15 October 2018

By portermathewsblog

via reiwa.com.au

Affordability in Perth’s residential sales market improved during the September 2018 quarter, with house and unit prices softening marginally.

Affordability in Perth’s residential sales market improved during the September 2018 quarter, with house and unit prices softening marginally.

REIWA President Damian Collins said there was excellent opportunity for buyers and investors to take advantage of current market conditions to secure their next home or investment property.

“While the worst of the market downturn appears to be behind us, the results of the September 2018 quarter reveal conditions are favourable for buyers and investors,” Mr Collins said.

Median house and unit price

reiwa.com data shows Perth’s median house price should settle at $505,000 for the September 2018 quarter.

“This is 1.9 per cent lower than the June 2018 quarter median and one per cent lower than last year’s September quarter,” Mr Collins said.

“While quarterly median figures can be more subject to stock composition changes, the fact that the annual change is only one per cent lower suggests that we are at or near the bottom.

“It was a similar story for the unit market, with the median expected to settle at $395,000, which is 1.3 per cent lower than the June 2018 quarter and 2.5 per cent lower than the September 2017 quarter.”

While the overall market experienced a decline in median house price during the quarter, 57 suburbs across the area bucked this trend.

“The top performing suburbs for median house price growth were Swan View, East Cannington, Como, Hillarys and Cottesloe.” Mr Collins said.

“In the unit market, Maylands, Midland, Tuart Hill, Fremantle and Claremont were the suburbs with the strongest price growth.”

Sales activity

There were fewer sales in the September 2018 quarter than there were during the June 2018 quarter.

Mr Collins said reiwa.com data showed 6,428 sales for the quarter, which was 4.9 per cent lower than last quarter.

“It’s not uncommon to experience a decline in sales during the September quarter, with West Australians typically less inclined to search for property during winter. We tend to see activity slow during the winter months before increasing again as the weather warms up,” Mr Collins said.

The share of house sales in Perth has increased, with reiwa.com data showing houses now comprise 74 per cent of all sales, compared to 65 per cent at the same time last year.

Perth’s top selling suburbs for house sales during the September 2018 quarter were Baldivis, Canning Vale, Morley, Dianella and Gosnells, while the suburbs to record the biggest improvement in house sales activity were Cooloongup, The Vines, Alexander Heights, Mirrabooka and Wattle Grove.

“It’s a good time to buy, which is reflected in the fact a higher proportion of houses are now being sold. This shift in the composition of sales (houses, units and land) indicates buyers are more inclined to purchase a house than they might have otherwise been. This can be attributed to housing affordability improving across the metro area, which has made buying a house a more attainable property purchase,” Mr Collins said.

“We’ve also seen an increase in activity between the $350,000 and $500,000 price range during the September quarter, which is pleasing as it indicates first home buyers remain an active component of the Perth market.”

Listings for sale

There were 13,850 properties for sale in Perth at the end of the September 2018 quarter.

Mr Collins said stock levels across the metro area had declined 3.7 per cent during the quarter.

“It’s pleasing that, although there were fewer sales this quarter, listing stock continues to be absorbed.

“This is the third consecutive quarter we’ve seen listings for sale decline, which is a positive step forward in the market’s recovery,” Mr Collins said.

Comments (0)

10 September 2018

By portermathewsblog

via therealestateconversation.com.au

Malcolm Gunning, President of the Real Estate Institute of Australia (REIA), and Leonard Teplin, Director of Marshall White debate the potential implications the most recent leadership spill could have for the residential property market.

It feels like we’ve had more leadership spills than seasons of The Bachelor, and some industry leaders are worried that Australia’s reputation for changing Prime Ministers at the drop of a hat is having negative consequences across the property market.

Director of Marshall White, Leonard Teplin says the constant change of leadership in Australia is driving residential buyer sentiment to an all-time low, and it’s the Australian public who are left to sit back and watch the fallout, again and again.

“There are no real winners, only losers. The Australian public must once again sit and watch while the effects ripple across our economy and property market,” Mr Teplin said.

“It’s no secret that every time there is an election, market sentiment drops, people delay purchases and put off big decisions until the new leader has been decided, and election promises turn into policies.

