30 July 2018

By portermathewsblog

via The West Australian

The West Australian economy is “out of the woods”, one of the nation’s most respected forecasters has declared, with housing and wages finally gaining traction.

Amid warnings the Turnbull Government was making the same mistake of the Howard government by spending a temporary revenue bump on expensive personal income tax cuts, Deloitte Access Economics said the outlook for WA was definitely brightening.

The State endured its worst year on record through 2016-17 while the domestic economy had been in the doldrums for the past four years. But a string of data, including job figures, point to an important turnaround.

Deloitte Access director Chris Richardson said it was now clear WA was recovering from the economic “wave” that was the end of the mining boom.

He expects a lift in retail sales, population growth, wages and housing construction will all improve through this year and accelerate into 2019-20.

Wage growth alone is tipped to more than double the insipid 0.6 per cent growth endured by private sector workers last financial year. “WA’s economy is out of the woods, but it isn’t quite yet out of the doldrums,” Mr Richardson said.

“The good news is that WA’s economy is gradually making its way on to a more settled and sustainable path. The State is restructuring and rebalancing and looking for non-mining related sources of growth.”

While most focus has been on the collapse in engineering spending by the mining sector, Deloitte Access highlighted the step-up by the State Government to fill the void.

It said the first stage of the $3 billion Perth Metronet, which includes 72km of rail line and 18 stations, would give a needed boost to the local economy. The situation is a little different for the Federal Budget, with Deloitte Access concerned that recent tax cuts are built on a mirage of improved tax revenues.

Mr Richardson said tax cuts were built on an increase in tax revenues that was likely to be transitory. The Budget was also expecting to absorb the cuts while it was still in deficit.

He said a gradual slowdown in China would eat into the better tax collections from the resources sector while a tightening of credit would hit east coast property markets. “Oz has repeated an old mistake: spending a temporary revenue boom on permanent promises,” he said.

Comments (0)

27 July 2018

By portermathewsblog

via houzz.com.au

Furniture that does more than one job is a godsend in a small home – here’s what you need to know before you buy.

In this practical series, we ask experts to answer your burning home and design questions. Here, Christine Gough, interior design leader at Ikea Australia, shares her top tips for selecting multi-functional furniture for a compact home.

If you’re struggling with clutter, a lack of space or a shortage of storage in your home, multi-functional furniture can really help. So what makes for a multi-functional piece? It is flexible, performs more than one function, and it can be moved around or customised to suit your needs. It often also includes storage, giving you a useful home for clutter so you can create a clear and inviting home.

Here are a few of the most useful designs to consider.

Image: Delaktig range at Ikea

Modular sofas

Modular sofas allow you to personalise your seating so that it fits your space – and your needs – perfectly. Choose from a ready-made combination of sofa pieces, or create a new combination to suit your home.

Modular sofas are designed with many functions and possibilities in mind. Many contain hidden storage, while others can be converted into a sofa bed to house an overnight guest. You’ll also find styles with removable covers so you can update the look of your sofa with ease.

‘Open-source’ furniture takes the idea of personalisation one step further. Ikea’s new modular Delaktig sofa (designed in conjunction with British designer Tom Dixon) has an aluminium frame and the set-up can be endlessly configured to suit your changing needs – add a side table, a lamp or two, move an armrest or change the cover, for example.

Storage or nest tables

If space is tight, pieces that do double duty, such as a coffee table with shelves or a storage basket, are a boon. They provide the perfect spot to store cushions, magazines and kids’ toys. Choosing a design on castors means you can also move it to different spots in a flash.

A nest of coffee tables is also a great option for a small space. It offers endless possibilities – pull the trio apart and use as separate side tables when you have friends over for drinks, or place them side-by-side to create one long coffee table for takeaway pizza night.

Furniture with concealed storage

Ottomans are an incredibly useful piece of furniture for any living room – they can act as seating, footstools or even a makeshift table to pop a book or magazine on. Select one with hidden storage inside, and it will provide you with a handy extra spot to store blankets, throws and the kids’ play things.

What are the most useful features to look for in a multi-functional piece?

