 Roland Road, in Western Australia is for sale through Neil McAllister of Bellcourt Property Group as featured on Luxury List

Despite the overall decline in sales, numerous suburbs recorded more sales this quarter than they did in the last quarter.

“The suburbs with the biggest improvement in house sales were North Perth, Queens Park, Singleton, Camillo and Beldon, while West Perth, Balcatta, Rockingham, Claremont and Mount Lawley had the biggest improvement in unit sales,” Mr Groves said.

“Good quality family homes attracting a lot of attention”

REIWA data shows the composition of sales shifted during the June quarter, with more house sales recorded in the $800,000 and above price range than in the last quarter.

“The June 2018 quarter continued the trends observed during the December 2017 quarter, with good quality family homes attracting a lot of attention in aspirational areas,” Groves told WILLIAMS MEDIA.

“As the Western Australian economy begins to regain strength and owner-occupier loans remain the most affordable they have been in decades, buyers are recognising there is good opportunity to secure a family home in areas that might previously have been considered out of reach,” Mr Groves said.

Listing stock has “hit the ceiling”

Mr Groves told WILLIAMS MEDIA stock levels across the metro area have declined 1.1 per cent during the June 2018 quarter.

“We certainly appear to have hit the ceiling as far as listing stock is concerned. Despite fewer sales being recorded this quarter, it is encouraging to see stock levels have continued to be absorbed,” Mr Groves said.

On average, it took 67 days to sell a house in Perth during the quarter, one day faster than both the March 2018 and June 2017 quarters.

2045 Roland Road, in Western Australia is for sale through Neil McAllister of Bellcourt Property Group as featured on Luxury List

2045 Roland Road, in Western Australia is for sale through Neil McAllister of Bellcourt Property Group as featured on Luxury List

Mr McGrath told WILLIAMS MEDIA that although the market is pretty tough, his area in the western suburbs of Perth have short supply.

“There’s no denying – it is pretty tough. The good news in the western suburbs is that we have got short supply, whereas in the greater Perth market there is oversupply in many places. The short supply in the western suburbs is ticking the value of buoyance.” Mr McGrath said.

Less vendors discounting their asking price

Data for the June 2018 quarter shows the proportion of vendors who had to discount their asking price in order to achieve a sale declined by five per cent.

“With reductions observed in average selling days and discounting, this is a good indicator sellers are listening to the advice of their agents and pricing their property in line with market expectations,” Mr Groves said.

Comments (0)

30 July 2018

By portermathewsblog

via The West Australian

The West Australian economy is “out of the woods”, one of the nation’s most respected forecasters has declared, with housing and wages finally gaining traction.

Amid warnings the Turnbull Government was making the same mistake of the Howard government by spending a temporary revenue bump on expensive personal income tax cuts, Deloitte Access Economics said the outlook for WA was definitely brightening.

The State endured its worst year on record through 2016-17 while the domestic economy had been in the doldrums for the past four years. But a string of data, including job figures, point to an important turnaround.

Deloitte Access director Chris Richardson said it was now clear WA was recovering from the economic “wave” that was the end of the mining boom.

He expects a lift in retail sales, population growth, wages and housing construction will all improve through this year and accelerate into 2019-20.

Wage growth alone is tipped to more than double the insipid 0.6 per cent growth endured by private sector workers last financial year. “WA’s economy is out of the woods, but it isn’t quite yet out of the doldrums,” Mr Richardson said.

“The good news is that WA’s economy is gradually making its way on to a more settled and sustainable path. The State is restructuring and rebalancing and looking for non-mining related sources of growth.”

While most focus has been on the collapse in engineering spending by the mining sector, Deloitte Access highlighted the step-up by the State Government to fill the void.

It said the first stage of the $3 billion Perth Metronet, which includes 72km of rail line and 18 stations, would give a needed boost to the local economy. The situation is a little different for the Federal Budget, with Deloitte Access concerned that recent tax cuts are built on a mirage of improved tax revenues.

Mr Richardson said tax cuts were built on an increase in tax revenues that was likely to be transitory. The Budget was also expecting to absorb the cuts while it was still in deficit.

He said a gradual slowdown in China would eat into the better tax collections from the resources sector while a tightening of credit would hit east coast property markets. “Oz has repeated an old mistake: spending a temporary revenue boom on permanent promises,” he said.

Comments (0)

23 July 2018

By portermathewsblog

via therealestateconversation.com.au

Real estate in Perth is at its most affordable on record, as falling prices give first home buyers their best chance of stepping onto the property ladder, according to the Housing Industry Association (HIA).

37 Marita Road, Nedlands, Perth under offer with Michelle Kerr from Abel McGrath as featured on Luxury List. Abel McGrath

37 Marita Road, Nedlands, Perth under offer with Michelle Kerr from Abel McGrath as featured on Luxury List. Abel McGrath