“In real estate, this sentiment is reflected in weaker conditions as buyers cautiously await the inevitable policy changes and market overcorrections that are sure to follow suit.

Industry leaders are concerned about the potential implications the leadership spill could have on the property market. Image by Adz via WikiCommons

Industry leaders are concerned about the potential implications the leadership spill could have on the property market. Image by Adz via WikiCommons

“As Scott Morrison gets set to take over as the nation’s leader, property purchasers both locally and abroad will be questioning what this change in direction will mean for them and their investments,” Mr Teplin told WILLIAMS MEDIA.

But Malcolm Gunning, President of the Real Estate Institute of Australia (REIA) doesn’t believe the leadership spill will have a drastic impact on the property market.

“I don’t think there will be any change because Scott Morrison was really the architect of the current economic policy,” Mr Gunning told WILLIAMS MEDIA.

“Tougher lending criteria introduced by the APRA, and the banking royal commission is what’s really having the biggest influence on the market at the moment.”

Jock Kreitals, CEO of the REIA agrees.

“In terms of the recent changes of Prime Ministers and Ministers, I do not see any impact on the market attributable to this. The policy of the Coalition regarding negative gearing and CGT remains unchanged.

“The PM as the previous Treasurer has reiterated the position a number of times. Further, the PM well understands the impact of changes in policy having worked in a policy role in the property sector,” Mr Kreitals told WILLIAMS MEDIA.

Real Estate Institute of New South Wales (REINSW) CEO, Tim McKibbin says the new Prime Minister should put good fiscal policy ahead of economically damaging, populist politics.

“Those advocating for removing the deductibility of expenses incurred in earning assessable income in the residential property market are damaging people’s ability to acquire a home,” Mr McKibbin told WILLIAMS MEDIA.

“This is adversely impacting the property industry – Australia’s biggest employer – and playing petty politics in the misguided belief it will promote their personal brand.”

Potential implications for foreign investment revenue

Mr Teplin believes the latest leadership spill could impact international investment revenue.

“A stable government is a pillar of optimised liveability and one of the main reasons Australia has enjoyed a consistent influx of foreign investment into the real estate market, in turn driving the delivery of new infrastructure and economic progress,” Mr Teplin said.

This recent setback could be detrimental for Australia’s international investment revenue, “which serves a much-needed portion of the market that drives new residential supply and delivers stock to the rental market,” Mr Teplin continued.

Mr Gunning told WILLIAMS MEDIA the message the government is sending to overseas investors is what worries him the most.

“Our government seems to be very stable – and I’m not talking about leadership changes – but both parties are reasonably well aligned in policy. What sends the discouraging message is the tightened immigration and the taxing of foreign investors,” Mr Gunning said.

“Chinese investment into Australia’s residential property market has stopped, and I can say with conviction that the message this sends back to China is that they’re not welcome. So it’s more about the message it sends by the government rather than the changes in leadership.”

“It will take investors out of the market”

If Labor were to win the next election, as it appears they will, Mr Gunning says the rental market will suffer.

“Labor is absolutely rusted on to negative gearing. They are of the opinion that it will help affordability, which is completely incorrect. What it will do is drive up rents because there will be fewer people buying investment property,” Mr Gunning said.

“There has been 13 per cent growth in rent over the last five years, which is historically low and below inflation. If Labor gets in, it will take investors out of the market which will hinder supply – up goes the demand and the cost of rent.”

Mr Kreitals told WILLIAMS MEDIA that if Labor were to be elected, the current market falls would be “exacerbated”.

“Labor has on many occasions, including recently, reiterated the position that it took to the 2016 election to change negative gearing and CGT arrangements. In the lead up to the 2016 election, a number of studies were undertaken to examine the impact of such changes. In short, housing prices will fall and rents will go up.

“SQM Research, for example, forecast that in the first year of the policy, prices would fall by up to 3 per cent, and by up to 8 per cent and 4 per cent in the following two years.

“It needs to be remembered that at the time of the 2016 election, property prices were rising. Introduction of Labor’s measures would exacerbate the current market falls and flow on to the construction industry and economic growth,” Mr Kreitals said.

Industry leaders debate the implications the leadership spill could have on the property market. Image by Maxmillian Conacher via Unsplash.