- Customisable: You should be able to personalise it to suit your style and living needs.

- Neutral colours: Shades of grey, taupe and stone will co-ordinate with most colour palettes, and can easily be updated seasonally with the addition of pattered and coloured cushions and throws.

- Flexibility: Look for features such as removable covers and castors that make it easy to move pieces around or switch up the look of your space.

Zone smart

It’s not just furniture that’s gone multi-functional, it’s rooms too. With many of us moving to smaller homes and open-plan living increasingly the norm, the number of activities that happen in each room has increased. Once upon a time, our living rooms were used for socialising or watching television, but today you might eat dinner there, play games, listen to music, fold laundry and even exercise.

To get the best from a multi-functional room, position furniture to create zones for different activities, such as dining, socialising, work and exercise. Be led by the space and your lifestyle needs, and not by convention. If it works better in your space to have a pair of modular sofas positioned back-to-back or side-by-side rather than a traditional sofa set-up, go for it.

When positioning furniture, factor in foot traffic too. There should be enough room to move through the room comfortably.

Image: Ikea

Comments (0)

23 July 2018

By portermathewsblog

via therealestateconversation.com.au

Real estate in Perth is at its most affordable on record, as falling prices give first home buyers their best chance of stepping onto the property ladder, according to the Housing Industry Association (HIA).

37 Marita Road, Nedlands, Perth under offer with Michelle Kerr from Abel McGrath as featured on Luxury List. Abel McGrath

37 Marita Road, Nedlands, Perth under offer with Michelle Kerr from Abel McGrath as featured on Luxury List. Abel McGrath

