24 October 2019

By portermathewsblog

via domain.com.au

Jessica Bellef is the author of the book Individual. Photo: Sue Stubbs.

Do you know what your favourite colour is? Ask a kid that same question, and the answer is instant and unwavering. As adults, we may have forgotten that an allegiance to a certain shade was symbolic of so much when were young.

Declaring a favourite colour was our way of defining ourselves and telling the world what we were about. We requested everything – outfits, bedroom walls, pencil cases, birthday-party decorations – in our chosen chroma. Our hero hues made us happy, even though we were likely to move on to another colour within a month’s time.

Fast-forward to our adult years, and we no longer spend time discussing our favourite colours. Sadly, our personal spaces often lack direct reference to the colours that make us joyful.

Declaring a favourite colour was our way of defining ourselves and telling the world what we were about. Photo: Sue Stubbs.

Declaring a favourite colour was our way of defining ourselves and telling the world what we were about. Photo: Sue Stubbs.

The thing is, we make decisions every day that unconsciously highlight and reinforce the palettes to which we are naturally drawn. From the clothes in our wardrobe to the food we put on our plate (and heck, even the plate itself), our choices about colour continue to tell the story of who we are.

If our homes work best for us when they reflect what makes us happy, secure and comforted, then shouldn’t we try to inject our own colour palette into the space?

Most interior stylists and designers will tell you that working with colour is the most immediate way to change the mood of a room. Countless articles, workshops and textbooks have delved deep into the technicalities and nuances of colour, breaking the complexities down into rules and prescriptive palettes, and often not leaving room for creative interpretation.

Most interior stylists and designers will tell you that working with colour is the most immediate way to change the mood of a room. Photo: Sue Stubbs.

Most interior stylists and designers will tell you that working with colour is the most immediate way to change the mood of a room. Photo: Sue Stubbs.

It can be a daunting and stifled way to learn about something that is so personal. It’s no wonder that lots of adults are afraid to play with colour in their homes – they’re too scared to jump in and express themselves with paint and decor, fearing that they will get it “wrong”. When it comes to colour, however, it isn’t so black and white.

We all have primal, physiological responses to certain colours that we can’t control. High-energy reds get the heart racing, while soft blues slow us down. We also have very individual thresholds when it comes to how much colour we can take before nausea sets in.

Some people love the feeling of being enveloped in a colour-saturated room, while others would prefer to spend their time in a colour-neutral space.

We all have primal, physiological responses to certain colours that we can’t control. Photo: Sue Stubbs.

We all have primal, physiological responses to certain colours that we can’t control. Photo: Sue Stubbs.

Our perception of a colour is tinted by our own life story and learned associations. All our memories, positive or negative, will have a connection to colour in some way: the school uniform that was begrudgingly worn, the facade of a crumbling building admired on an exotic holiday, the walls of the dentist’s waiting room.

It is these fragmented moments that form our preferred colour palettes.

We should unapologetically colour our home environments in palettes that are unique to us, in ways that mean something to us. We need to spend a little time thinking about the colours that give us joy, just as we would have done as bright-eyed young things in the school playground.

Some people love the feeling of being enveloped in a colour-saturated room, while others would prefer to spend their time in a colour-neutral space. Photo: Sue Stubbs.

Some people love the feeling of being enveloped in a colour-saturated room, while others would prefer to spend their time in a colour-neutral space. Photo: Sue Stubbs.

Colour considerations

These are not rules, but things to think about:

Get in tune with the colours to which you react positively. Recall places and moments that made you feel good, and create a mood board (digital or physical) that represents these memories. Take note of recurring colours and themes.

Adding colour to a room doesn’t have to mean you must paint the walls in vibrant hues. Colour can be added to a neutral-walled room through artworks, textiles and decor, and you can add as much or as little as you want.

Individual by Jessica Bellef, Murdoch Books. Photo: Murdoch Books.

Individual by Jessica Bellef, Murdoch Books. Photo: Murdoch Books.

Know that you can have too much of a good thing. Overusing one colour in a space will either overwhelm you with its intensity or be so monotonous that you will find the space boring and flat. Play around with a mix of colours in a space until you find a balance that pleases you.

Understand that paint is temporary and decor is easily swapped out. There is no harm in trying new things, as “mistakes” can be erased swiftly.

Observe the scene outside your windows and the way the light works its way through the house. I love having a green quilt cover in my bedroom, as it connects the room to the treetops directly beyond the window, drawing the outside in and grounding me in nature.

Our preference for certain types of colour will evolve as we grow and advance through our life stages. Embrace these changes, and never stop experimenting with colour in your home.

Comments (0)

21 August 2019

By portermathewsblog

via domain.com.au

I’ve learnt a few lessons and gleaned good advice from colleagues. Photo: Stocksy

After almost a decade in the same house, I’d forgotten how painful it can be to move.

The sort, the pack, the kids circling around your feet – and, in our case, a stressed cat who marked his territory somewhere but smelt like everywhere – and clearing the last of the household dross before a manic clean.

We would have loved to have outsourced every aspect of the move but budget constraints came into play so we were forced to take on the task ourselves.

In a few months we have to do it again, and this time we’re going to do things differently. I’ve learnt a few lessons and have gleaned good advice from colleagues. This is what we’ve learnt:

1. Hire movers (or rope in friends with beers and pizza) early

We found many of our preferred moving companies were already booked. What’s more, you need to research their costs and reputation. Ours charged on an hourly rate, but once the big hand crossed from 10am we were pinged for the full 60 minutes’ labour.

Gather a packing kit early. This includes tape, plenty of boxes and permanent markers. Photo: Stocksy

Gather a packing kit early. This includes tape, plenty of boxes and permanent markers. Photo: Stocksy

2. Change your address details in advance

Contact insurers, the bank, the council and so on. Embrace Australia Post’s mail forwarding service, which will notify some parties like banks, energy and phone providers.

3. Assemble your packing kit

Hoard boxes in many sizes. We were lucky to have a friend who’d recently moved, but also try supermarkets and liquor stores which often have spare boxes available. Cheap but large bags, the type you find at $2 shops, are great for soft big items such as linen, pillows, clothing and rugs.

You’ll also need packing tape, a tape dispenser (no one likes hunting for the start of the roll), bubblewrap or – just as good and more environmentally friendly – old newspapers for wrapping breakable and fragile items. We sorted out our linen cupboard fairly early on and found towels, pillow cases and flannels to be great items to wrap things like wine glasses and plates. Make sure you have a few permanent markers to label boxes.

Hire movers (or rope in friends with beers and pizza) early. Photo: Jason South

Hire movers (or rope in friends with beers and pizza) early. Photo: Jason South

4. Marie Kondo the hell out of your home

Tackle packing and sorting your belongings with this room-by-room approach almost the moment the house contract is signed. Even if you pack just one box a day during this process, that will ease the pressure on moving day. This is the perfect time to donate or sell that chest of drawers, and rid yourself of excess kitchen equipment or unwanted clothing.

Start with things you don’t really need on a day-to-day basis. Books and trinkets can be packed early. And you’ll be surprised how little your kids will miss their toys.

Tackle the kitchen at the beginning. How many wine glasses, mugs, utensils and cooking gadgets do you really need? Think like a motel owner and leave the bare minimum to make your meals for the next few weeks.

Start organising and packing your home room-by-room almost the moment the house contract is signed. Photo: Stocksy

Start organising and packing your home room-by-room almost the moment the house contract is signed. Photo: Stocksy

5. Colour-code the boxes relating to your rooms

If only we had done this, it would have made things so much easier to find our iron, hair dryer and Alexa – they are still missing …

6. Remove boxes immediately

If there is space, perhaps in a secure garage or basement, start placing the packed boxes away. This clears the house, and stops the urge to break into them to hunt for something later. If this isn’t an option, pack a full room or clear a large space where boxes can be left untouched.

7. Clean as you pack

Vacuum behind the beds, and give the doors and cupboards a wipe down – this will save time and effort on moving day.

Always designate a special place for your house keys. Photo: iStock

Always designate a special place for your house keys. Photo: iStock

8. Pay someone to clean the oven

If your budget stretches to any outsourcing, let it be for this. Cleaning the oven is a crappy job at the best of times, let alone at one of the most stressful. I can think of little worse than wiping oven cleaner and scrubbing metal racks on the evening we left. Awful.