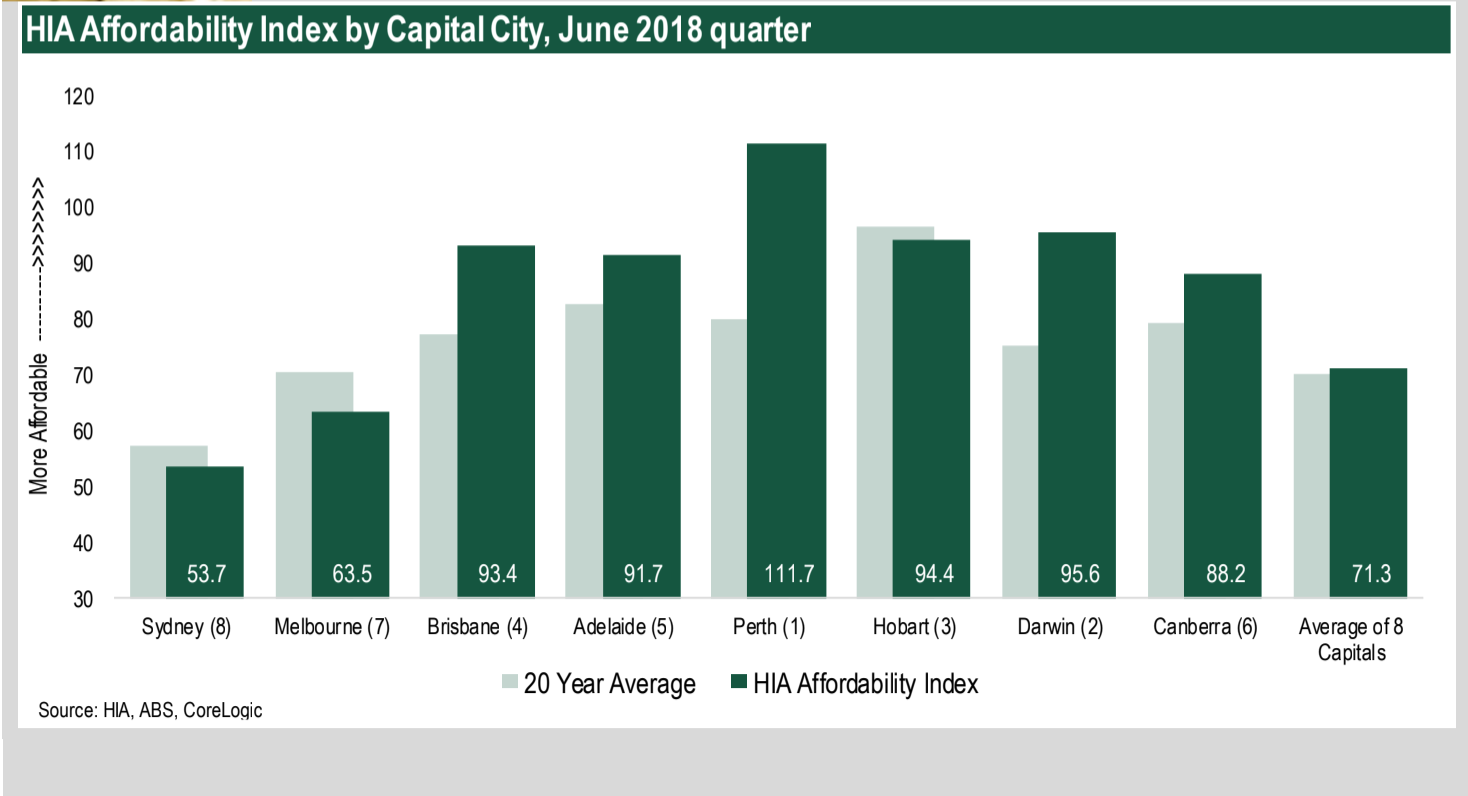

Figures from the Housing Industry of Australia (HIA) Affordability Index show Perth is the most affordable of the nation’s capital cities.

In the June 2018 quarter, the Housing Industry of Australia (HIA) Affordability Index registered 74.9, up by 0.4 per cent over the quarter and up by 0.8 per cent compared with a year earlier when affordability had reached its poorest level in nearly six years.

The HIA Affordability Index is designed so that a result of exactly 100 means that precisely 30 per cent of earnings are absorbed by mortgage repayments.

Higher results signify more favourable affordability – those above 100 signify that mortgage repayments account for less than 30 per cent of gross earnings, whereas scores below the 100 mark mean that more than 30 per cent of average earnings are absorbed by mortgage repayments.

According to HIA’s analysis, Perth is the most affordable capital city to buy a home in with an affordability rating of 111.7, closely followed by Darwin (95.6), Brisbane (93.4), and Hobart (94.4).

37 Marita Road, Nedlands, Perth under offer with Michelle Kerr from Abel McGrath as featured on Luxury List.

“Perth continues to present good opportunities for buyers, especially in the more affordable end of the market,” President of the Real Estate Institute of Western Australia (REIWA) Hayden Groves told WILLIAMS MEDIA.

In news that will surprise approximately no one, Sydney remains the least affordable capital city to purchase in, with a miserable affordability rating of 53.7.

Key findings from the HIA Affordability Report

- Easing price pressures are driving the improvements in housing affordability

- Housing affordability improved in five of Australia’s eight capital cities for the June 2018 quarter – Hobart, Melbourne and Adelaide were the only capital cities to see a deterioration

- Perth is now Australia’s most affordable capital city, followed closely by Darwin and Hobart

- Mortgage repayments account for 42.1 per cent of earnings in capital cities and 34.3 per cent in regional markets

HIA Economist Diwa Hopkins says affordability is hugely improving considering this time last year, affordability was at the lowest level in over six years.

“Easing house price pressures are providing some affordability relief for home buyers.

“Previous strong price increases were met by an unprecedented level of building which is now starting to come online. This is providing much-needed additional supply in key markets, helping to reduce price pressures and ultimately improve affordability for home buyers,” Hopkins said.

Source: HIA

Source: HIA

But the current plunge in house prices is unlikely to last for long, Hopkins warns.

“With an even balance in overall housing supply and demand in these key markets, the current downturn in dwelling prices is unlikely to be prolonged or severe.

“We could expect this downturn in prices to play out like previous cycles. They typically last 12 to 18 months, with the size of the fall modest relative to the immediately preceding expansion,” Hopkins said.

Ongoing fallout from the resources boom and bust cycles to thank for price plunge

Both rent and dwelling prices have been falling in Perth and Darwn for the last five years, amid the ongoing fallout from the resources boom and bust cycles.

While this is great news for renters and buyers in a market previously notorious for poor housing affordability, Hopkins warns it may be symptomatic of wider economic problems and in particular slowing population growth.

The weak economic conditions in both of these cities are seeing more people leave for interstate than are arriving, Hopkins says.

In particular population growth has followed these cycles and currently both cities are seeing more people leave for interstate than are arriving, resulting in spare capacity in their respective housing markets.

New home building activity has also fallen sharply in both cities as a result of the price declines, which risks causing an undersupply to emerge over the longer term in Perth and Darwin.

Groves told WILLIAMS MEDIA buyers are cautious right now.