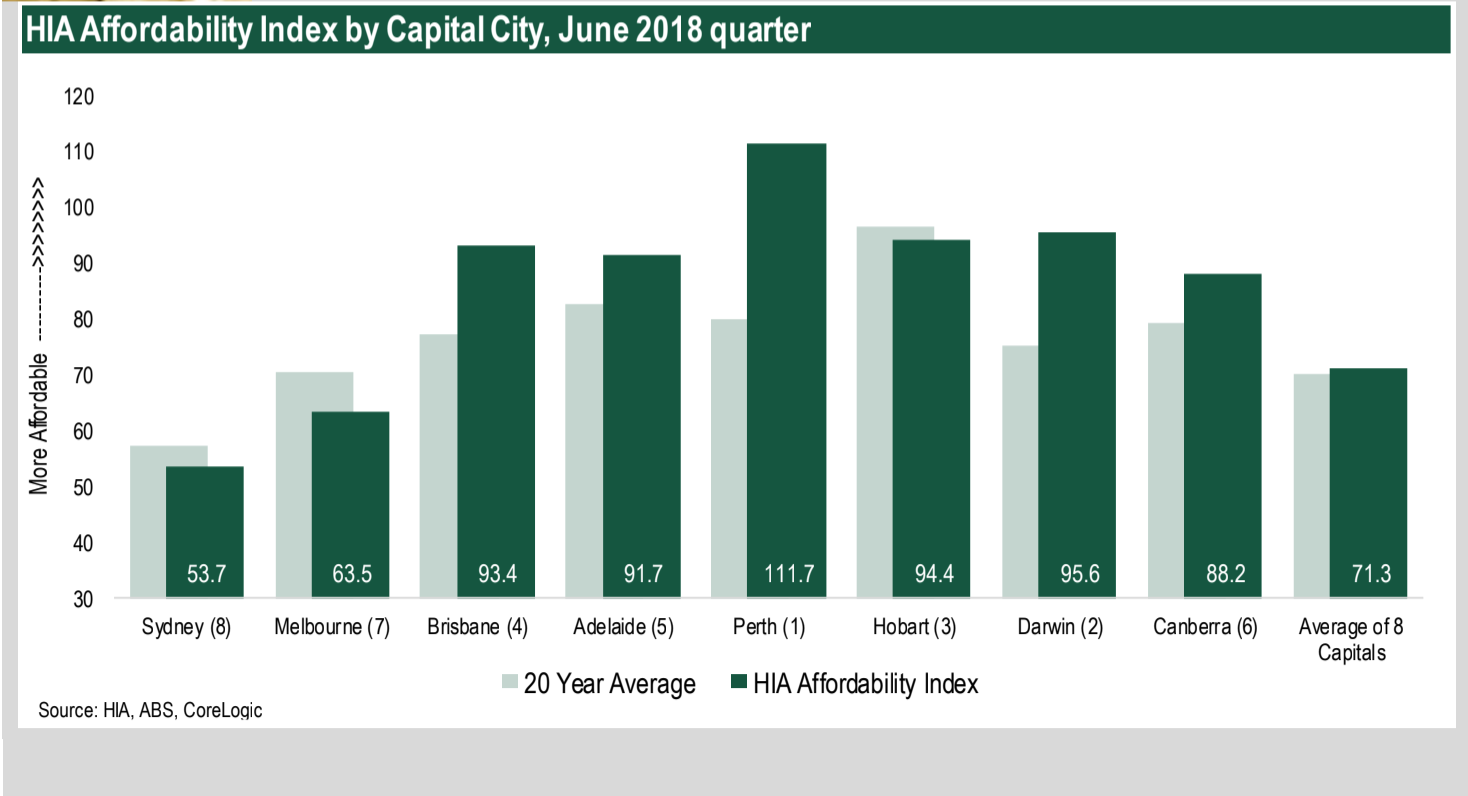

Figures from the Housing Industry of Australia (HIA) Affordability Index show Perth is the most affordable of the nation’s capital cities.

In the June 2018 quarter, the Housing Industry of Australia (HIA) Affordability Index registered 74.9, up by 0.4 per cent over the quarter and up by 0.8 per cent compared with a year earlier when affordability had reached its poorest level in nearly six years.

The HIA Affordability Index is designed so that a result of exactly 100 means that precisely 30 per cent of earnings are absorbed by mortgage repayments.

Higher results signify more favourable affordability – those above 100 signify that mortgage repayments account for less than 30 per cent of gross earnings, whereas scores below the 100 mark mean that more than 30 per cent of average earnings are absorbed by mortgage repayments.

According to HIA’s analysis, Perth is the most affordable capital city to buy a home in with an affordability rating of 111.7, closely followed by Darwin (95.6), Brisbane (93.4), and Hobart (94.4).

37 Marita Road, Nedlands, Perth under offer with Michelle Kerr from Abel McGrath as featured on Luxury List.

“Perth continues to present good opportunities for buyers, especially in the more affordable end of the market,” President of the Real Estate Institute of Western Australia (REIWA) Hayden Groves told WILLIAMS MEDIA.

In news that will surprise approximately no one, Sydney remains the least affordable capital city to purchase in, with a miserable affordability rating of 53.7.

Key findings from the HIA Affordability Report

- Easing price pressures are driving the improvements in housing affordability

- Housing affordability improved in five of Australia’s eight capital cities for the June 2018 quarter – Hobart, Melbourne and Adelaide were the only capital cities to see a deterioration

- Perth is now Australia’s most affordable capital city, followed closely by Darwin and Hobart

- Mortgage repayments account for 42.1 per cent of earnings in capital cities and 34.3 per cent in regional markets

HIA Economist Diwa Hopkins says affordability is hugely improving considering this time last year, affordability was at the lowest level in over six years.

“Easing house price pressures are providing some affordability relief for home buyers.

“Previous strong price increases were met by an unprecedented level of building which is now starting to come online. This is providing much-needed additional supply in key markets, helping to reduce price pressures and ultimately improve affordability for home buyers,” Hopkins said.

Source: HIA

Source: HIA

But the current plunge in house prices is unlikely to last for long, Hopkins warns.

“With an even balance in overall housing supply and demand in these key markets, the current downturn in dwelling prices is unlikely to be prolonged or severe.

“We could expect this downturn in prices to play out like previous cycles. They typically last 12 to 18 months, with the size of the fall modest relative to the immediately preceding expansion,” Hopkins said.

Ongoing fallout from the resources boom and bust cycles to thank for price plunge

Both rent and dwelling prices have been falling in Perth and Darwn for the last five years, amid the ongoing fallout from the resources boom and bust cycles.