9. Eat your way out of your home

Refrain from big grocery shops in the weeks leading up to your move. Try to use whatever you’ve got on hand, which will make the move (plus the cleaning of the fridge, freezer and pantry) all that much easier.

10. Stuff, seal and shut drawers

There’s no need to empty your clothing drawers. Get as much in them as possible, then simply seal them shut and ship them off.

Boxes with lids are great for those essentials you’ll need on the first night at your new home including toiletries, breakfast for the next day and tea and coffee. Photo: iStock

Boxes with lids are great for those essentials you’ll need on the first night at your new home including toiletries, breakfast for the next day and tea and coffee. Photo: iStock

11. Avoid an electrical assemblage nightmare

Place electrics in their own separate box. Take a picture before disassembling these items to see how the now-jumbled cords should be plugged in when you arrive at your new abode. Clear, resealable sandwich bags are great for screws and small parts that will be needed later.

12. Pack ‘the next day’ essentials

Invest in some large clear boxes with lids. These are great for those essentials you’ll need on the first night at your new home including toiletries, breakfast for the next day and tea and coffee. It’s a good idea to include two changes of clothing for you and the family, one work outfit and the school uniforms (including shoes), bedding for your first night, some towels and details of a good takeaway joint – cooking is going to be the last thing on your mind.

13. Make a place for your keys

And be vigilant about putting them back there during the shift. My set ended up in my son’s school bag.

If you can, hire a babysitter. Photo: Stocksy

If you can, hire a babysitter. Photo: Stocksy

14. Hire a babysitter

If that’s not an option, ask friends and family to mind the kids on the day of the move. We are forever grateful to our friends who took our young children for this stressful day.

15. Leave cleaning equipment and supplies somewhere handy

You’ll need them on shifting day and at your new house – we now have two of everything.

Comments (0)

01 October 2018

By portermathewsblog

via reiwa.com.au

Author: REIWA President Hayden Groves

Real estate transactions are complex. For many West Australians, it can be a challenge to determine their individual rights and responsibilities when it comes to dealing with property issues.

Real estate transactions are complex. For many West Australians, it can be a challenge to determine their individual rights and responsibilities when it comes to dealing with property issues.

REIWA launched a public information service in 1992 to assist buyers, sellers, tenants and landlords navigate their property journeys. This valuable service allows members of the WA public dealing with a REIWA agent to find answers to their real estate queries and concerns.

Last financial year more than 20,000 phone calls were placed to the REIWA Information Service (2,000 more than the previous financial year), with West Australians seeking clarification and assistance from the Institute on a wide range of real estate matters.

As the WA market has slowed these past few years, the REIWA Information Service has seen call volumes increase. Residential property management continues to be the most common topic the public ring about, with 70 per cent of all phone calls for the year to date received from tenants and landlords. The remaining 30 per cent of calls have generally related to residential sales.

When it comes to WA tenants, they most commonly call REIWA to discuss the early termination of their rental lease. They also want to know what rights their landlords have to enter their property while tenanted and what rights they have with regards to repairs and maintenance.

Landlords, on the other hand, most commonly call to seek information on a tenant’s obligation to pay rent, to find out how the court system works in order to claim damages and to clarify their rights around abandoned goods.

In the residential sales market, buyers who call the REIWA Information Service generally do so to get information about their obligation to obtain finance approval within a period of time. They also commonly call to clarify their rights for the pre-settlement inspection. While WA sellers most frequently ring to find out about the settlement process, satisfying contractual conditions and to discuss buyer requests which are not addressed in the contract for sale.

The REIWA Information Service team is comprised of two full time staff members and 70 local REIWA agents who give three hours of their time every few months on a voluntary basis.

When you call up, you are given direct access to these local property experts who can educate you on areas you’re unsure about and help resolve any tricky property matters you might be facing.

If you are dealing with a REIWA agent and have a real estate query you want answered, I’d highly recommend contacting the REIWA Information Service on 9380 8200 for assistance.

Comments (0)

25 September 2018

By portermathewsblog

therealestateconversation.com.au

Over the past six months, grey clouds have been building in the distance for borrowers, and for many, the brewing storm is yet to hit in full force.

Australia’s current lending landscape is a tough one. Moves by legislators and regulators to kerb borrower enthusiasm have created headaches for those now looking to build a

portfolio.

That said, there is opportunity ahead for those able to weather the challenge.

The state of play

The runaway nature of Australian property prices in Sydney and Melbourne from 2012 was causing concern for legislators.

It was claimed investors were taking up all the stock and isolating first homebuyers from the market – and there were no indications things were going to slow down.

In 2014 the Australian Prudential Regulation Authority (APRA) responded by instructing banks to cap growth in investor lending to 10 per cent of their total loan book.

An additional move in 2017 by APRA required banks to keep interest-only loans to less than 30 per cent of their mortgage portfolio too.

While both these measures were said to be temporary – in fact, the first has been recently relaxed – they appear to have done their job too well with investor-loan growth now at single-digit percentages.

Add to the mix the current banking enquiry. It’s findings so far have levelled criticism at bank practices.

To compensate and prepare for the eventual recommendations, lenders are already tightening their requirements from borrowers – particularly investors.

What’s happened

The upshot is that getting a property loan approval at the moment is tough.

It’s been a fast turnaround too. Whereas six months ago a bank customer might have been approved to borrow $800,000, nowadays that same client might be lucky to get $500,000.

That means many who contract to purchase based on a pre-approval gained under the old guidelines, will find their application knocked back under the bank’s new rules.

Another reason for impending mortgage stress is many loans are about to roll over from Interest-only to Principal-and-Interest in the next 12 months.

This means higher repayments for some already stressed borrowers.

These customers will have little choice but to accept the new loan terms being offered by their current lender, because competition for interest only lending will be virtually non-existent.

Here’s the perfect storm scenario:

- The cost of money will go up,

- The availability of money will drop,

- And, in certain markets, value growth will be non-existent for a number of years.

Is there opportunity?

In short – yes, but it’ll be those who got their affairs in order early who’ll benefit most.

Investors who’ve built a resilient portfolio are certain to take advantage.

Your investment strategies must be long-term so you can smooth out the peaks and troughs of market and finance cycles in order to secure your future for decades to come.

1. Have impeccable records

Now more than ever, it’s important to have kept your financial records in tip-top order.

By this, I mean you need to know your numbers inside and out, and back to front.

It all has to be documented as well. Not so long ago, for example, it was acceptable to front up to the bank with little more than your estimated living costs and gross income, and with a signed statutory declaration as back up.

Nowadays, it’s a case of being able to account for every dollar. You may have put “Annual clothing allowance – $1000” in the loan application, but today’s banking credit departments are checking your credit card statements as well.

They know your Gucci shoes and Burberry briefcase cost twice that, and they’re willing to say, “No!”

Having impeccable records means you can accurately account for every dollar.

It also demonstrates to the bank that you can stay on top of your loan commitments.

Being a good customer really can pay dividends in these trying times.

2. Maintain cash flow

Cash flow is king when it comes to loan serviceability, so if you’ve built a multi-property portfolio, make sure your income isn’t overextended.

Key to this is portfolio diversification. We always recommend maintaining a buffer as part of your investment strategy because changes in interest rates, personal circumstances and the cost of living are inevitable.

In addition, banks are now upping their ‘stress test’ on client’s finances – increasing their own interest rate and cost tolerances on your supplied numbers.

Being on top of your cash flow can be the difference between a yes or no on your next loan.

3. Equity buffer

Along with cash flow you must maintain an equity buffer as well.

Having adequate equity is essential to a lender’s requirements.

The problem that often occurs during a period of high property value growth (like recently) is some owners use their new-found equity on unproductive debt.

They might spend up big on their credit cards and then consolidate that debt into their house loan.

While they’re at it, they might get a bit extra from the bank in order to buy a new car or go on holiday.

These borrowers are not allowing for the future and have effectively re-bought their property off the bank at today’s prices because they ‘feel wealthy’.

The best opportunities are there for those who have liquidity in their equity.

