By portermathewsblog

Real estate in Perth is at its most affordable on record, as falling prices give first home buyers their best chance of stepping onto the property ladder, according to the Housing Industry Association (HIA).

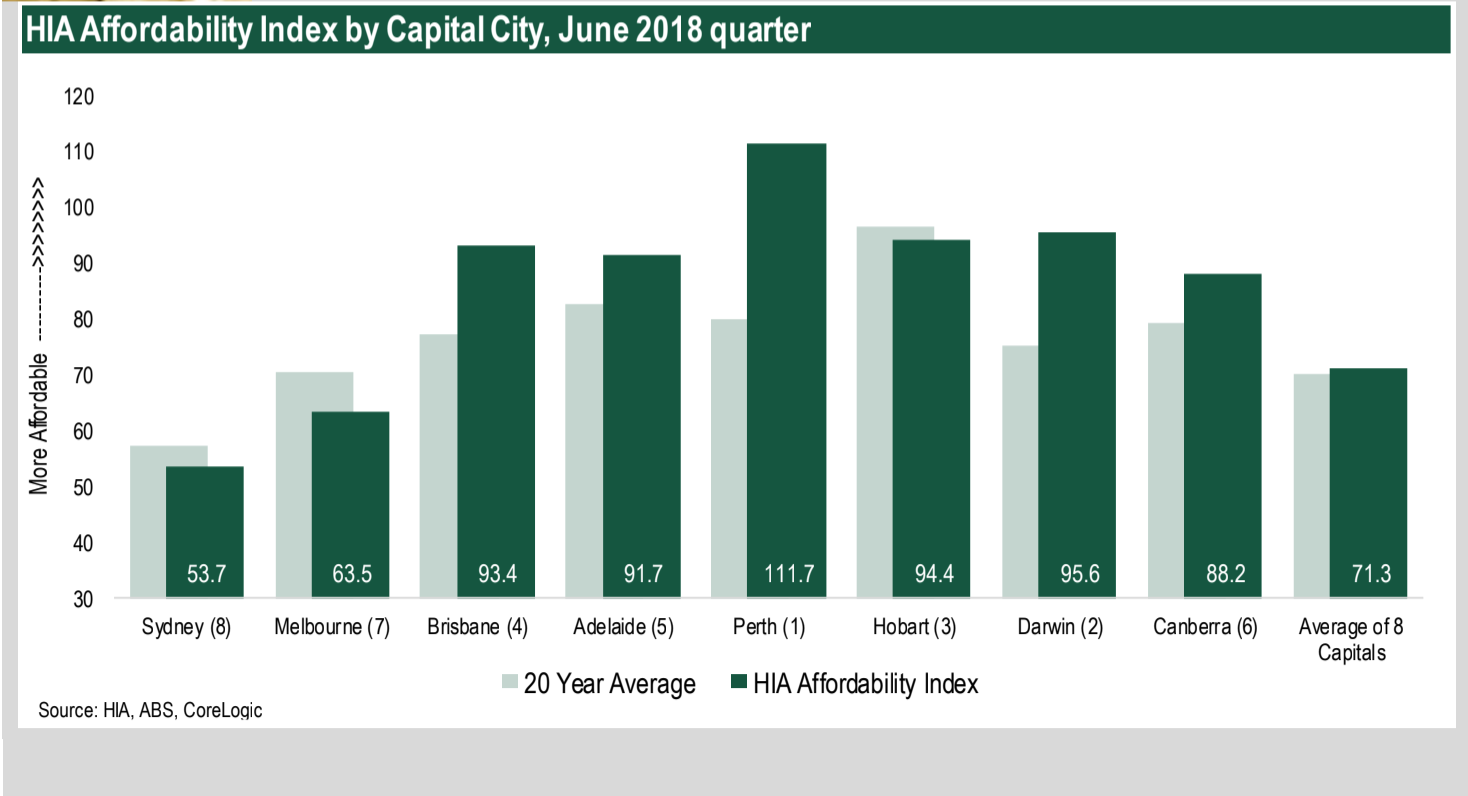

Figures from the Housing Industry of Australia (HIA) Affordability Index show Perth is the most affordable of the nation’s capital cities.

In the June 2018 quarter, the Housing Industry of Australia (HIA) Affordability Index registered 74.9, up by 0.4 per cent over the quarter and up by 0.8 per cent compared with a year earlier when affordability had reached its poorest level in nearly six years.

The HIA Affordability Index is designed so that a result of exactly 100 means that precisely 30 per cent of earnings are absorbed by mortgage repayments.