While this is great news for renters and buyers in a market previously notorious for poor housing affordability, Hopkins warns it may be symptomatic of wider economic problems and in particular slowing population growth.

The weak economic conditions in both of these cities are seeing more people leave for interstate than are arriving, Hopkins says.

In particular population growth has followed these cycles and currently both cities are seeing more people leave for interstate than are arriving, resulting in spare capacity in their respective housing markets.

New home building activity has also fallen sharply in both cities as a result of the price declines, which risks causing an undersupply to emerge over the longer term in Perth and Darwin.

Groves told WILLIAMS MEDIA buyers are cautious right now.

“Trade-up family home buyers are lamenting they didn’t buy six months ago when the bottom of the market was apparent. Sellers who’ve been considering selling over the past few years are now cautious about coming to market too soon in anticipation of selling for more in the short-term future, especially down-sizers looking to maximise their capital-gains-tax-free benefit.

“Investors are likely to remain cautious until they see tangible growth which is likely to be towards the end of this year,” Groves said.

The best suburbs in Perth to invest in

According to data from REIWA, the rental yield for the Perth Metro region for houses currently sits at 3.6 per cent based on the overall median house rent price of $359 per week and median house price of $512,500.

This means on average, a typical property investor can expect to generate a 3.6 per cent annual return on their house purchase price.

REIWA says the suburbs of Bullsbrook, Medina, Parmelia, Armadale, Cooloongup, Maddington, Stratton, Camillo, Warnbro and Merriwa are house rental hotspots, offering investors the best return on their investment.

9 Bates Way, Warnbro available for rent through Property Osborne Park, as featured on Thehomepage.com.au

9 Bates Way, Warnbro available for rent through Property Osborne Park, as featured on Thehomepage.com.au

“Whilst the Perth property market is showing signs of a recovery in 2018, buyers and tenants remain the beneficiaries of the current environment, with a good supply of housing and rental stock to choose from at the more affordable end of the property market,” he said.

“With our local market on the cusp of recovering, now is the time for buyers and investors to take advantage of favourable conditions before our local market becomes less affordable,” Groves told WILLIAMS MEDIA.

Chief Operations Officer for Professionals Real Estate Group in Western Australia, Shane Kempton agrees.

“In the vast majority of areas in Perth, property prices are very low and buyers should now move quickly to secure a property before the recovery in the market gains further momentum to avoid buyers regret,” Kempton told WILLIAMS MEDIA.

View the Housing Industry of Australia (HIA) Affordability Index here.

Comments (0)

20 July 2018

By portermathewsblog

via houzz.com.au

Passionate about technology? A home-automation system is likely to be on your wish list – here’s what you need to know

In this practical series, we ask experts to answer your burning home and design questions. A premium home-automation system – also known as a smart-home system – allows you to control multiple functions in the home, such as lighting, heating and cooling, audio, security, door locks and even kitchen appliances – from a single device, be it a touch-screen remote control or an app on your phone or tablet, from wherever you are in the world.

Tempted? Here, Trevor Rooney, director of residential markets at Crestron, reveals everything you need to know about setting up a home-automation system in your own abode.

Home automation is all about convenience. Having the ability to control core elements in your home remotely, such as lighting, heating, entertainment and front-door access, can save time and make life run more smoothly.

Image: Crestron

What sort of things can a home-automation system do?

- Give you remote access to door locks so you can control who has access to your home when you’re not there.

- Switch lights on and off remotely or connect them to a timer or sensors, so they go on automatically (also great for security when you’re not home).

- Control heating or cooling so you can come home to a warm interior in winter or a cool one in summer.

- Give you remote access to alarms and surveillance systems; you will be notified if anyone approaches your home and can see who is at your front door. You can also switch surveillance on and off remotely.

- Change the television channel or switch the set on or off via voice command.

- Set your coffee machine to turn on automatically in the morning (it will even brew you a cup before you get out of bed).

- Automate your pool and pond cleaning, with the ability to adjust settings from your smart device while you’re not at home.