I’m a big believer in making your money work for you and if your equity isn’t liquid, you can’t capitalise on opportunities when they arise.

Building a resilient portfolio in times of great growth is essential so you not only survive any eventual slowdown, but can pounce on newly revealed profitable prospects.

If you’ve failed to prepare for our new, tougher financial times, now might be the chance to catch your breath, talk to an expert strategist and plan for the cycles next turn.

After all, the state of your wallet dictates the state of your mind.

Comments (0)

04 September 2018

By portermathewsblog

via therealestateconversation.com.au

Jon Bahen, director of Abel Property – Cottesloe told WILLIAMS MEDIA about building inspection reports in Western Australia, including what they are, why you need one, and what they cover.

What is a building inspection report? And do you need one?

For most people purchasing a property is one of the biggest financial decisions they will make in their life and it is always important to ensure due diligence on the home has been done. A building inspection report can be part of this process and is a great way to protect your interests and peace of mind.

In most circumstances, a building inspection report is included as a condition of the Contract for Sale. The investigation for this report needs to be carried out by a qualified building inspector, surveyor or builder and the cost for this report is borne by the buyer.

There are a number of different types of building reports with different cost structures. For example, a basic structural inspection can be obtained for $280 for a single level three bed, two bath, brick and tile/metal home with slab on the ground, while a premium inspection which is usually used is around $495. This expenditure is a wise investment considering the potential cost of buying a property that needs extensive unexpected restoration and repairs.

What does a building inspection report look like?

The report will include photos and address of the property, name of the applicant, the time and date and the age of the home. It also lists the name, contact details, and qualifications of the inspector, including their WA Builders Registration number.

Next, a summary of the significant findings will be highlighted to ensure the prospective buyer can easily see what necessary or immediate repairs are required.

The report will contain explanations of the definitions used by the inspector to record the condition of the property and any disclaimers and information about what is not reported on.

The remainder of the pages will contain photos and detailed room-by-room information on the condition of the floors, walls, ceilings, doors, and all fixtures including bathroom and kitchen appliances.

What does a building inspection report cover?

The inspection covers a visual assessment of the property and provides an opinion regarding its general condition. An estimate of the cost to repair the defects is not within the scope of the Australian Standard and does not form part of a report. If the property is part of strata or company title, the inspection does not cover common property, only the immediate interior and exterior.

The electrical and plumbing systems are only checked for basic functioning. If the buyer requires a more detailed report on these systems, they will need to employ licensed professional plumbers or electricians.

Comments (0)

10 August 2018

By portermathewsblog

via popsugar.com.au

Image Source: Studio McGee

Image Source: Studio McGee

Wouldn’t it be so nice to know what an interior designer actually notices in your home? Having this information would make it that much easier when you clean or decorate new spaces, or even when you decide what to renovate and what to leave as is. It can be somewhat difficult to take a critical eye to your own space that you see consistently day after day, but knowing where to place your focus and creative energy would certainly help to take out some of that guesswork, so we decided to reach out to design professional Shelly Gerritsma from Canter Lane Interiors instead. Read on to learn the five design elements she always notices first and wants you to focus on first as well.

Flooring

Image Source: A Beautiful Mess

Image Source: A Beautiful Mess

As soon as she steps into your home, Shelly notices what’s beneath her feet. “Flooring is a major item. If carpet is dated/worn/sagging/etc, it really devalues the home,” Shelly says. So, instead of using that area rug that has probably seen better days, opt for a brand new design in a fun print, or if you want to really get creative, try adding hardwoods in a funky colour. Shelly will notice!

Wall Colour & Finish

Image Source: Inspired by Charm

Once she’s assessed the flooring, Shelly is onto your wall colour and finishes. She advises that “using the proper paint finish for spaces is huge. Do not use a semi-gloss or a gloss paint finish on main living walls as it cheapens the space and looks too harsh. Stick with a flat or matte finish.” She also reminds us that nothing draws negative attention quicker than sloppy paint lines, so always ensure that those appear neat and finished.

Ceilings

Image Source: A Beautiful Mess

Image Source: A Beautiful Mess

Another foundational element that will draw major attention from Shelly is your ceiling. Whether you want to modernise the appearance of your ceiling or you just need to open up the space a bit, this is one area that you won’t regret putting some time into. Shelly confirms that “smoothing out popcorn ceilings is a great way to add home value and to make spaces feel larger due to the shadows cast by this dated finish.”

Scale-Appropriate Furniture

Image Source: Studio McGee

Image Source: Studio McGee

Properly scaled furnishings are key when it comes to creating a harmonious flow that’s sure to get noticed in your home. Shelly says, “Make sure that your furniture is not overwhelmingly large or so small that it looks out of balance in the space.” A huge sectional that is crammed into a space or a dainty nightstand displayed in an oversize master bedroom will do nothing but draw negative attention.

Clutter!

Image Source: Studio McGee

Image Source: Studio McGee

And lastly, we finish up with none other than that attention-grabbing eyesore: clutter. Yes, clutter! Shelly promises, “Keeping spaces clean and clutter to a minimum is a huge plus. Our spaces truly affect our well being, and spaces that are messy and dirty can have major psychological and physical impact.” Plus, not only will your guests appreciate your clutter-free home but you too will benefit from your Zen space.

Comments (0)

27 July 2018

By portermathewsblog

via houzz.com.au

Furniture that does more than one job is a godsend in a small home – here’s what you need to know before you buy.

In this practical series, we ask experts to answer your burning home and design questions. Here, Christine Gough, interior design leader at Ikea Australia, shares her top tips for selecting multi-functional furniture for a compact home.

If you’re struggling with clutter, a lack of space or a shortage of storage in your home, multi-functional furniture can really help. So what makes for a multi-functional piece? It is flexible, performs more than one function, and it can be moved around or customised to suit your needs. It often also includes storage, giving you a useful home for clutter so you can create a clear and inviting home.

Here are a few of the most useful designs to consider.

Image: Delaktig range at Ikea

Modular sofas

Modular sofas allow you to personalise your seating so that it fits your space – and your needs – perfectly. Choose from a ready-made combination of sofa pieces, or create a new combination to suit your home.

Modular sofas are designed with many functions and possibilities in mind. Many contain hidden storage, while others can be converted into a sofa bed to house an overnight guest. You’ll also find styles with removable covers so you can update the look of your sofa with ease.

‘Open-source’ furniture takes the idea of personalisation one step further. Ikea’s new modular Delaktig sofa (designed in conjunction with British designer Tom Dixon) has an aluminium frame and the set-up can be endlessly configured to suit your changing needs – add a side table, a lamp or two, move an armrest or change the cover, for example.

Storage or nest tables

If space is tight, pieces that do double duty, such as a coffee table with shelves or a storage basket, are a boon. They provide the perfect spot to store cushions, magazines and kids’ toys. Choosing a design on castors means you can also move it to different spots in a flash.

A nest of coffee tables is also a great option for a small space. It offers endless possibilities – pull the trio apart and use as separate side tables when you have friends over for drinks, or place them side-by-side to create one long coffee table for takeaway pizza night.

Furniture with concealed storage

Ottomans are an incredibly useful piece of furniture for any living room – they can act as seating, footstools or even a makeshift table to pop a book or magazine on. Select one with hidden storage inside, and it will provide you with a handy extra spot to store blankets, throws and the kids’ play things.

What are the most useful features to look for in a multi-functional piece?

- Customisable: You should be able to personalise it to suit your style and living needs.

- Neutral colours: Shades of grey, taupe and stone will co-ordinate with most colour palettes, and can easily be updated seasonally with the addition of pattered and coloured cushions and throws.

- Flexibility: Look for features such as removable covers and castors that make it easy to move pieces around or switch up the look of your space.

Zone smart

It’s not just furniture that’s gone multi-functional, it’s rooms too. With many of us moving to smaller homes and open-plan living increasingly the norm, the number of activities that happen in each room has increased. Once upon a time, our living rooms were used for socialising or watching television, but today you might eat dinner there, play games, listen to music, fold laundry and even exercise.

To get the best from a multi-functional room, position furniture to create zones for different activities, such as dining, socialising, work and exercise. Be led by the space and your lifestyle needs, and not by convention. If it works better in your space to have a pair of modular sofas positioned back-to-back or side-by-side rather than a traditional sofa set-up, go for it.