“Trade-up family home buyers are lamenting they didn’t buy six months ago when the bottom of the market was apparent. Sellers who’ve been considering selling over the past few years are now cautious about coming to market too soon in anticipation of selling for more in the short-term future, especially down-sizers looking to maximise their capital-gains-tax-free benefit.

“Investors are likely to remain cautious until they see tangible growth which is likely to be towards the end of this year,” Groves said.

The best suburbs in Perth to invest in

According to data from REIWA, the rental yield for the Perth Metro region for houses currently sits at 3.6 per cent based on the overall median house rent price of $359 per week and median house price of $512,500.

This means on average, a typical property investor can expect to generate a 3.6 per cent annual return on their house purchase price.

REIWA says the suburbs of Bullsbrook, Medina, Parmelia, Armadale, Cooloongup, Maddington, Stratton, Camillo, Warnbro and Merriwa are house rental hotspots, offering investors the best return on their investment.

9 Bates Way, Warnbro available for rent through Property Osborne Park, as featured on Thehomepage.com.au

9 Bates Way, Warnbro available for rent through Property Osborne Park, as featured on Thehomepage.com.au

“Whilst the Perth property market is showing signs of a recovery in 2018, buyers and tenants remain the beneficiaries of the current environment, with a good supply of housing and rental stock to choose from at the more affordable end of the property market,” he said.

“With our local market on the cusp of recovering, now is the time for buyers and investors to take advantage of favourable conditions before our local market becomes less affordable,” Groves told WILLIAMS MEDIA.

Chief Operations Officer for Professionals Real Estate Group in Western Australia, Shane Kempton agrees.

“In the vast majority of areas in Perth, property prices are very low and buyers should now move quickly to secure a property before the recovery in the market gains further momentum to avoid buyers regret,” Kempton told WILLIAMS MEDIA.

View the Housing Industry of Australia (HIA) Affordability Index here.

Comments (0)

09 July 2018

By portermathewsblog

via reiwa.com.au

Are you looking to jazz up your home but don’t have the available funds? Maybe you are planning to sell, or just want to give it a facelift?

Are you looking to jazz up your home but don’t have the available funds? Maybe you are planning to sell, or just want to give it a facelift?

Either way you don’t need to spend an arm or a leg, you just need a little bit of inspiration.

Here are five ways you can give your home the ultimate make-over without breaking the bank.

1. Clean out/de-clutter your home

Start by a good old clean out – this you can do for free. Living in a messy, cluttered house will have you feeling anxious and itching for a change of atmosphere, plus it won’t make a good first impression on visitors.

rid of junk you don’t need, wash the walls, doorways and clean all the dust and cob-webs! This will have an immediate effect on the oxygen circulation of the house – breathing in fresh air is the start to feeling good in your home.

2. Paint the walls

Whether you want to change the colour all together or just want to lift the look,the most effective way to rejuvenate your home is to apply a fresh coat of paint.

Light to neutral colours gives you more flexibility with furniture and décor, and creates the illusion of space. Plus, painting your home is relatively cheap, unless you want to seek a professional painter to do the job.

While you have the paint out, it is also a good idea to re-paint the doors, door frames, skirtings and ceilings in simple white, to freshen up the aesthetic of your house.

For some inspo, find out how to select the right paint colour for your home.

3. Re-decorate

It is ridiculously affordable to decorate your home these days, you just need to trigger your creative side.

Adding plants and some pottery to your home is a great way to set the mood and can be very affordable and easily maintained with a little bit of TLC. Adding a splash of greenery to your space is not only aesthetically appealing, but pot plants also help purify the air, just make sure you buy plants suitable for indoors.

Candles, incense and infusers also have dual purpose when it comes to décor. They look good, and smell good, once again adding that infused delicious aroma to your home.

When it comes to the bedroom and living rooms, pillows, throws and new linen is something that will always catch the eye. What better feeling is there than purchasing fresh new bedding? Try and coordinate this with whatever colour you paint the walls or keep the same colours but you can mix up the styles.

Remember, simple can sometimes mean more, so try keep all decorations minimal but effective.

4. Rearrange furniture

If you already love your furniture but still feel sick of it, a simple re-organise of the couches, TVs beds, tables etc can make you feel like you’re in a whole new house.

Making different uses out of the things you already have in your home will save you money. You think you might be sick of an item, but put it somewhere else and you might fall in love with it all over again.

5. Update light fittings

Lighting is the key to making any home stand out, and you would be surprised what a simple swap of the light fittings will do.

If you’re on a budget consider going for one or two designer light fittings in the main living areas, then cheaper ones for the other rooms.

While we are on the topic of lighting, you can also replace the light switch covers which won’t cost you a lot at all. Swap out those old fashioned, plain switch covers for silver, stainless steel or modern white covers.

Comments (0)

25 June 2018

By portermathewsblog

via therealestateconversation.com.au

Many investors steer clear of vacant land because they mistakenly believe they can’t claim interest repayments on it.

In fact, the biggest thing that most accountants get wrong when advising clients on vacant land is that the interest component on it isn’t tax deductible.

I’ve had many arguments with many accountants about this topic over the years!

The key component is the clear intent to build a property within a reasonable timeframe. If the investor was audited, the investor would need to prove that the timeframe – whether it’s a few weeks or months – was necessary to enable to construct the investment property.

I’ve heard this ‘non-advice’ so many times over the years and that’s why it’s so important that you get advice from a property accountant with a strong understanding of the relevant legislation.

Which land is best?

With vacant land, there are a number of different strategies that you could implement.

The first one is residential land that is being carved up by a developer, but you buy before the titles for each individual block have been registered. Effectively, you’re buying land off the plan, but it’s important to understand that there are pros and cons to this strategy.

The pro is that if it’s in a high-demand area and you’ve bought during the early stages of development, you tend to make some money. You also generally only need to put down a few hundred or thousand dollars as the deposit. Naturally, because you are very much dependent on how fast the developer can register each block, you’re at the whim of the market, which can be a con. For example, in my portfolio, I once bought 18 blocks of land that were not yet registered.