For even greater convenience, you can pre-determine the settings on your automated system for lighting, heating and entertainment to suit different situations. For example, you could set the system to control various elements simultaneously, so that when you go to bed it turns off all the inside lights, switches on the security camera at the front door, adjusts the kids’ night lights, and switches off the heater – all with one swipe of your smart-screen remote or an app on your phone.

Can automation cut my energy bills?

Absolutely. Here’s how:

- Accidentally left your lights on when you left the house? With home automation, you can switch lights off from wherever you are.

- Connecting blinds to a sensor-controlled system means they’ll close automatically when the temperature reaches a certain point, keeping your home cooler and reducing air-conditioning costs. You can also keep your home naturally cooler by setting up an automated shading system for overhead or exterior window shades.

- No more overheating your home unnecessarily; by installing a smart thermostat, your heating will switch off automatically when the temperature reaches a certain level.

How is a home-automation system different to a smart-home assistant?

Devices such as Google Home and Amazon Echo are great for convenience. They can perform simple tasks by using voice recognition, such as checking the weather, reading out the day’s headlines or performing Google searches.

A premium home-automation system is far more sophisticated. It allows you to automate several different devices through one simple-to-use interface or an app on your phone. So, instead of having five different remote controls to manage your various devices, you just have the one platform, which can be controlled by voice or touch.

Image: Crestron

Image: Crestron

How does voice control work?

Systems such as those at Crestron can be connected to Amazon Echo’s Alexa Voice Service to enable voice control. This allows you to give voice commands, such as ‘Alexa, turn off the kitchen lights’ or ‘Alexa, raise the temperature in the family room by five degrees.’

You can also control multiple systems simultaneously through a number of preset scenes. For example, in the morning you could say ‘Alexa, tell Crestron to activate Morning Theme,’ and the blinds will slowly open, the lights will switch on and a warm shower will start running in the bathroom. Or, if you want to set the mood for an intimate dinner party, simply say, ‘Alexa, tell Crestron to activate Intimate Dinner.’ The dining room lights will dim, the window coverings will adjust and soothing music will play from your speakers.

What should I expect to pay?

This depends on the level of automation you want. Crestron’s new PYNG 2.0 platform (available later this year), which controls audio/visual functions, such as the television, Foxtel, Apple TV and Sonos, starts from around $3,500. This would include the processor and a touch-screen remote control. Incorporating lighting and shading solutions into a home-automation system would see this cost rise to around $10,000, depending on the size of the space.

A fully connected smart-home system starts from around $25,000, depending on the size of the property.

Can I retrofit an automated system?

It’s best incorporated during the building phase. However, it’s certainly possible to install after the build.

Comments (0)

16 July 2018

By portermathewsblog

via therealestateconversation.com.au

Be a smart investor and have a loan strategy.

You have saved away and have enough cash to consider purchasing property as an investment. Like any purchase, it is a huge one so having a strategy in place will keep you focused and ensure that you are doing as much due diligence as you can for a successful investment.

Not many successful investors became successful by accident – we recommend you start by seeking professional financial advice to really determine what your borrowing capacity is and how realistic your investment is.

Debt does not have to be scary, unless it is the wrong type of debt. In an ideal situation, you will want your debt to be productive and if you have planned how your cash flow will be affected, then you can have a clear understanding of how purchasing that next investment will affect your lifestyle. Productive debt in our eyes can be used as an advantage to buy an asset or generate income such as rental income.

Understanding your loan strategy

If you are looking to invest in multiple properties, we think it’s important to understand the short and long term perspective of property ownership. You have to think about how this next loan or investment is going to influence your life and your cash flow as well as what the situation might look like with your third or fourth investment. We say this as it can really make a difference in the type of property you purchase in the first place.

Think about how positively or negatively geared loans will affect what you purchase or how you live in the future. It may seem odd to be thinking so far in advance, but we think it is important to really understand your financial situation and also the results you would like to achieve as a property investor.

This is where we think it is important to be surround by the right advice. The right financial advisor for you will be able to help you plan the various scenarios to suit your end goal – after all everyone has different goals in their lives.