When positioning furniture, factor in foot traffic too. There should be enough room to move through the room comfortably.

Image: Ikea

Comments (0)

23 July 2018

By portermathewsblog

via therealestateconversation.com.au

Real estate in Perth is at its most affordable on record, as falling prices give first home buyers their best chance of stepping onto the property ladder, according to the Housing Industry Association (HIA).

37 Marita Road, Nedlands, Perth under offer with Michelle Kerr from Abel McGrath as featured on Luxury List. Abel McGrath

37 Marita Road, Nedlands, Perth under offer with Michelle Kerr from Abel McGrath as featured on Luxury List. Abel McGrath

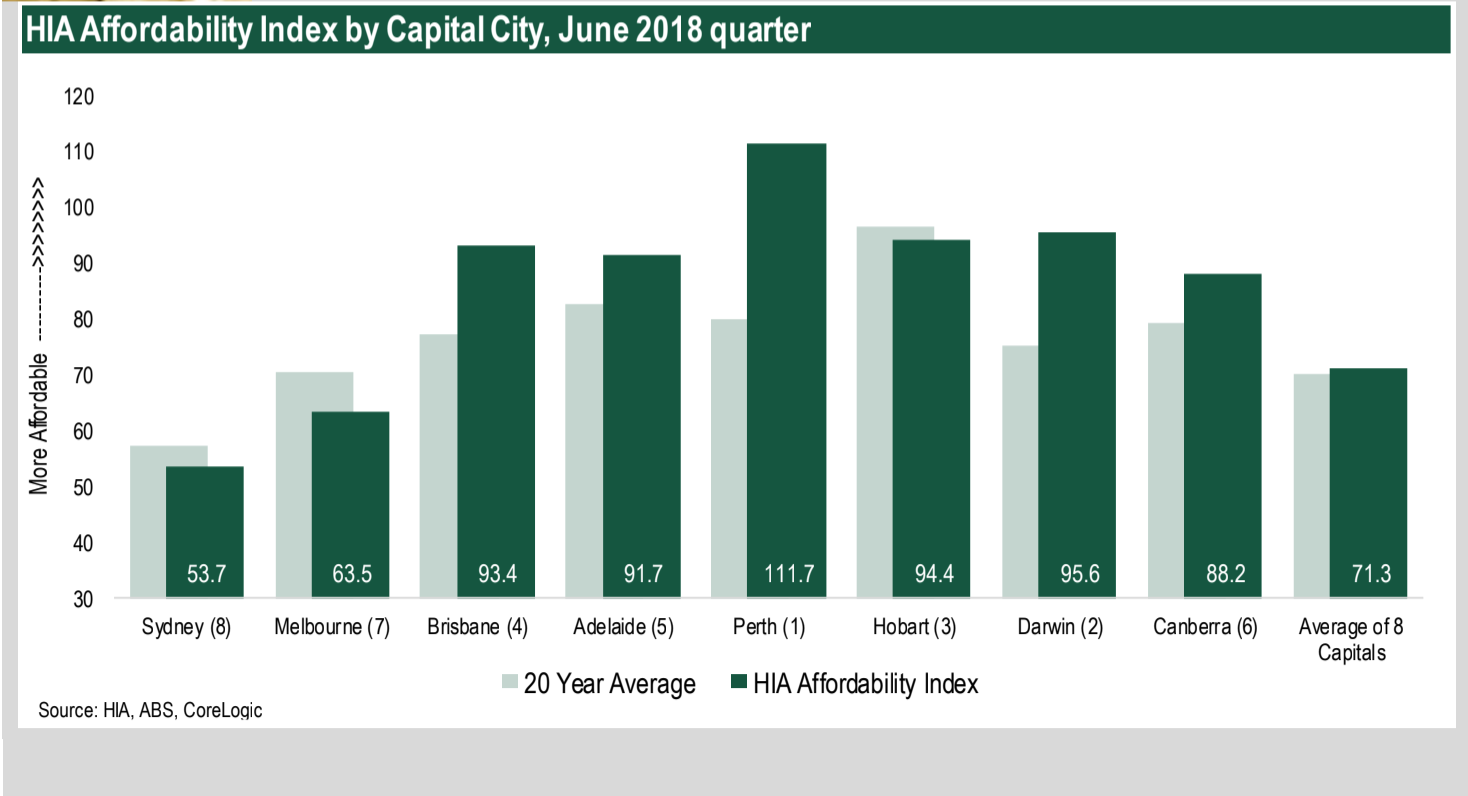

Figures from the Housing Industry of Australia (HIA) Affordability Index show Perth is the most affordable of the nation’s capital cities.

In the June 2018 quarter, the Housing Industry of Australia (HIA) Affordability Index registered 74.9, up by 0.4 per cent over the quarter and up by 0.8 per cent compared with a year earlier when affordability had reached its poorest level in nearly six years.

The HIA Affordability Index is designed so that a result of exactly 100 means that precisely 30 per cent of earnings are absorbed by mortgage repayments.

Higher results signify more favourable affordability – those above 100 signify that mortgage repayments account for less than 30 per cent of gross earnings, whereas scores below the 100 mark mean that more than 30 per cent of average earnings are absorbed by mortgage repayments.

According to HIA’s analysis, Perth is the most affordable capital city to buy a home in with an affordability rating of 111.7, closely followed by Darwin (95.6), Brisbane (93.4), and Hobart (94.4).

37 Marita Road, Nedlands, Perth under offer with Michelle Kerr from Abel McGrath as featured on Luxury List.

“Perth continues to present good opportunities for buyers, especially in the more affordable end of the market,” President of the Real Estate Institute of Western Australia (REIWA) Hayden Groves told WILLIAMS MEDIA.

In news that will surprise approximately no one, Sydney remains the least affordable capital city to purchase in, with a miserable affordability rating of 53.7.

Key findings from the HIA Affordability Report

- Easing price pressures are driving the improvements in housing affordability

- Housing affordability improved in five of Australia’s eight capital cities for the June 2018 quarter – Hobart, Melbourne and Adelaide were the only capital cities to see a deterioration

- Perth is now Australia’s most affordable capital city, followed closely by Darwin and Hobart

- Mortgage repayments account for 42.1 per cent of earnings in capital cities and 34.3 per cent in regional markets

HIA Economist Diwa Hopkins says affordability is hugely improving considering this time last year, affordability was at the lowest level in over six years.

“Easing house price pressures are providing some affordability relief for home buyers.

“Previous strong price increases were met by an unprecedented level of building which is now starting to come online. This is providing much-needed additional supply in key markets, helping to reduce price pressures and ultimately improve affordability for home buyers,” Hopkins said.

Source: HIA

Source: HIA

But the current plunge in house prices is unlikely to last for long, Hopkins warns.

“With an even balance in overall housing supply and demand in these key markets, the current downturn in dwelling prices is unlikely to be prolonged or severe.

“We could expect this downturn in prices to play out like previous cycles. They typically last 12 to 18 months, with the size of the fall modest relative to the immediately preceding expansion,” Hopkins said.

Ongoing fallout from the resources boom and bust cycles to thank for price plunge

Both rent and dwelling prices have been falling in Perth and Darwn for the last five years, amid the ongoing fallout from the resources boom and bust cycles.

While this is great news for renters and buyers in a market previously notorious for poor housing affordability, Hopkins warns it may be symptomatic of wider economic problems and in particular slowing population growth.

The weak economic conditions in both of these cities are seeing more people leave for interstate than are arriving, Hopkins says.

In particular population growth has followed these cycles and currently both cities are seeing more people leave for interstate than are arriving, resulting in spare capacity in their respective housing markets.

New home building activity has also fallen sharply in both cities as a result of the price declines, which risks causing an undersupply to emerge over the longer term in Perth and Darwin.

Groves told WILLIAMS MEDIA buyers are cautious right now.

“Trade-up family home buyers are lamenting they didn’t buy six months ago when the bottom of the market was apparent. Sellers who’ve been considering selling over the past few years are now cautious about coming to market too soon in anticipation of selling for more in the short-term future, especially down-sizers looking to maximise their capital-gains-tax-free benefit.