Industry leaders debate the implications the leadership spill could have on the property market. Image by Maxmillian Conacher via Unsplash.

And if stability is the cornerstone of sound investment, Mr Teplin says buyers will look to take their money elsewhere for more predictable returns in safer markets.

“As sentiment plummets and the population continues to grow faster than new stock can be delivered to meet the market, now more than ever we need a strong, stable, united government to help rebuild the real estate market and deliver stock to where it is most needed,” Mr Teplin said.

“Political in-fighting isn’t just bad for business on a global scale – its effects are felt right across the property market long after party room vengeance has been executed.”

Affordability improving for renters, first home buyers

The June quarter 2018 edition of the Adelaide Bank/REIA Housing Affordability Report found that affordability has improved for renters and the number of first home buyers increased during the second quarter of 2018.

The number of first home buyers increased to 28,401 – an increase of 7.3 per cent during the quarter and an increase of 20.6 per cent in the June quarter of 2017.

First home buyers now make up 17.8 per cent of the owner-occupier market, compared with 14.3 per cent at this time last year.

Rental affordability improved in New South Wales, Victoria, Queensland, South Australia and Tasmania, remained steady in Western Australia and declined in the Northern Territory and the Australian Capital Territory.

New South Wales remains the least affordable state for renters, where the proportion of income required to meet rent repayments is 28.8 per cent – 4.7 percentage points higher than the national level.

Scott Morrison admitted last year that Australia has a housing affordability problem and announced a number of measures in the May budget.

“There are no silver bullets to make housing more affordable. But by adopting a comprehensive approach, by working together, by understanding the spectrum of housing needs, we can make a difference,” Mr Morrison said at the time.

Mr Kreitals told WILLIAMS MEDIA it’s worth considering the importance of property to the economy, highlighted by the latest GDP figures.

“For the quarter, the economy grew by 0.9 per cent and 3.4 per cent for the year, which is the fastest rate of growth since the September quarter 2012.

“The property industry is continuing to drive the Australian economy with investment in new dwellings increasing 3.6 per cent for the quarter. The construction industry grew by 1.9 per cent for the quarter and 5.5 per cent over the year,” Mr Kreitals said.

Comments (0)

23 July 2018

By portermathewsblog

via therealestateconversation.com.au

Real estate in Perth is at its most affordable on record, as falling prices give first home buyers their best chance of stepping onto the property ladder, according to the Housing Industry Association (HIA).

37 Marita Road, Nedlands, Perth under offer with Michelle Kerr from Abel McGrath as featured on Luxury List. Abel McGrath

37 Marita Road, Nedlands, Perth under offer with Michelle Kerr from Abel McGrath as featured on Luxury List. Abel McGrath