Comments (0)

12 July 2018

By portermathewsblog

via domain.com.au

With Australia’s major supermarkets banning the plastic bag it’s a good time to get on board #PlasticFreeJuly.

The initiative, whereby people pledge to reduce plastic from their lives for a month, is a great opportunity to learn about plastic-free eco alternatives beyond the tote bag.

Founder of the Plastic Free July Foundation, Rebecca Prince-Ruiz, says while plastic is an extremely useful material the fact it’s designed to last forever causes problems for the environment.

One of the biggest impacts is, of course, on wildlife. But plastic is a huge problem for humans too. Plastic bags contain a cocktail of chemicals that leach into the environment and increase up the food chain. “The UN Environment said it’s one of the greatest environmental challenges of our time,” Prince-Ruiz says.

Images of the Great Pacific Garbage Patch might suggest it’s a problem happening elsewhere. “CSIRO research found plastic in every beach in Australia,” Prince-Ruiz says. “And because we have high concentrations of wildlife, we’re the area in the world where seabirds are most at risk.”

Only 9 per cent of all plastic we’ve made on our planet is recycled, according to Prince-Ruiz. “This is a problem we can’t recycle our way out of. We need to rethink our use of this material.”

She suggests eliminating all single-use throwaway plastic such as plastic lollypop sticks, bottle caps, drink bottles and bags. “These are what we’re finding in our environment. It’s not about being perfect, or a competition. It’s about saying ‘hey, I’m going to try’.”

Frustration with sourcing plastic-free products led Sydney-based Lottie Dalziel to found an online marketplace where consumers can purchase plastic-free products all in one place. Launched in March, banish offers more than 460 products across 22 eco-friendly and cruelty-free brands, and is part of a growing movement to rein in the problem of plastic waste.

From the quirky and old-fashioned, to the funky and plain brilliant, here’s a glance at what’s out there to help you replace plastic in the home in July and beyond.

Kitchen

Beeswax wraps

Use to replace cling wrap. “It comes in funky colours and is a piece of fabric coated in beeswax,” Dalziel says. “Using the heat in your hand, it moulds. You just unwrap and rinse in cold water and use again.”

Beeswax wraps can replace cling wrap. Photo: Beeutiful.com.au

Beeswax wraps can replace cling wrap. Photo: Beeutiful.com.au

Lunch skins

The lightweight fabric bags come with a velcro closure and replace plastic lunch and snack bags.

Reusable produce bags

“Take these shopping with you and put your fresh produce into them, Dalziel says. “Keep them in their bags and it helps separate them in your crisper.”

Knitted and fabric cleaning cloths

Washable and re-usable, these replace your Wettex or Chux.

Coconut fibre scourers

A trendy accompaniment to your au naturel wooden chopping board.

Reusable straws

Choose from bamboo or stainless steel options.

Reusable bamboo straws. Photo: Banish.com.au

Reusable bamboo straws. Photo: Banish.com.au

Tea strainers

Combine the old-fashioned metal tea strainer with loose-leaf teas to banish plastic from your morning cuppa.

Bamboo takeaway cutlery

Chuck these in your lunchbox or buy in bulk for parties instead of the plastic variety.

Dishwashing tablets

Add a tablet to your dishwasher compartment and use as normal. Lil Bit sells a Cajeput-scented, Himalayan salt tablet.

Dust brush

Eco-Max offer a handmade and biodegradable recycled timber and coconut fibre dust brush.

Himalayan salt dishwashing tablets. Photo: Lil’ Bit

Himalayan salt dishwashing tablets. Photo: Lil’ Bit

Bathroom & personal hygiene

Shampoo and conditioner bars

Handmade, full of yummy ingredients and sure to start a trend. Get them at Lush and Beauty and the Bees.

Deodorant paste

Scent up with this option from Good & Clean. A portion of profits goes to your conservation project of choice.

Bamboo toothbrushes

“Cut off the bristles and the bamboo is completely biodegradable,” Dalziel says.

Dental lace

Made from Mulberry silk and mint-flavoured, it comes in it’s own refillable glass and stainless steel container. Get it at Ecostainable.