In fact, registration wasn’t supposed to happen for another two years. However, it happened in just eight months and I wasn’t ready. So all of a sudden I had 18 parcels of land that I had to settle on, but I didn’t have my finance organised.

After discussing it with the developer, I ended up settling on four of them and he released the other 14 back to the market, which worked out well for him because the market had improved.

So, if the land is registered well ahead of time, you can be left scrambling.

On the other hand, if registration takes longer than expected, the market could have slowed down. Like any off-the-plan project, you only need one bad valuation to negatively impact

the entire subdivision or development. Plus, everyone will be building at the same time, which means you’re competing for trades and will likely be finished at the same time, too, and that means a strong likelihood of softer prices.

What about greenfield and infill sites?

When I say greenfield sites, I mean blocks of rural land that you intend to rezone for residential usage. Now this is a strategy for more advanced investors because there is more risk as well as a higher financial component required for earthworks and approval costs. Greenfield sites can be bought for an affordable price, but if you can’t get the subdivision approved you need to have the money behind you to fight all your way up to the Environment Court if necessary.

A better strategy is to target infill sites within already established residential areas.

In this scenario, you buy a larger block of land, usually with a house on it, to carve off the land at the back or the side to sell as vacant or with a new property on it.

The other option is to subdivide, then construct a new dwelling and then keep both. Infill developments can also lean towards knocking the old house down, splitting the block into two and selling the vacant land, or building two houses or even multiples. It must always come back to whether there is a market for your project and whether the numbers add up, because you must take into account all of the costs on the way in and on the way out.

That way you can make an educated decision whether to keep holding long term or take your profits to invest elsewhere.

Whichever strategy you choose, you must do your figures on the worst-case scenario to see if it adds up. That’s because land generally has a lower, or no yield to start off with, which means your holding costs can be higher than with a house, for example.

At the end of the day, vacant land as a strategy, does work. You just need to have your eyes wide open to ensure your figures are correct and you must understand that it might be a while before income rolls in.

Finally, it goes without saying that you must get tax advice from a specialist accountant who understands property. If you don’t, you could end up with pockets just as vacant as the land you’re investing in.

Comments (0)

22 June 2018

By portermathewsblog

via popsugar.com.au

If searching for your keys is a part of your morning ritual, it’s time to break the cycle. Being organised is more than just a personality trait, it’s a lifestyle decision that’s easier to achieve if you stock your home with the right tools. These 15 clutter-busting essentials will make your days feel longer and less stressful. Cheers to that!

Idea: If you don’t want to hang a key hook, do yourself a favour and get a key catchall. Having a designated place to place your keys when you walk through the door will save you from the “running late” syndrome. Don’t be that person.

Get it: Making your own leather catchall is easier than you’d think. Follow this tutorial on A Beautiful Mess to DIY your own

Image Source: Bahar Yurukoglu for Domino

Image Source: Bahar Yurukoglu for Domino

Idea: You know how it goes . . . You take the time to meticulously fold sheets and towels, and by the end of week, it looks like a bomb exploded in your linen closet. Here’s where clear shelf dividers come in. They’ll keep your stacks of linens in order without creating an eyesore.

Get it: Stock up on these acrylic shelf dividers to tame your most unruly closet.

Idea: Put your pantry on display by keeping dried goods and other treats in lidded glass jars.

Get it: You can get her kitchen jars at Ikea.

Idea: If you’ve seen these used to hang pots and pans, you’ll be happy to know that the idea translates for any room in the house. We love how Sugar + Cloth blogger Ashley Rose used one for above-the-bed storage and decor.

Image Source: Paul Costello for Domino

Image Source: Paul Costello for Domino

Idea: If shuffling through a drawer to find a tube of lipstick gives you anxiety, you’ll be amazed by the efficiency that a simple drawer organiser can offer.

Idea: Forget the space-saving allure of forgoing a knife block — we’re crazy about the fact that you can see the shapes and sizes of your most utilised knives while keeping them in reach.

Idea: It’s amazing how quickly a tray can corral clutter. Bonus points for turning the top of your toilet into an extension of your medicine cabinet (with the addition of a slim bud vase and framed picture, of course).

Image Source: Cahan Eric For Domino

Image Source: Cahan Eric For Domino

Idea: Labelled boxes are a great way to organise the things you want out of sight.

Idea: Sure, you can use them to hang a curtain, but they work wonders in making the most out of shelves. Follow Martha Stewart’s lead, and use them to organise kitchen items like pot and pan lids, trays, and cutting boards.

Image Source: Lesley A. Unruh for Domino

Image Source: Lesley A. Unruh for Domino

Idea: Whether you need more storage space for clothes or craft supplies, these wall-mounted mesh drawers allow you to customize your storage and easily see what you’re storing.

-

Makeup Brush Cups

Idea: Instead of cramming makeup brushes into a messy drawer or makeup bag, keep them within easy reach in a stylish cup.

Idea: Whether it’s a drawer filled with neat rows of spices or a creative DIY that frees cabinet space, every organized cook seems to have their spice collection under control.

Get it: A Beautiful Mess has an easy-to-follow tutorial for making these nifty magnetic spice jars.

-

Clever Toilet Paper Storage

Idea: Running out of it when you need it is the worst, but stacking it in plain sight can cramp your bathroom’s style. Kill two birds with one stone by turning a basket into a toilet paper organiser and dispenser.

Image Source: Monica Wang for The Everygirl

Image Source: Monica Wang for The Everygirl

Idea: A lack of cabinet space doesn’t have to stop you from owning bulky appliances like KitchenAid mixers and high-powered blenders. Some of the cutest rentals we’ve seen use stainless steel shelves for stylishly organization, making it easy to keep everything within sight. The best part? You can extend them or shorten them for a customized height.

Get it: This shelving unit is a great starter package.

Comments (0)

18 June 2018

By portermathewsblog

via therealestateconversation.com.au

Buying and selling property in WA has traditionally been by way of a conventional private treaty arrangement, however buyers and sellers are missing out on a more pure form of transaction, and that’s the auction.