“Investors are likely to remain cautious until they see tangible growth which is likely to be towards the end of this year,” Groves said.

The best suburbs in Perth to invest in

According to data from REIWA, the rental yield for the Perth Metro region for houses currently sits at 3.6 per cent based on the overall median house rent price of $359 per week and median house price of $512,500.

This means on average, a typical property investor can expect to generate a 3.6 per cent annual return on their house purchase price.

REIWA says the suburbs of Bullsbrook, Medina, Parmelia, Armadale, Cooloongup, Maddington, Stratton, Camillo, Warnbro and Merriwa are house rental hotspots, offering investors the best return on their investment.

9 Bates Way, Warnbro available for rent through Property Osborne Park, as featured on Thehomepage.com.au

9 Bates Way, Warnbro available for rent through Property Osborne Park, as featured on Thehomepage.com.au

“Whilst the Perth property market is showing signs of a recovery in 2018, buyers and tenants remain the beneficiaries of the current environment, with a good supply of housing and rental stock to choose from at the more affordable end of the property market,” he said.

“With our local market on the cusp of recovering, now is the time for buyers and investors to take advantage of favourable conditions before our local market becomes less affordable,” Groves told WILLIAMS MEDIA.

Chief Operations Officer for Professionals Real Estate Group in Western Australia, Shane Kempton agrees.

“In the vast majority of areas in Perth, property prices are very low and buyers should now move quickly to secure a property before the recovery in the market gains further momentum to avoid buyers regret,” Kempton told WILLIAMS MEDIA.

View the Housing Industry of Australia (HIA) Affordability Index here.

Comments (0)

20 July 2018

By portermathewsblog

via houzz.com.au

Passionate about technology? A home-automation system is likely to be on your wish list – here’s what you need to know

In this practical series, we ask experts to answer your burning home and design questions. A premium home-automation system – also known as a smart-home system – allows you to control multiple functions in the home, such as lighting, heating and cooling, audio, security, door locks and even kitchen appliances – from a single device, be it a touch-screen remote control or an app on your phone or tablet, from wherever you are in the world.

Tempted? Here, Trevor Rooney, director of residential markets at Crestron, reveals everything you need to know about setting up a home-automation system in your own abode.

Home automation is all about convenience. Having the ability to control core elements in your home remotely, such as lighting, heating, entertainment and front-door access, can save time and make life run more smoothly.

Image: Crestron

What sort of things can a home-automation system do?

- Give you remote access to door locks so you can control who has access to your home when you’re not there.

- Switch lights on and off remotely or connect them to a timer or sensors, so they go on automatically (also great for security when you’re not home).

- Control heating or cooling so you can come home to a warm interior in winter or a cool one in summer.

- Give you remote access to alarms and surveillance systems; you will be notified if anyone approaches your home and can see who is at your front door. You can also switch surveillance on and off remotely.

- Change the television channel or switch the set on or off via voice command.

- Set your coffee machine to turn on automatically in the morning (it will even brew you a cup before you get out of bed).

- Automate your pool and pond cleaning, with the ability to adjust settings from your smart device while you’re not at home.

For even greater convenience, you can pre-determine the settings on your automated system for lighting, heating and entertainment to suit different situations. For example, you could set the system to control various elements simultaneously, so that when you go to bed it turns off all the inside lights, switches on the security camera at the front door, adjusts the kids’ night lights, and switches off the heater – all with one swipe of your smart-screen remote or an app on your phone.

Can automation cut my energy bills?

Absolutely. Here’s how:

- Accidentally left your lights on when you left the house? With home automation, you can switch lights off from wherever you are.

- Connecting blinds to a sensor-controlled system means they’ll close automatically when the temperature reaches a certain point, keeping your home cooler and reducing air-conditioning costs. You can also keep your home naturally cooler by setting up an automated shading system for overhead or exterior window shades.

- No more overheating your home unnecessarily; by installing a smart thermostat, your heating will switch off automatically when the temperature reaches a certain level.

How is a home-automation system different to a smart-home assistant?

Devices such as Google Home and Amazon Echo are great for convenience. They can perform simple tasks by using voice recognition, such as checking the weather, reading out the day’s headlines or performing Google searches.

A premium home-automation system is far more sophisticated. It allows you to automate several different devices through one simple-to-use interface or an app on your phone. So, instead of having five different remote controls to manage your various devices, you just have the one platform, which can be controlled by voice or touch.

Image: Crestron

Image: Crestron

How does voice control work?

Systems such as those at Crestron can be connected to Amazon Echo’s Alexa Voice Service to enable voice control. This allows you to give voice commands, such as ‘Alexa, turn off the kitchen lights’ or ‘Alexa, raise the temperature in the family room by five degrees.’

You can also control multiple systems simultaneously through a number of preset scenes. For example, in the morning you could say ‘Alexa, tell Crestron to activate Morning Theme,’ and the blinds will slowly open, the lights will switch on and a warm shower will start running in the bathroom. Or, if you want to set the mood for an intimate dinner party, simply say, ‘Alexa, tell Crestron to activate Intimate Dinner.’ The dining room lights will dim, the window coverings will adjust and soothing music will play from your speakers.

What should I expect to pay?

This depends on the level of automation you want. Crestron’s new PYNG 2.0 platform (available later this year), which controls audio/visual functions, such as the television, Foxtel, Apple TV and Sonos, starts from around $3,500. This would include the processor and a touch-screen remote control. Incorporating lighting and shading solutions into a home-automation system would see this cost rise to around $10,000, depending on the size of the space.

A fully connected smart-home system starts from around $25,000, depending on the size of the property.

Can I retrofit an automated system?

It’s best incorporated during the building phase. However, it’s certainly possible to install after the build.

Comments (0)

16 July 2018

By portermathewsblog

via therealestateconversation.com.au

Be a smart investor and have a loan strategy.

You have saved away and have enough cash to consider purchasing property as an investment. Like any purchase, it is a huge one so having a strategy in place will keep you focused and ensure that you are doing as much due diligence as you can for a successful investment.

Not many successful investors became successful by accident – we recommend you start by seeking professional financial advice to really determine what your borrowing capacity is and how realistic your investment is.

Debt does not have to be scary, unless it is the wrong type of debt. In an ideal situation, you will want your debt to be productive and if you have planned how your cash flow will be affected, then you can have a clear understanding of how purchasing that next investment will affect your lifestyle. Productive debt in our eyes can be used as an advantage to buy an asset or generate income such as rental income.

Understanding your loan strategy

If you are looking to invest in multiple properties, we think it’s important to understand the short and long term perspective of property ownership. You have to think about how this next loan or investment is going to influence your life and your cash flow as well as what the situation might look like with your third or fourth investment. We say this as it can really make a difference in the type of property you purchase in the first place.

Think about how positively or negatively geared loans will affect what you purchase or how you live in the future. It may seem odd to be thinking so far in advance, but we think it is important to really understand your financial situation and also the results you would like to achieve as a property investor.

This is where we think it is important to be surround by the right advice. The right financial advisor for you will be able to help you plan the various scenarios to suit your end goal – after all everyone has different goals in their lives.

Comments (0)

12 July 2018

By portermathewsblog

via domain.com.au

With Australia’s major supermarkets banning the plastic bag it’s a good time to get on board #PlasticFreeJuly.

The initiative, whereby people pledge to reduce plastic from their lives for a month, is a great opportunity to learn about plastic-free eco alternatives beyond the tote bag.

Founder of the Plastic Free July Foundation, Rebecca Prince-Ruiz, says while plastic is an extremely useful material the fact it’s designed to last forever causes problems for the environment.

One of the biggest impacts is, of course, on wildlife. But plastic is a huge problem for humans too. Plastic bags contain a cocktail of chemicals that leach into the environment and increase up the food chain. “The UN Environment said it’s one of the greatest environmental challenges of our time,” Prince-Ruiz says.

Images of the Great Pacific Garbage Patch might suggest it’s a problem happening elsewhere. “CSIRO research found plastic in every beach in Australia,” Prince-Ruiz says. “And because we have high concentrations of wildlife, we’re the area in the world where seabirds are most at risk.”