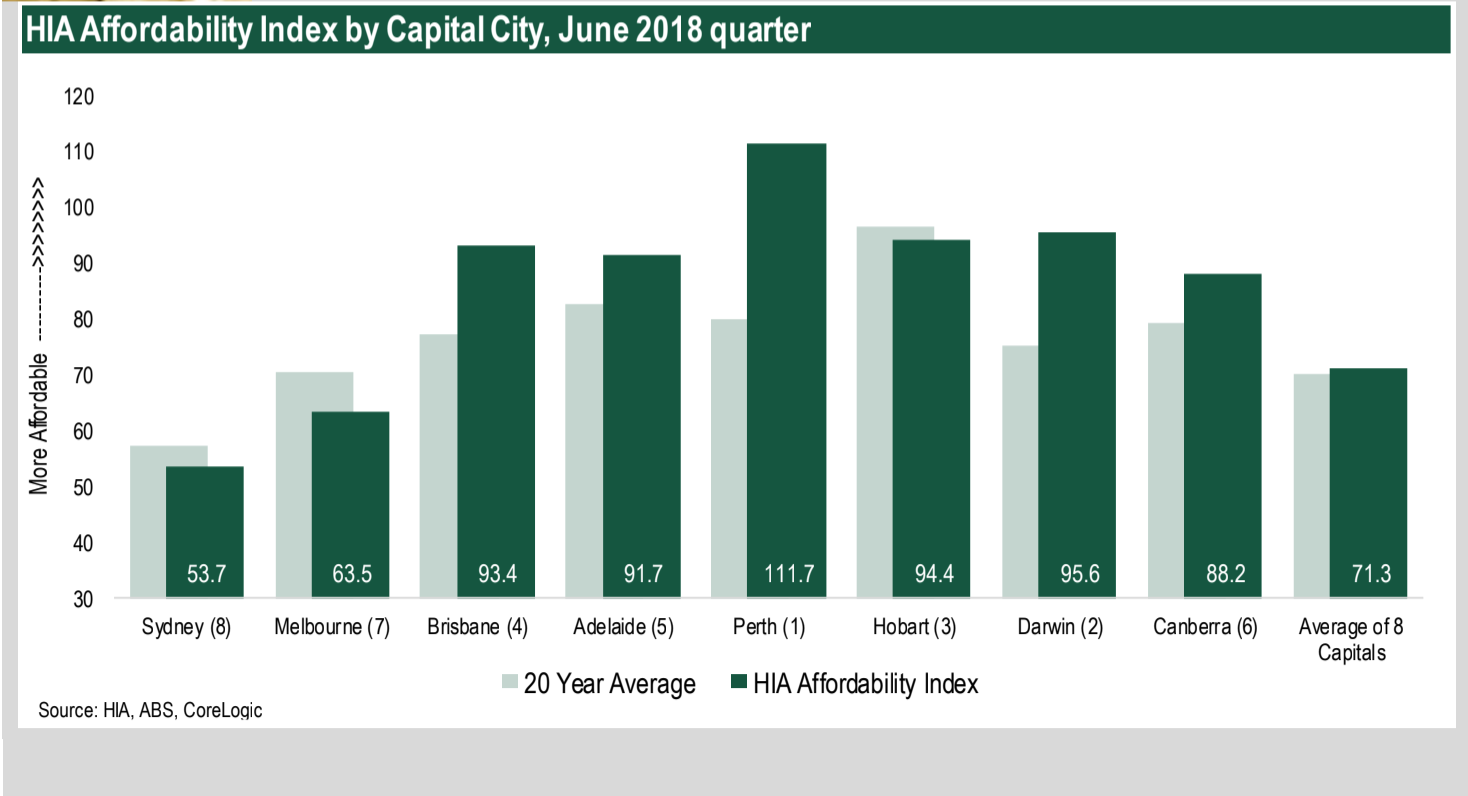

Figures from the Housing Industry of Australia (HIA) Affordability Index show Perth is the most affordable of the nation’s capital cities.

In the June 2018 quarter, the Housing Industry of Australia (HIA) Affordability Index registered 74.9, up by 0.4 per cent over the quarter and up by 0.8 per cent compared with a year earlier when affordability had reached its poorest level in nearly six years.

The HIA Affordability Index is designed so that a result of exactly 100 means that precisely 30 per cent of earnings are absorbed by mortgage repayments.

Higher results signify more favourable affordability – those above 100 signify that mortgage repayments account for less than 30 per cent of gross earnings, whereas scores below the 100 mark mean that more than 30 per cent of average earnings are absorbed by mortgage repayments.

According to HIA’s analysis, Perth is the most affordable capital city to buy a home in with an affordability rating of 111.7, closely followed by Darwin (95.6), Brisbane (93.4), and Hobart (94.4).

37 Marita Road, Nedlands, Perth under offer with Michelle Kerr from Abel McGrath as featured on Luxury List.

“Perth continues to present good opportunities for buyers, especially in the more affordable end of the market,” President of the Real Estate Institute of Western Australia (REIWA) Hayden Groves told WILLIAMS MEDIA.

In news that will surprise approximately no one, Sydney remains the least affordable capital city to purchase in, with a miserable affordability rating of 53.7.

Key findings from the HIA Affordability Report

- Easing price pressures are driving the improvements in housing affordability

- Housing affordability improved in five of Australia’s eight capital cities for the June 2018 quarter – Hobart, Melbourne and Adelaide were the only capital cities to see a deterioration

- Perth is now Australia’s most affordable capital city, followed closely by Darwin and Hobart

- Mortgage repayments account for 42.1 per cent of earnings in capital cities and 34.3 per cent in regional markets

HIA Economist Diwa Hopkins says affordability is hugely improving considering this time last year, affordability was at the lowest level in over six years.