Granted, auctions are becoming a more accepted selling method and the numbers of weekly auctions in WA has increased significantly over the past five years, but still lag a long way behind private treaty sales and the Eastern states. So why is that we’ve been slow to jump on the auction bandwagon?

Firstly, WA’s law for property transactions using the current “Offer & Acceptance” method protect both buyer and seller and in the majority of cases are easy to follow. The system works effectively for all parties to the transaction including the buyer, seller, settlement agent/conveyancer and banks. The downside of this system is that is can be time consuming and in many cases is conditional upon buyers obtaining finance, property inspections, having to sell their current home, etc.

More importantly, the system has a major flaw in it and that’s the asking price is disclosed and typically buyers knock the price down to where they feel comfortable – so it’s not good for sellers.

So why should we look to auctions? The auction system is the most pure form of selling and buying as there are no “secrets” surrounding price or selling terms; all terms are provided in the marketing campaign and the buyers set the price on where they see value. Selling by auction in most cases is quicker than private treaty. And the seller has three bites of the cherry; sell before auction day, on auction day or usually within 30 post auction day.

There are two main misconceptions surrounding auctions:

1. They cost too much. The cost of the auction is merely the auctioneer’s fee for calling the auction and working with the seller, buyer and agent to achieve the desired result. Typically, an auctioneers’ fee is in the vicinity of $700 to $1000. All other costs are associated with the marketing campaign to promote the property.

2. Auctions only “work in expensive areas”. That’s just a suburban myth. There’s many examples of properties below the current Perth median price of $510,000 selling at auction.

WA is one of only two states, the other being Tasmania, that don’t have a cooling off period in our property contracts. A cooling off period allows the buyer to “break” the Offer to Purchase usually between 2 to 5 business days after the offer has been signed. In other words, if the buyer changes their mind for whatever reason they can legally break the offer and walk away for a very small consideration to the seller, usually between 0.2% – 0.25% of the purchase price.

As WA doesn’t have cooling off provisions in our property contracts, this makes it far too easy for sellers and agents to default to Private Treaty transactions. If cooling off provisions were introduced to our property contracts, I’d predict a huge increase in the number of property auctions taking place in WA.

Finally, too few real estate agents embrace auctions and the auction process with vigor. They lack confidence and in some cases, the ability to explain the different marketing options available to sellers and automatically default to Private Treaty. This is a marketing injustice to sellers and the sooner we can demystify and legitimise the auction process for both buyers and sellers, the better.

Comments (0)

11 June 2018

By portermathewsblog

via therealestateconversation.com.au

Buying your first property is hard, so let’s make it easier for you.

Congratulations! You have decided to take the plunge, you have done some reading on what the various responsibilities when it comes to being a homeowner, you have spoken to the bank and have an idea of how much you are able to afford.

These steps take some time so we are here to encourage you to take the next step in home ownership. We know it’s a little bit nerve wrecking and a little bit scary, but we have compiled some advice from our in house experts to help you with this exciting time!

Looking for affordability without compromising on location

For many of us, your first home is not going to be your forever home. We recommend taking a holistic approach to purchasing property. Even if you are going to be living in that property, look at it as an investment as well.

For those first homebuyers who do not want to compromise on space, you may have to look further out depending on your budget or look for townhouses or terraces. If you are looking to keep more of your lifestyle, an inner city apartment may be the apt living situation for you.

What we emphasise is buying smart and seeing your home purchase as more than just a living situation but a step in growing your portfolio. You might want to ask yourself “How much rent will I get for this apartment?” or “What has been the capital growth in the area over the last few years?”.

We think asking these questions will not only give you peace of mind if you have to move out and rent or sell your property, but it is also how many people start their property portfolio. The first one does not have to be picture perfect, but it helps if it is a sound investment.

Location and amenities

The building, home or internal features are not the only things that you should consider when you buy. Are you in a desirable school catchment zone, are there amenities or transport facilities planned in your area or has a new shopping centre been planned?

Looking at the amenities and area around you is particularly important, as they are great financial health indicators that the area you are looking to buy in has infrastructure and amenity to attract people to live there.

Look on suburb out from your dream location

Looking for undervalued suburbs next to the pricier areas is always a something we recommend to our first home buyers – over time, population growth and gentrification will mean that there will be capital growth in your area.

It’s always good to also look at areas with employment growth as this will increase demand for homes in that area. Finally, do your research. It takes time to go through all the listings in the area you love and view the various prices they get sold for but it’s all worth it when you know you are on to a great purchase.

Comments (0)

06 June 2018

By portermathewsblog

via reiwa.com.au

The latest REIWA Curtin Buy-Rent Index for the March 2018 quarter has revealed it’s the best time to buy in Perth since 2013.

The latest REIWA Curtin Buy-Rent Index for the March 2018 quarter has revealed it’s the best time to buy in Perth since 2013.

The Index, released quarterly, assesses whether it’s better to buy or rent in Perth based on past and current trends in the economic and property market climate.

REIWA President Hayden Groves said the March 2018 quarter index showed the annual rate of house price growth required over 10 years to break even in the Buy-Rent Index had declined from 3.3 per cent to 3.1 per cent over the quarter, suggesting an improvement for prospective homebuyers weighing up the decision.

“To put that into perspective, Perth’s annual house price growth rate has been 5.9 per cent for the last 15 years. Based on the March 2018 quarter Index, house prices in Perth would only need to grow by more than 3.1 per cent annually for buying to be considered more financially beneficial than renting,” Mr Groves said.

“This improvement in buying conditions can be attributed to the Perth median house price softening by 1.9 per cent during the March quarter, while the median house rent price increased $5 to $360 per week. We also saw the 10 year average mortgage rate drop to 6.43 per cent, which means home owners are paying less on their mortgage repayments.

“This is the most affordable buying environment we’ve seen in Perth for some time, so if you’ve been weighing up whether to buy, now is the time to take advantage of favourable market conditions,” Mr Groves said.