Only 9 per cent of all plastic we’ve made on our planet is recycled, according to Prince-Ruiz. “This is a problem we can’t recycle our way out of. We need to rethink our use of this material.”

She suggests eliminating all single-use throwaway plastic such as plastic lollypop sticks, bottle caps, drink bottles and bags. “These are what we’re finding in our environment. It’s not about being perfect, or a competition. It’s about saying ‘hey, I’m going to try’.”

Frustration with sourcing plastic-free products led Sydney-based Lottie Dalziel to found an online marketplace where consumers can purchase plastic-free products all in one place. Launched in March, banish offers more than 460 products across 22 eco-friendly and cruelty-free brands, and is part of a growing movement to rein in the problem of plastic waste.

From the quirky and old-fashioned, to the funky and plain brilliant, here’s a glance at what’s out there to help you replace plastic in the home in July and beyond.

Kitchen

Beeswax wraps

Use to replace cling wrap. “It comes in funky colours and is a piece of fabric coated in beeswax,” Dalziel says. “Using the heat in your hand, it moulds. You just unwrap and rinse in cold water and use again.”

Beeswax wraps can replace cling wrap. Photo: Beeutiful.com.au

Beeswax wraps can replace cling wrap. Photo: Beeutiful.com.au

Lunch skins

The lightweight fabric bags come with a velcro closure and replace plastic lunch and snack bags.

Reusable produce bags

“Take these shopping with you and put your fresh produce into them, Dalziel says. “Keep them in their bags and it helps separate them in your crisper.”

Knitted and fabric cleaning cloths

Washable and re-usable, these replace your Wettex or Chux.

Coconut fibre scourers

A trendy accompaniment to your au naturel wooden chopping board.

Reusable straws

Choose from bamboo or stainless steel options.

Reusable bamboo straws. Photo: Banish.com.au

Reusable bamboo straws. Photo: Banish.com.au

Tea strainers

Combine the old-fashioned metal tea strainer with loose-leaf teas to banish plastic from your morning cuppa.

Bamboo takeaway cutlery

Chuck these in your lunchbox or buy in bulk for parties instead of the plastic variety.

Dishwashing tablets

Add a tablet to your dishwasher compartment and use as normal. Lil Bit sells a Cajeput-scented, Himalayan salt tablet.

Dust brush

Eco-Max offer a handmade and biodegradable recycled timber and coconut fibre dust brush.

Himalayan salt dishwashing tablets. Photo: Lil’ Bit

Himalayan salt dishwashing tablets. Photo: Lil’ Bit

Bathroom & personal hygiene

Shampoo and conditioner bars

Handmade, full of yummy ingredients and sure to start a trend. Get them at Lush and Beauty and the Bees.

Deodorant paste

Scent up with this option from Good & Clean. A portion of profits goes to your conservation project of choice.

Bamboo toothbrushes

“Cut off the bristles and the bamboo is completely biodegradable,” Dalziel says.

Dental lace

Made from Mulberry silk and mint-flavoured, it comes in it’s own refillable glass and stainless steel container. Get it at Ecostainable.

Metal razors

Built to last, you probably have one in your cabinet. For something new and nifty try the Parker Safety Razor.

100% natural deodorant paste. Photo: Good & Clean

100% natural deodorant paste. Photo: Good & Clean

Menstrual cups

Made with soft, medical-grade silicon, menstrual cups are used like tampons. Find them at Banish and other stockists.

Biodegradable cotton buds

Go Bamboo sell biodegradable bamboo cotton buds.

Tooth and gum powder

Natural ingredients mean this is also better for you. Buy it online at Banish.

Laundry

Soap nuts/soap berries

The saponin-rich shells of the Sapindus Mukorossi tree nut produce foam when mixed with water. “Add about seven nuts to your washing load in a bag,” Dalziel says. (Micro-plastics in traditional detergents end up in the world’s waterways).

Toilet

Toilet bombs

Pop one in the toilet for five minutes, scrub and flush away. Get them at Lil Bit.

Waste

Biodegradable trash bags

Hurrah. These do exist! Find them online at Biotuff and Flora & Fauna.

Biodegradable cotton buds. Photo: Shop Naturally

Biodegradable cotton buds. Photo: Shop Naturally

Comments (0)

09 July 2018

By portermathewsblog

via reiwa.com.au

Are you looking to jazz up your home but don’t have the available funds? Maybe you are planning to sell, or just want to give it a facelift?

Are you looking to jazz up your home but don’t have the available funds? Maybe you are planning to sell, or just want to give it a facelift?

Either way you don’t need to spend an arm or a leg, you just need a little bit of inspiration.

Here are five ways you can give your home the ultimate make-over without breaking the bank.

1. Clean out/de-clutter your home

Start by a good old clean out – this you can do for free. Living in a messy, cluttered house will have you feeling anxious and itching for a change of atmosphere, plus it won’t make a good first impression on visitors.

rid of junk you don’t need, wash the walls, doorways and clean all the dust and cob-webs! This will have an immediate effect on the oxygen circulation of the house – breathing in fresh air is the start to feeling good in your home.

2. Paint the walls

Whether you want to change the colour all together or just want to lift the look,the most effective way to rejuvenate your home is to apply a fresh coat of paint.

Light to neutral colours gives you more flexibility with furniture and décor, and creates the illusion of space. Plus, painting your home is relatively cheap, unless you want to seek a professional painter to do the job.

While you have the paint out, it is also a good idea to re-paint the doors, door frames, skirtings and ceilings in simple white, to freshen up the aesthetic of your house.

For some inspo, find out how to select the right paint colour for your home.

3. Re-decorate

It is ridiculously affordable to decorate your home these days, you just need to trigger your creative side.

Adding plants and some pottery to your home is a great way to set the mood and can be very affordable and easily maintained with a little bit of TLC. Adding a splash of greenery to your space is not only aesthetically appealing, but pot plants also help purify the air, just make sure you buy plants suitable for indoors.

Candles, incense and infusers also have dual purpose when it comes to décor. They look good, and smell good, once again adding that infused delicious aroma to your home.

When it comes to the bedroom and living rooms, pillows, throws and new linen is something that will always catch the eye. What better feeling is there than purchasing fresh new bedding? Try and coordinate this with whatever colour you paint the walls or keep the same colours but you can mix up the styles.

Remember, simple can sometimes mean more, so try keep all decorations minimal but effective.

4. Rearrange furniture

If you already love your furniture but still feel sick of it, a simple re-organise of the couches, TVs beds, tables etc can make you feel like you’re in a whole new house.

Making different uses out of the things you already have in your home will save you money. You think you might be sick of an item, but put it somewhere else and you might fall in love with it all over again.

5. Update light fittings

Lighting is the key to making any home stand out, and you would be surprised what a simple swap of the light fittings will do.

If you’re on a budget consider going for one or two designer light fittings in the main living areas, then cheaper ones for the other rooms.

While we are on the topic of lighting, you can also replace the light switch covers which won’t cost you a lot at all. Swap out those old fashioned, plain switch covers for silver, stainless steel or modern white covers.

Comments (0)

06 July 2018

By portermathewsblog

popsugar.com.au

Image Source: A House in the Hills

If there are rules that you as a renter must follow, make it these 10 commandments. Because, while paying your rent on time is important, so too is making sure your place is personalised and stylish. Working within the boundaries of your landlord, it’s little things like a new light fixture that will make an impact without costing a lot of time or money. And, the best part about this entire list is that you’ll leave with your security deposit intact once it’s time to move up and on.

- Thou Shalt Add Storage

Let’s get real, custom cabinetry is not an option if you don’t own the place. Since rentals usually lack storage, add your own with affordable Ikea bookcases, simple shelves, or these organising solutions.

- Thou Shalt Change the Hardware

Rental hardware is basic . . . your style, not so much. Switching out cabinet pulls and bathroom hardware will make a huge difference. Just remember to keep the original pieces to swap back in before moving out.

- Thou Shalt Ditch Vertical Blinds

Image Source: Dana Miller for House*Tweaking

They are the ultimate decorating sin! To prevent your space from looking like a hospital room, take them down or hide them under curtains. Again, don’t toss — they’re essential if you want your security deposit back.