Higher results signify more favourable affordability – those above 100 signify that mortgage repayments account for less than 30 per cent of gross earnings, whereas scores below the 100 mark mean that more than 30 per cent of average earnings are absorbed by mortgage repayments.

According to HIA’s analysis, Perth is the most affordable capital city to buy a home in with an affordability rating of 111.7, closely followed by Darwin (95.6), Brisbane (93.4), and Hobart (94.4).

“Perth continues to present good opportunities for buyers, especially in the more affordable end of the market,” President of the Real Estate Institute of Western Australia (REIWA) Hayden Groves told WILLIAMS MEDIA.

In news that will surprise approximately no one, Sydney remains the least affordable capital city to purchase in, with a miserable affordability rating of 53.7.

Key findings from the HIA Affordability Report

- Easing price pressures are driving the improvements in housing affordability

- Housing affordability improved in five of Australia’s eight capital cities for the June 2018 quarter – Hobart, Melbourne and Adelaide were the only capital cities to see a deterioration

- Perth is now Australia’s most affordable capital city, followed closely by Darwin and Hobart

- Mortgage repayments account for 42.1 per cent of earnings in capital cities and 34.3 per cent in regional markets

HIA Economist Diwa Hopkins says affordability is hugely improving considering this time last year, affordability was at the lowest level in over six years.

“Easing house price pressures are providing some affordability relief for home buyers.

“Previous strong price increases were met by an unprecedented level of building which is now starting to come online. This is providing much-needed additional supply in key markets, helping to reduce price pressures and ultimately improve affordability for home buyers,” Hopkins said.

Source: HIA

Source: HIA

But the current plunge in house prices is unlikely to last for long, Hopkins warns.

“With an even balance in overall housing supply and demand in these key markets, the current downturn in dwelling prices is unlikely to be prolonged or severe.

“We could expect this downturn in prices to play out like previous cycles. They typically last 12 to 18 months, with the size of the fall modest relative to the immediately preceding expansion,” Hopkins said.

Ongoing fallout from the resources boom and bust cycles to thank for price plunge

Both rent and dwelling prices have been falling in Perth and Darwn for the last five years, amid the ongoing fallout from the resources boom and bust cycles.

While this is great news for renters and buyers in a market previously notorious for poor housing affordability, Hopkins warns it may be symptomatic of wider economic problems and in particular slowing population growth.

The weak economic conditions in both of these cities are seeing more people leave for interstate than are arriving, Hopkins says.

In particular population growth has followed these cycles and currently both cities are seeing more people leave for interstate than are arriving, resulting in spare capacity in their respective housing markets.

New home building activity has also fallen sharply in both cities as a result of the price declines, which risks causing an undersupply to emerge over the longer term in Perth and Darwin.

Groves told WILLIAMS MEDIA buyers are cautious right now.

“Trade-up family home buyers are lamenting they didn’t buy six months ago when the bottom of the market was apparent. Sellers who’ve been considering selling over the past few years are now cautious about coming to market too soon in anticipation of selling for more in the short-term future, especially down-sizers looking to maximise their capital-gains-tax-free benefit.

“Investors are likely to remain cautious until they see tangible growth which is likely to be towards the end of this year,” Groves said.

The best suburbs in Perth to invest in

According to data from REIWA, the rental yield for the Perth Metro region for houses currently sits at 3.6 per cent based on the overall median house rent price of $359 per week and median house price of $512,500.

This means on average, a typical property investor can expect to generate a 3.6 per cent annual return on their house purchase price.

REIWA says the suburbs of Bullsbrook, Medina, Parmelia, Armadale, Cooloongup, Maddington, Stratton, Camillo, Warnbro and Merriwa are house rental hotspots, offering investors the best return on their investment.

9 Bates Way, Warnbro available for rent through Property Osborne Park, as featured on Thehomepage.com.au

9 Bates Way, Warnbro available for rent through Property Osborne Park, as featured on Thehomepage.com.au

“Whilst the Perth property market is showing signs of a recovery in 2018, buyers and tenants remain the beneficiaries of the current environment, with a good supply of housing and rental stock to choose from at the more affordable end of the property market,” he said.

“With our local market on the cusp of recovering, now is the time for buyers and investors to take advantage of favourable conditions before our local market becomes less affordable,” Groves told WILLIAMS MEDIA.

Chief Operations Officer for Professionals Real Estate Group in Western Australia, Shane Kempton agrees.

“In the vast majority of areas in Perth, property prices are very low and buyers should now move quickly to secure a property before the recovery in the market gains further momentum to avoid buyers regret,” Kempton told WILLIAMS MEDIA.

View the Housing Industry of Australia (HIA) Affordability Index here.