Mr J-Han Ho, a Property Researcher and Senior Lecturer in the School of Economics and Finance at Curtin University, said the data indicated a continued improvement for the home buyer in the near future.

“Our analysis shows home buyers gaining an advantage, largely due to the low interest rates for home loans, home ownership costs continuing to be affordable and the median rents stabilising,” Mr Ho said.

View the March 2018 quarter Buy-Rent Index.

Comments (0)

01 June 2018

By portermathewsblog

popsugar.com.au

Image Source: POPSUGAR Photography / Lisette Mejia

Image Source: POPSUGAR Photography / Lisette Mejia

If the idea of getting your home company-ready is keeping you from hosting a dinner party or even your out-of-town in-laws, we can help. Sure, you could spend all day cleaning and decorating in anticipation, but who has the time? Here are the only things you really need to do before your guests arrive. Don’t worry — they are nothing but easy.

The Scent of Your Home

Image Source: POPSUGAR Photography / Brinton Parker

Image Source: POPSUGAR Photography / Brinton Parker

Decor isn’t the first thing guests

notice when they walk through your door — it’s the smell. Whether you’re

concerned about the fish you cooked the night before or your dog skipping a

bath — or worse, the scents you’ve become nose-blind to — put your

mind at ease by lighting a candle or simmering a small pot of citrus peels and

cinnamon sticks a half hour before guests arrive. We can’t get enough of these yummy-smelling candles.

A Well-Stocked Bar

Image Source: POPSUGAR Photography / Lisette Mejia

Image Source: POPSUGAR Photography / Lisette Mejia

After greeting guests, the first

thing that you will want to do is offer them a drink. You don’t need to be full

service, but make sure you have the home bar basics covered.

Fresh Flowers

Image Source: POPSUGAR Photography / Mark Popovich

Image Source: POPSUGAR Photography / Mark Popovich

Flowers are the only decoration a

house really ever needs, no matter the occasion (although we feel pretty

strongly about candles too!). To get the most bang out of your buck, buy potted

flowers, like orchids. They may look delicate, but with proper care, they

will last for a month or longer.

The Lack of Clutter

Image Source: POPSUGAR Photography / Grace Hitchcock

Image Source: POPSUGAR Photography / Grace Hitchcock

Even if you don’t have time to do a

deep cleaning, you can still organise your clutter. Get a tray or a set of

lidded boxes for each room and corral all the odds and ends — remotes,

keys, mail — in one place. Guests will feel relaxed in a space that

appears organised, even if it is just for show!

A Tidy Bathroom

Image Source: POPSUGAR Photography / Grace Hitchcock

Image Source: POPSUGAR Photography / Grace Hitchcock

Before guests arrive, make sure your

bathroom has clean hand towels and enough toilet paper. Extra points for wiping

down surfaces and lighting a candle

An Organised Entryway

Image Source: POPSUGAR Photography / Lisette Mejia

Not only is it the first place and

last place that your guests will see, your entryway is also where they will be

dropping their coats and bags. Depending on how much room you have, add a coat

rack, umbrella stand, and a place to sit while taking shoes on or off.

Comments (0)

28 May 2018

By portermathewsblog

reiwa.com.au

One of the most widely misunderstood elements of real estate is what condition a property should be in at settlement or possession.

One of the most widely misunderstood elements of real estate is what condition a property should be in at settlement or possession.

What does ‘buying as inspected’ really mean?

In short, a property is sold “as inspected”. If there was dust on a ceiling fan when you first inspected before contracting to buy then the fan can be dusty at settlement. The same goes for a dirty oven, a blown light globe or a squeaky laundry door. If it was dirty, blown or squeaky at inspection before purchase then so it should be at settlement.

Buyers will typically expect that the property is handed over to them spick n’ span and thankfully most house-proud sellers leave their homes in an appropriate condition when moving out, however legally there is no obligation for them to do so.

What should you expect at settlement?

If you’re buying a home, it’s smart to have a realistic expectation of what to expect at settlement.

Unless otherwise specified in the contract, the seller is under no obligation to have the property professionally cleaned for settlement and it is surprising how few buyers ask that such a condition be included.

The seller’s only obligation under the contract (Clause 6.1(b) 2 of the General Conditions) is to “…remove from the Property, before possession, all vehicles, rubbish and chattels, other than the Property Chattels.”

Many modern contracts to purchase include provision for essential plumbing, gas and electrical components to be working at settlement. Hence, if at settlement the toilet cistern leaks then the seller ought to make good because the contract says so.

It is trickier when, for example, a telephone jack doesn’t work at settlement. It is not strictly electrical but it is probably reasonable for a buyer to assume that it was functioning at inspection. This is partly because, caveat emptor (buyer beware) has all but disappeared according to some legal practitioners. The onus is probably on the seller to disclose (in this case) that the telephone jack didn’t work.

How to ensure you’re happy with the property at settlement

My view is that buyers need to take reasonable steps to ensure the property they have bought will be presented to them in a condition they are satisfied with.

This can be achieved by either contracting with the seller to guarantee it and/or being more thorough when inspecting the property in the first instance. Ask the agent if it’s ok to turn on taps, flush loos, flick switches, open and close doors, open the oven, turn on the dishwasher and so on before making an offer to purchase.

Buyers ought to have a realistic expectation of what to expect at settlement when buying an established home and acknowledge that opinions of presentation are subjective.

Speak to our market experts on 9475 9622 to discuss about your property concerns

Comments (0)

21 May 2018

By portermathewsblog

via popsugar.com.au

Image Source: Thomas J. Story/Sunset Publishing Corp

Image Source: Thomas J. Story/Sunset Publishing Corp

An old home with a lack of square metres might feel limiting to some, but the 83-square-metre, 1900s-era Sunset Smart Cottage proves any space can be transformed with strategic decorating and innovative home gadgets. Even the interior design concept for the cottage involved an emerging tech trend: virtual interior design services. Sunset tapped designers Jessica McCarthy and Emily Gaydon from Decorist, a virtual decorating service that offers a fresh approach to the design and remodelling process. “Online services such as Decorist are often budget friendly and more accessible to the masses. We liked the idea that users can get matched up with designers based on their personal style and goals and can work through the process over email, FaceTime, and even texts,” says Sunset home editor Chantal Lamers.