- Thou Shalt Line Cabinets

This might seem trivial and a bit annoying, but lining your cabinets is a must. Not only will it make your kitchen look clean, but also it will mask worn and grungy cabinets without having to paint. Adhesive liner works, but a softer grip liner is better because it’s easy to install; it will also prevent glassware from chipping.

- Thou Shalt Accessorise Like Crazy

It’s true, and that’s the only way you’re going to get a truly personal space. Go to town with throws, pillows, and accents that reflect your style.

- Thou Shalt Avoid Wallpaper

Well, in most cases. Sure it’s stylish, but in all honestly, wallpaper is really inconvenient to remove, especially if you won’t be in your place for long. If you love the patterned look, consider the removable wallpaper seen in this studio or these alternative wallpaper ideas.

- Thou Shalt Hang Art

Image Source: Love Grows Wild

No excuses — get your art on the walls! Patching up a tiny hole come move-out day is nothing compared to the impact it will make on your space. No need to create a full-blown gallery wall either. Try hanging one statement piece and resting photos on a mantel or shelf, similar to this home.

- Thou Shalt Invest in Rugs

Especially if your place has carpet! Rugs are an easy way to cover up that not-so-cute carpet and can be packed up with you come your next move. Rugs are also a necessity to keep noise down, especially in older apartments with wood floors.

- Thou Shalt Emphasise Lighting

Image Source: POPSUGAR Photography

This is another trick that many renters often overlook. Take it from HGTV stars Anthony Carrino and John Colaneri who suggest you use lighting to set the tone and make an impact in a rental. Get creative with floor and table lamps that can easily be moved from place to place.

- Thou Shalt Make the Most of Plants

No yard? No problem. Pots are a great way to achieve the bohemian jungalow look or even have your own urban garden. The best part is you won’t have to fret about leaving any of them behind.

Comments (0)

02 July 2018

By portermathewsblog

via houzz.com.au

An interior designer reveals the essential rules for achieving a perfectly balanced interior.

Have you ever walked into a room and it just felt right, but you couldn’t put your finger on exactly why? Chances are that proportion was a key factor – whoever designed the room would have paid careful attention to getting the size and scale of the furniture and accessories just right for the space.

We talked to Rohan Smith, senior interior designer at Coco Republic Interior Design, to find out how you can create beautifully proportioned rooms in your own home.

Why does proportion matter?

Why does proportion matter?

Because furnishing a room is more involved than simply placing a few pieces of furniture in a space – some fundamental rules of design need to be considered, one of the most important being proportion. You need to consider not only the proportional relationship between the pieces themselves, but to the space that contains them.

A room looks and feels right when the proportions are good, and there’s neither too little nor too much furniture. If furniture is too big, the flow of the room can feel awkward. If it’s too small, the space won’t feel cosy or inviting.

What are the most common mistakes people make?

Having all the furniture and furnishings in a room the same height, colour and style. The room ends up looking dull and static. This is easily rectified. A tall floor lamp, for example, can add some height to a corner, while providing a lovely ambient light source. A tall cabinet or bookcase can add visual interest as well as handy storage.

How do you assess proportion?

One of the easiest ways to assess whether a sofa, dining table or bed will suit the size of your room is to map it out with newspaper and lay it on the floor. This will give you a sense of how much floor space the piece will take up. Living with this template for a few days will give you a definite feel for how it will be to live with the piece.

A more technical method would be to use the Houzz Sketch tool or an app such as Magicplan. You simply take photos on your smartphone, which the app then translates into a plan of the space. You can then add objects, annotations and attributes to create a complete plan of your room.

What proportions do you need to consider for a living room?

Living rooms can be tricky to get right, especially in open-plan spaces.

If the room is your main television viewing space, then you’ll need to factor in technology as well as furniture. Is the TV too big for the room? Is the entertainment unit balanced with the size of the TV, and the room as a whole? A common mistake is to have a small entertainment unit with a large TV – it should be the other way around. Also, consider whether the sofa is the correct distance from the TV for viewing comfort. It should be about 2.5 times the screen width in distance away, and no more than 5 metres. The centre of the TV should be about 1 to 1.1 metres from the floor.

A large sofa and a small rug also look unbalanced.

For living rooms, the furniture arrangement should be conducive to conversation. Two sofas facing each other or a U-shaped arrangement are ideal. The coffee table should also be the right height for the sofa. You should be easily able reach the coffee table from a seated position so you can rest a cup of tea or a glass of wine.

What about a bedroom?

One of the main considerations in the bedroom is the size of the bedside table in proportion to the bed. For a king-size bed, go for a large-scale beside table of about 70-90 centimetres in width, depending on the size of your bedroom. For a queen-size bed, a bedside table of around 50-60 centimetres is ideal.

Bedside lamps should also sit proportionally with the bedside table and bedhead. Again, for a king-size bed, a larger lamp will work best.

Are there any golden rules for hanging pendant lamps?

When pendant lamps are hung too high or low, they can look completely out of place in a room. You need to consider the size and style of the pendant, the ceiling height, and the space in which they will be hung.

Despite these variables, there are still a few hard-and-fast rules that can help when hanging pendants. For kitchen benches, hang lights around 70-80 centimetres above benchtops. This height allows the pendants to provide a useful light source for working, without intruding on the line of sight from the kitchen to the adjoining living or dining room.

For your dining table, sit pendants at 75 centimetres above table height to create an intimate and cosy dining space. For entries and hallways where people will be walking beneath the pendant lights, space allowing, the ideal hanging height is 240 centimetres from floor level.

What about hanging art?

Choosing artwork that is the wrong scale for a room is a common mistake, with most people erring on the small size. Checking to see whether a gallery will allow you to bring a piece home on approval is the best way around this. If you fall in a love with a piece that is too small for your room, have it re-framed with a larger mount.

Another common mistake is to hang artwork too high on the wall. If a piece is hung too high it will have no connection to the furniture below it, and if it’s above eye level it can ruin the look of a room.

Ideally, artwork should be hung so that the centre of the piece is at average eye level or about 150 centimetres from the ground. In a dining room you might want to hang the pieces slightly lower to factor in the seated viewing height.

Also remember that having some negative space is important. Leaving some walls bare not only puts more significance on the pieces you’ve hung, but creates a calmer feel in the room.

And rugs?

Rugs are a great way to bring a furniture grouping together. They provide a border for furniture to sit on and can help you create individual dining and living zones in an open-plan room where furniture has a tendency to ‘float’. Ideally rugs should sit under the front legs of the sofa and occasional chairs – this helps visually link the pieces together.

What about the proportions for colour in a room?

When making your selection, consider the 60-30-10 rule, which is a timeless decorating principle that can help you create a balanced colour scheme. Your 60 per cent is the main colour for a room, which anchors a space and provides a backdrop for the other colours. In a living room this would be walls, sofas and rugs.

Your 30 per cent is the secondary colour, which would encompass occasional chairs, bedlinen, window furnishings and occasional furniture. It should support the main colour, while being different enough to set it apart and give the room interest.

The final 10 per cent is your accent colour. For a living room, this would include scatter cushions, decorative accessories and artwork. For a bedroom, think throw pillows and artwork.

Do the rules of proportion apply to the little details too?

Keeping an eye on the proportion of decorative accessories is another important consideration. One large bowl on a dining table might be all you need in that space to create drama. Conversely, combining small objects with other similar objects can create just as much impact. A collection of ceramic pots makes one big statement, whereas a few pots scattered about will look disconnected and out of proportion.

Lamps should not overshadow the table on which they are placed. A large lamp on a slender table, for example, would appear top heavy. Too much variety of scale can cause visual chaos in a focused area, such as a bookshelf. Instead, group items of similar type and scale together, and line up like-sized books for a balanced look.

Comments (0)

25 June 2018

By portermathewsblog

via therealestateconversation.com.au

Many investors steer clear of vacant land because they mistakenly believe they can’t claim interest repayments on it.

In fact, the biggest thing that most accountants get wrong when advising clients on vacant land is that the interest component on it isn’t tax deductible.

I’ve had many arguments with many accountants about this topic over the years!

The key component is the clear intent to build a property within a reasonable timeframe. If the investor was audited, the investor would need to prove that the timeframe – whether it’s a few weeks or months – was necessary to enable to construct the investment property.