“Easing house price pressures are providing some affordability relief for home buyers.

“Previous strong price increases were met by an unprecedented level of building which is now starting to come online. This is providing much-needed additional supply in key markets, helping to reduce price pressures and ultimately improve affordability for home buyers,” Hopkins said.

Source: HIA

Source: HIA

But the current plunge in house prices is unlikely to last for long, Hopkins warns.

“With an even balance in overall housing supply and demand in these key markets, the current downturn in dwelling prices is unlikely to be prolonged or severe.

“We could expect this downturn in prices to play out like previous cycles. They typically last 12 to 18 months, with the size of the fall modest relative to the immediately preceding expansion,” Hopkins said.

Ongoing fallout from the resources boom and bust cycles to thank for price plunge

Both rent and dwelling prices have been falling in Perth and Darwn for the last five years, amid the ongoing fallout from the resources boom and bust cycles.

While this is great news for renters and buyers in a market previously notorious for poor housing affordability, Hopkins warns it may be symptomatic of wider economic problems and in particular slowing population growth.

The weak economic conditions in both of these cities are seeing more people leave for interstate than are arriving, Hopkins says.

In particular population growth has followed these cycles and currently both cities are seeing more people leave for interstate than are arriving, resulting in spare capacity in their respective housing markets.

New home building activity has also fallen sharply in both cities as a result of the price declines, which risks causing an undersupply to emerge over the longer term in Perth and Darwin.

Groves told WILLIAMS MEDIA buyers are cautious right now.

“Trade-up family home buyers are lamenting they didn’t buy six months ago when the bottom of the market was apparent. Sellers who’ve been considering selling over the past few years are now cautious about coming to market too soon in anticipation of selling for more in the short-term future, especially down-sizers looking to maximise their capital-gains-tax-free benefit.

“Investors are likely to remain cautious until they see tangible growth which is likely to be towards the end of this year,” Groves said.

The best suburbs in Perth to invest in

According to data from REIWA, the rental yield for the Perth Metro region for houses currently sits at 3.6 per cent based on the overall median house rent price of $359 per week and median house price of $512,500.

This means on average, a typical property investor can expect to generate a 3.6 per cent annual return on their house purchase price.

REIWA says the suburbs of Bullsbrook, Medina, Parmelia, Armadale, Cooloongup, Maddington, Stratton, Camillo, Warnbro and Merriwa are house rental hotspots, offering investors the best return on their investment.

9 Bates Way, Warnbro available for rent through Property Osborne Park, as featured on Thehomepage.com.au

9 Bates Way, Warnbro available for rent through Property Osborne Park, as featured on Thehomepage.com.au

“Whilst the Perth property market is showing signs of a recovery in 2018, buyers and tenants remain the beneficiaries of the current environment, with a good supply of housing and rental stock to choose from at the more affordable end of the property market,” he said.

“With our local market on the cusp of recovering, now is the time for buyers and investors to take advantage of favourable conditions before our local market becomes less affordable,” Groves told WILLIAMS MEDIA.

Chief Operations Officer for Professionals Real Estate Group in Western Australia, Shane Kempton agrees.

“In the vast majority of areas in Perth, property prices are very low and buyers should now move quickly to secure a property before the recovery in the market gains further momentum to avoid buyers regret,” Kempton told WILLIAMS MEDIA.

View the Housing Industry of Australia (HIA) Affordability Index here.

Comments (0)

30 April 2018

By portermathewsblog

REIWA President Hayden Groves via reiwa.com.au

Although housing affordability has improved in WA in recent times, it remains a legitimate concern for many West Australians.

Although housing affordability has improved in WA in recent times, it remains a legitimate concern for many West Australians.

A recent Housing Affordability Report by the Real Estate Institute of Australia and Adelaide Bank showed while affordability improved in WA on an annual basis in the December quarter 2017, it had declined when compared to the September quarter 2017.

It’s concerning that despite favourable buying conditions and record low interest rates, housing affordability remains such a pertinent worry for many West Australians.