So what exactly was the design strategy behind this tiny tech oasis? POPSUGAR caught up with Decorist designer Jessica McCarthy to get her insights on the smartest solutions for living large in a small home. Read on to discover the optical illusions and space-planning secrets she used in every room!

- A Bold First Impression

Image Source: Thomas J. Story/Sunset Publishing Corp

Even the tiniest cottage can have major curb appeal. Jessica suggests painting your front door in a bold hue and replacing the exterior hardware. The cost-effective upgrades are details guests will definitely notice. Keep landscaping affordable and low-maintenance by planting drought-friendly shrubs and perennials from the Sunset Western Garden Collection. Top off the look by adding a few potted plants to the porch for an extra touch of greenery.

- Layered Textures

Image Source: Thomas J. Story/Sunset Publishing Corp

To combat the claustrophobic feel of a narrow living room, Jessica suggests opting for a neutral colour palette and avoiding bold patterns to make the room feel large and airy. Since colour and pattern take a backseat, you can go wild with texture. Grasscloth wallpaper, leather seating, linen curtains, and a variety of throw pillows give the space a rich, layered feel. To complete the look, add a semi-flushmount instead of a hanging pendant or chandelier to make the ceilings feel even taller and hang curtains as high as possible.

-

A Discreet Media Station

Image Source: Thomas J. Story/Sunset Publishing Corp

Take advantage of precious wall space by creating a media station that is discreet and beautiful. Jessica suggests thinking outside of the gallery wall box by incorporating gorgeous baskets instead of framed art to distract from the floating TV screen. Keeping baskets in the same colour family is Jessica’s trick for achieving a clean and uncluttered vibe.

- Stylish Storage

Image Source: Thomas J. Story/Sunset Publishing Corp

While Jessica wanted to keep the colour minimal, she used an accent colour throughout the house for fluidity. In this case, a custom-built cabinet in navy ties in with the sofa pillows and kitchen, but it also conceals clutter behind cabinets and displays beautiful objects on shelves.

- A Mini Breakfast Nook

Image Source: Thomas J. Story/Sunset Publishing Corp

Just because you have a small kitchen doesn’t mean you can’t eat in it. Jessica loves the idea of pushing a narrow console against a wall and adding bar stools for a makeshift dining nook.

-

Open Shelves

Image Source: Thomas J. Story/Sunset Publishing Corp

Image Source: Thomas J. Story/Sunset Publishing Corp

Eliminating upper cabinets can visually expand a small kitchen. Jessica leveraged the brightening power of counter-to-ceiling white subway tiles paired with white floating shelves for an airy and undeniably stylish effect. If a remodel isn’t in the works, Jessica suggests painting cabinets and installing new hardware for a customised look.

- Plug-In Sconces

Image Source: Thomas J. Story/Sunset Publishing Corp

If spacious nightstands aren’t in the cards, swap in petite side tables and free up table space by installing plug-in sconces that don’t require expensive or permanent electrical work.

- A Calm Colour Palette

Image Source: Thomas J. Story/Sunset Publishing Corp

Like the living room, the bedroom also follows suit with a calming colour palette. Jessica chose a single tone and explored a range of shades on the walls, bedding, rug, and accent decor.

- Statement Art

Image Source: Thomas J. Story/Sunset Publishing Corp

Small bedrooms don’t necessarily require diminutive art. In fact, Jessica recommends doing the exact opposite by hanging large baskets, textural pieces, vintage finds from travels, and oversize prints to really make a statement.

- Well-Utilised Corners

Image Source: Thomas J. Story/Sunset Publishing Corp

To make a big design impact in a corner of the room, mix pieces with varying textures. Jessica especially likes the way the leather wall object, wicker chair, and fur throw create a cosy effect that feels curated.

- A Modern Murphy Bed

Image Source: Thomas J. Story/Sunset Publishing Corp

A murphy bed can be the perfect solution for children’s rooms that require space to play or a guest room that can double as an office. Jessica likes the idea of hanging something dramatic but soft above the bed, like the woven wall art. The texture adds interest but won’t break or budge when the bed is closed.

-

Customised Closets

Image Source: Thomas J. Story/Sunset Publishing Corp

Image Source: Thomas J. Story/Sunset Publishing Corp

Katy Milton of California Closets designed the built-in cabinetry to make the most out of a tiny closet. Jessica recommends adding baskets and bins to cleverly conceal clutter while keeping things in order.

-

Multitasking Work Space

Image Source: Thomas J. Story/Sunset Publishing Corp

Multifunctional pieces like a small desk, which can be used as an extra table surface for displaying decor, doing homework, and being creative, are one of Jessica’s favourite small-room staples. If you have multiple pieces of children’s art or a group of family photos without the space to hang them, consider investing in the Meural. It’s a digital canvas that gives you instant access to over 30,000 works of art, but which also allows you to upload your child’s drawings and rotate between images.

- Wall Storage

Image Source: Thomas J. Story/Sunset Publishing Corp

Jessica believes shelving can double as eye candy when you mix in your favorite artwork and accessories.

- Minimal Accessories

Image Source: Thomas J. Story/Sunset Publishing Corp

Create the illusion of more square footage by selecting the right colour palette and working in some cosmetic details. Jessica likes to use large mirrors and extra layers of lighting with sconces to make the space appear larger. Keeping the space clutter-free and minimally accessorised is another tricks she recommends for small bathrooms.

-

Small-Scale Patio Furniture

Image Source: Thomas J. Story/Sunset Publishing Corp

If you don’t have room for an outdoor sofa or settee, consider using an Adirondack chair with a foot stool that can be moved. Pair it with a small table and you have the basic comforts needed for lounging

Comments (0)

21 May 2018

By portermathewsblog

via reiwa.com.au

First home buyers are active in Perth’s property market, with data for the March 2018 quarter revealing an increase in sales for properties priced $500,000 and below.