I’ve heard this ‘non-advice’ so many times over the years and that’s why it’s so important that you get advice from a property accountant with a strong understanding of the relevant legislation.

Which land is best?

With vacant land, there are a number of different strategies that you could implement.

The first one is residential land that is being carved up by a developer, but you buy before the titles for each individual block have been registered. Effectively, you’re buying land off the plan, but it’s important to understand that there are pros and cons to this strategy.

The pro is that if it’s in a high-demand area and you’ve bought during the early stages of development, you tend to make some money. You also generally only need to put down a few hundred or thousand dollars as the deposit. Naturally, because you are very much dependent on how fast the developer can register each block, you’re at the whim of the market, which can be a con. For example, in my portfolio, I once bought 18 blocks of land that were not yet registered.

In fact, registration wasn’t supposed to happen for another two years. However, it happened in just eight months and I wasn’t ready. So all of a sudden I had 18 parcels of land that I had to settle on, but I didn’t have my finance organised.

After discussing it with the developer, I ended up settling on four of them and he released the other 14 back to the market, which worked out well for him because the market had improved.

So, if the land is registered well ahead of time, you can be left scrambling.

On the other hand, if registration takes longer than expected, the market could have slowed down. Like any off-the-plan project, you only need one bad valuation to negatively impact

the entire subdivision or development. Plus, everyone will be building at the same time, which means you’re competing for trades and will likely be finished at the same time, too, and that means a strong likelihood of softer prices.

What about greenfield and infill sites?

When I say greenfield sites, I mean blocks of rural land that you intend to rezone for residential usage. Now this is a strategy for more advanced investors because there is more risk as well as a higher financial component required for earthworks and approval costs. Greenfield sites can be bought for an affordable price, but if you can’t get the subdivision approved you need to have the money behind you to fight all your way up to the Environment Court if necessary.

A better strategy is to target infill sites within already established residential areas.

In this scenario, you buy a larger block of land, usually with a house on it, to carve off the land at the back or the side to sell as vacant or with a new property on it.

The other option is to subdivide, then construct a new dwelling and then keep both. Infill developments can also lean towards knocking the old house down, splitting the block into two and selling the vacant land, or building two houses or even multiples. It must always come back to whether there is a market for your project and whether the numbers add up, because you must take into account all of the costs on the way in and on the way out.

That way you can make an educated decision whether to keep holding long term or take your profits to invest elsewhere.

Whichever strategy you choose, you must do your figures on the worst-case scenario to see if it adds up. That’s because land generally has a lower, or no yield to start off with, which means your holding costs can be higher than with a house, for example.

At the end of the day, vacant land as a strategy, does work. You just need to have your eyes wide open to ensure your figures are correct and you must understand that it might be a while before income rolls in.

Finally, it goes without saying that you must get tax advice from a specialist accountant who understands property. If you don’t, you could end up with pockets just as vacant as the land you’re investing in.

Comments (0)

22 June 2018

By portermathewsblog

via popsugar.com.au

If searching for your keys is a part of your morning ritual, it’s time to break the cycle. Being organised is more than just a personality trait, it’s a lifestyle decision that’s easier to achieve if you stock your home with the right tools. These 15 clutter-busting essentials will make your days feel longer and less stressful. Cheers to that!

Idea: If you don’t want to hang a key hook, do yourself a favour and get a key catchall. Having a designated place to place your keys when you walk through the door will save you from the “running late” syndrome. Don’t be that person.

Get it: Making your own leather catchall is easier than you’d think. Follow this tutorial on A Beautiful Mess to DIY your own

Image Source: Bahar Yurukoglu for Domino

Image Source: Bahar Yurukoglu for Domino

Idea: You know how it goes . . . You take the time to meticulously fold sheets and towels, and by the end of week, it looks like a bomb exploded in your linen closet. Here’s where clear shelf dividers come in. They’ll keep your stacks of linens in order without creating an eyesore.

Get it: Stock up on these acrylic shelf dividers to tame your most unruly closet.

Idea: Put your pantry on display by keeping dried goods and other treats in lidded glass jars.

Get it: You can get her kitchen jars at Ikea.

Idea: If you’ve seen these used to hang pots and pans, you’ll be happy to know that the idea translates for any room in the house. We love how Sugar + Cloth blogger Ashley Rose used one for above-the-bed storage and decor.

Image Source: Paul Costello for Domino

Image Source: Paul Costello for Domino

Idea: If shuffling through a drawer to find a tube of lipstick gives you anxiety, you’ll be amazed by the efficiency that a simple drawer organiser can offer.

Idea: Forget the space-saving allure of forgoing a knife block — we’re crazy about the fact that you can see the shapes and sizes of your most utilised knives while keeping them in reach.

Idea: It’s amazing how quickly a tray can corral clutter. Bonus points for turning the top of your toilet into an extension of your medicine cabinet (with the addition of a slim bud vase and framed picture, of course).

Image Source: Cahan Eric For Domino

Image Source: Cahan Eric For Domino

Idea: Labelled boxes are a great way to organise the things you want out of sight.

Idea: Sure, you can use them to hang a curtain, but they work wonders in making the most out of shelves. Follow Martha Stewart’s lead, and use them to organise kitchen items like pot and pan lids, trays, and cutting boards.

Image Source: Lesley A. Unruh for Domino

Image Source: Lesley A. Unruh for Domino

Idea: Whether you need more storage space for clothes or craft supplies, these wall-mounted mesh drawers allow you to customize your storage and easily see what you’re storing.

-

Makeup Brush Cups

Idea: Instead of cramming makeup brushes into a messy drawer or makeup bag, keep them within easy reach in a stylish cup.

Idea: Whether it’s a drawer filled with neat rows of spices or a creative DIY that frees cabinet space, every organized cook seems to have their spice collection under control.

Get it: A Beautiful Mess has an easy-to-follow tutorial for making these nifty magnetic spice jars.

-

Clever Toilet Paper Storage

Idea: Running out of it when you need it is the worst, but stacking it in plain sight can cramp your bathroom’s style. Kill two birds with one stone by turning a basket into a toilet paper organiser and dispenser.

Image Source: Monica Wang for The Everygirl

Image Source: Monica Wang for The Everygirl

Idea: A lack of cabinet space doesn’t have to stop you from owning bulky appliances like KitchenAid mixers and high-powered blenders. Some of the cutest rentals we’ve seen use stainless steel shelves for stylishly organization, making it easy to keep everything within sight. The best part? You can extend them or shorten them for a customized height.

Get it: This shelving unit is a great starter package.

Comments (0)

14 June 2018

By portermathewsblog

via domain.com.au

If you’ve ever bought a heating appliance only to find it woefully inadequate for the task at hand, you need Christian Hoerning’s advice. A technical expert at EECA Energywise, he tells us how to stay toasty without getting burned by the end-of-month bill:

For larger rooms you want to heat regularly, it’s worth paying a bit more upfront for a fixed heater with lower running costs and more heat output than a small electric heater can provide.

Electric heaters may be enough for smaller rooms and rooms you only heat occasionally.

Hang on the wall electric fires can be two or three sided and have floating shelves such as those in the Skope Trento Suite from The Fireplace. Photo: The Fireplace

Hang on the wall electric fires can be two or three sided and have floating shelves such as those in the Skope Trento Suite from The Fireplace. Photo: The Fireplace

Avoid unflued gas heaters (either portable or with pipes fixed to the walls) that release toxic fumes and moisture, and open fires that are draughty and inefficient.

Match the size of your heater to the space. An oversized or undersized heater won’t work effectively, and can cost more to run.

To minimise the environmental impacts, choose a heating option that uses renewable energy, like wood, wood pellets or electricity (which is about 80 per cent renewable on average).

An Escea outdoor cooking fire completes this outdoor kitchen by Dravitzki Brown Architecture, it comes with an adjustable cooking plate for flame grilling. Photo: Escea

An Escea outdoor cooking fire completes this outdoor kitchen by Dravitzki Brown Architecture, it comes with an adjustable cooking plate for flame grilling. Photo: Escea

Choose the most efficient model for the job, and use and maintain your heater properly – for example, have heat pumps serviced and regularly clean the filters.

Fireplace: The expert advice