State property taxes are a barrier

REIWA is a strong advocator for addressing housing affordability, and we firmly believe current state property tax arrangements significantly contribute to this problem.

When REIWA surveyed the WA public about this topic last year, respondents overwhelmingly told us that property taxes negatively impact their lives. This is a growing issue and we need to do something to address it.

Home ownership still attainable in WA

The good news is; WA remains one of the most affordable states in the country for housing. Particularly in comparison to east coast property markets like NSW, where the median house price is higher and first home buyers find it more difficult to enter the property market. Here in WA, home ownership is still very much attainable.

In fact, we have the highest proportion of first home buyers out of any state or territory in Australia, with the Housing Affordability Report revealing 34 per cent of all owner-occupier home loans in WA in the December 2017 quarter were to first home buyers.

Additionally, although the average home loan amount to WA first home buyers increased during the December 2017 quarter, it was still $50,000 more affordable than the average loan amount required in NSW. A considerable difference.

However, more needs to be done. While the McGowan Government continues to face a challenging fiscal environment, REIWA still believes an incremental reform of property taxes will encourage both owner occupation and investment.

The residential property market is a key contributor to state revenue, specifically through transfer duty – one of the most inefficient and ineffective taxes. In the long term, we would like to see the Government transition to a broad-based land tax instead of relying on transactional taxes for revenue.

All West Australians deserve to have access to affordable, accessible and appropriate housing stock.

We call on the McGowan Government to commit to conducting a state tax review to look at more sustainable ways of funding essential services that doesn’t impact so heavily on affordability.

Comments (0)

16 April 2018

By portermathewsblog

Hayden Groves via therealestateconversation.com.au

The REIWA has come out in support of the WA state government’s plans to improve housing affordability by increasing housing diversity and density.

The Real Estate Institute of Western Australia supports a State Government plan to improve housing diversity and density to boost housing affordability.

REIWA President Hayden Groves said housing affordability remains one of the more challenging issues affecting West Australians.

“REIWA believes that access to secure and appropriate housing is essential to the success of communities and the prosperity of our state.

“REIWA is committed to ensuring everyone wins in property and will work alongside the WA Government to ensure the Affordable Housing Action Plan makes a positive impact to the lives of West Australians,” Mr Groves said.

Minister for Housing; Veterans Issues; Youth, Peter Tinley outlined the strategic plan this week, which promotes a ‘connected city’ by ensuring the needs of our diverse population are met.

“REIWA would like to congratulate Minister Tinley and the WA Government on this initiative that will promote a connected, sustainable and accessible property market into the future,” Mr Groves said.

The McGowan Government aims to deliver affordable homes as part of its METRONET vision and is currently developing its Affordable Housing Action Plan for release in mid-2018.

REIWA will work alongside the Government during the development of the action plan which focuses on:

- Connection between people, place and home;

- Real and enduring affordability for those on low-to-moderate incomes;

- Earlier and more connected housing and support services;

- Creation of diverse precincts that will include options for low-income earners; and,

- Diversity of options to meet diversity of need.

REIWA sits on the METRONET industry board and will work closely to advocate the delivery of affordable housing stock and the creation of METROHUBS.

REIWA will continue to actively support Government in ensuring all Western Australian’s have access to affordable housing through collaboration with the private sector.

Comments (0)

08 February 2018

By portermathewsblog

via hartpartners.com.au

Parliament has passed the legislation allowing first home buyers to save for a deposit inside superannuation through the First Home Super Saver Scheme (FHSSS) and also allowing older Australians to ‘downsize’ and then contribute the proceeds of the sale of their family home into superannuation.

From 1 July 2018, a first home buyer will be able to withdraw voluntary superannuation contributions they have made since 1 July 2017(up to $30,000 each, with individuals being able to contribute up to $15,000 a year within existing caps), along with a deemed rate of earnings, to help buy their home.

Also, from 1 July 2018, when Australians aged 65 and oversell a home they have owned for at least 10 years, they may contribute up to $300,000 from the proceeds into their superannuation accounts, over and above existing contribution restrictions. Both members of a couple may take advantage of this measure, together contributing up to $600,000 from the proceeds of the sale into superannuation.

Comments (0)