First home buyers are active in Perth’s property market, with data for the March 2018 quarter revealing an increase in sales for properties priced $500,000 and below.

REIWA President Hayden Groves said after observing subdued first home buyer activity during the December 2017 quarter, it was pleasing to see the lower end of the market strengthen early in 2018.

“The final quarter of 2017 saw the composition of the Perth market shift. Last quarter there were significantly more sales in the higher priced end of the market and less in the first home buyer price range. It’s been a different story this quarter, with the balance of sales shifting back to the lower end of the market,” Mr Groves said.

Median house and unit price

Perth’s preliminary median house price is $510,000 for the March 2018 quarter.

Mr Groves said once all sales settle, this figure was expected to increase to $517,000, which would put the March 2018 quarter median marginally lower (by 0.6 per cent) than the December 2017 quarter.

“Although Perth’s median house price experienced a minor adjustment during the March 2018 quarter, the median house price is up 0.4 per cent when compared to the same time last year, which shows prices are stable,” Mr Groves said.

Perth’s preliminary median unit price is $401,000 for the March 2018 quarter.

“This is expected to lift to $410,000 once all sales settle, which would put it equal with the December quarter median.

“These results are in line with REIWA’s 2018 forecast, which expects stable conditions throughout the remainder of this year, with moderate price growth during the next 12 months,” Mr Groves said.

Sales activity

Preliminary Landgate data shows there were 5,865 dwelling sales during the March 2018 quarter.

“We expect around 6,603 sales for the quarter overall, which is marginally lower than volumes recorded during the December quarter,” Mr Groves said.

There was a 5.7 per cent increase in house sales in the sub-$500,000 price range during the March 2018 quarter.

“Increased activity in the lower end of the market is usually a sign first home buyers are active. We are fortunate the dream of home ownership is more attainable for West Australians than it is on the east coast. After seeing activity drop off last quarter, it’s good to see first home buyers are increasing their presence in the market,” Mr Groves said.

Listings for sale

There were 14,413 properties for sale in Perth at the end of the March 2018 quarter.

Mr Groves said listings had increased 10.2 per cent over the quarter, but were down 2.9 per cent when compared to the March 2017 quarter.

“While it is pleasing listings have declined on an annual basis, the increase over the quarter is not cause for alarm. With overall sentiment in WA improving and all signs indicating the market has begun to turn, sellers are feeling more confident than they have been and therefore more inclined to put their property up for sale.

“We’ve also seen a sharp decline in rental listings over the past year which has had a flow-on effect to the established market. With some investors choosing to sell their rental property instead of lease it, this has contributed to the rise in the number of properties for sale in Perth,” Mr Groves said.

Average selling days

It took 67 days on average to sell a house in Perth during the March 2018 quarter.

Mr Groves said although average selling days increased over the quarter, it was still two days quicker to sell than it was during the March 2017 quarter.

“With more listings on the market, buyers now have more choice, which has had an impact on the time it takes to sell. It’s very encouraging though, that on an annual basis, we’re seeing average selling days decrease,” Mr Groves said.

Comments (0)

14 May 2018

By portermathewsblog

via reiwa.com.au

With steady rents, declining listings, improved leasing figures and faster leasing times, data for the March 2018 quarter reveals Perth’s rental market is leading the charge in Perth’s property market recovery.

With steady rents, declining listings, improved leasing figures and faster leasing times, data for the March 2018 quarter reveals Perth’s rental market is leading the charge in Perth’s property market recovery.

REIWA President Hayden Groves said the first quarter of 2018 showed Perth’s rental market had strengthened, with improvements recorded across all key indicators.

“Perth’s rental market appears to be building on the momentum of the latter half of 2017, which is very encouraging – not just for the rental market, but also for the overall property market. Historically, the sales market follows the rental market during a recovery,” Mr Groves said.

Median rent prices

Perth’s overall median rent price is $350 per week for the March 2018 quarter.

Mr Groves said this was the twelfth straight month of stable rent prices, with no changes recorded since April 2017.

“All sub-regions experienced stable median prices except for the South West sub-region, which saw its overall median rent price increase $10 to $330 per week during the quarter,” Mr Groves said.

reiwa.com data shows there was a $5 per week increase to both the median house and median unit rent during the March 2018 quarter.

“The median house rent increased to $360 per week, while the median unit rent increased to $325 per week,” Mr Groves said.

“It bodes well for landlords that the house and unit median rents are improving simultaneously.”

Leasing activity

There were 14,112 rental properties leased in Perth during the March 2018 quarter.

“Leasing volumes for the March 2018 quarter are up 4.2 per cent compared to the December 2017 quarter,” Mr Groves said.

“Four out of the five sub-regions saw an improvement in leasing volumes, with the Central sub-region (up 7.7 per cent) and North East sub-region (up 6.1 per cent) the stand-outs.”

At a suburb level, reiwa.com data shows East Cannington, St James, North Fremantle, Ellenbrook and Booragoon saw the biggest growth in leasing activity levels over the quarter.

Listings for rent

Rental listings declined 4.5 per cent during the quarter, with 8,508 listings recorded at the end of March 2018.

Mr Groves said there had been a substantial reduction in the number of rental properties available in Perth over the last 12 months.

“Compared to the March 2017 quarter, listings for rent are now 18.6 per cent lower than they were at the same time last year. This can be attributed to an increase in population growth to the state and fewer new dwelling commencements occurring in the metro area,” Mr Groves said.

Average leasing time

It was two days faster to lease a property during the March 2018 quarter than it was during the December 2017 quarter.

“It took 47 days on average for landlords to find a tenant during the March quarter, which is two days faster than the December quarter and three days faster than the March 2017 quarter,” Mr Groves said.

“With stock levels declining and leasing activity increasing, the Perth rental market is finally starting to re-balance. For tenants, now is a good time to secure a longer-term lease before rents rise.”

Comments (0)