Metal razors

Built to last, you probably have one in your cabinet. For something new and nifty try the Parker Safety Razor.

100% natural deodorant paste. Photo: Good & Clean

100% natural deodorant paste. Photo: Good & Clean

Menstrual cups

Made with soft, medical-grade silicon, menstrual cups are used like tampons. Find them at Banish and other stockists.

Biodegradable cotton buds

Go Bamboo sell biodegradable bamboo cotton buds.

Tooth and gum powder

Natural ingredients mean this is also better for you. Buy it online at Banish.

Laundry

Soap nuts/soap berries

The saponin-rich shells of the Sapindus Mukorossi tree nut produce foam when mixed with water. “Add about seven nuts to your washing load in a bag,” Dalziel says. (Micro-plastics in traditional detergents end up in the world’s waterways).

Toilet

Toilet bombs

Pop one in the toilet for five minutes, scrub and flush away. Get them at Lil Bit.

Waste

Biodegradable trash bags

Hurrah. These do exist! Find them online at Biotuff and Flora & Fauna.

Biodegradable cotton buds. Photo: Shop Naturally

Biodegradable cotton buds. Photo: Shop Naturally

Comments (0)

09 July 2018

By portermathewsblog

via reiwa.com.au

Are you looking to jazz up your home but don’t have the available funds? Maybe you are planning to sell, or just want to give it a facelift?

Are you looking to jazz up your home but don’t have the available funds? Maybe you are planning to sell, or just want to give it a facelift?

Either way you don’t need to spend an arm or a leg, you just need a little bit of inspiration.

Here are five ways you can give your home the ultimate make-over without breaking the bank.

1. Clean out/de-clutter your home

Start by a good old clean out – this you can do for free. Living in a messy, cluttered house will have you feeling anxious and itching for a change of atmosphere, plus it won’t make a good first impression on visitors.

rid of junk you don’t need, wash the walls, doorways and clean all the dust and cob-webs! This will have an immediate effect on the oxygen circulation of the house – breathing in fresh air is the start to feeling good in your home.

2. Paint the walls

Whether you want to change the colour all together or just want to lift the look,the most effective way to rejuvenate your home is to apply a fresh coat of paint.

Light to neutral colours gives you more flexibility with furniture and décor, and creates the illusion of space. Plus, painting your home is relatively cheap, unless you want to seek a professional painter to do the job.

While you have the paint out, it is also a good idea to re-paint the doors, door frames, skirtings and ceilings in simple white, to freshen up the aesthetic of your house.

For some inspo, find out how to select the right paint colour for your home.

3. Re-decorate

It is ridiculously affordable to decorate your home these days, you just need to trigger your creative side.

Adding plants and some pottery to your home is a great way to set the mood and can be very affordable and easily maintained with a little bit of TLC. Adding a splash of greenery to your space is not only aesthetically appealing, but pot plants also help purify the air, just make sure you buy plants suitable for indoors.

Candles, incense and infusers also have dual purpose when it comes to décor. They look good, and smell good, once again adding that infused delicious aroma to your home.

When it comes to the bedroom and living rooms, pillows, throws and new linen is something that will always catch the eye. What better feeling is there than purchasing fresh new bedding? Try and coordinate this with whatever colour you paint the walls or keep the same colours but you can mix up the styles.

Remember, simple can sometimes mean more, so try keep all decorations minimal but effective.

4. Rearrange furniture

If you already love your furniture but still feel sick of it, a simple re-organise of the couches, TVs beds, tables etc can make you feel like you’re in a whole new house.

Making different uses out of the things you already have in your home will save you money. You think you might be sick of an item, but put it somewhere else and you might fall in love with it all over again.

5. Update light fittings

Lighting is the key to making any home stand out, and you would be surprised what a simple swap of the light fittings will do.

If you’re on a budget consider going for one or two designer light fittings in the main living areas, then cheaper ones for the other rooms.

While we are on the topic of lighting, you can also replace the light switch covers which won’t cost you a lot at all. Swap out those old fashioned, plain switch covers for silver, stainless steel or modern white covers.

Comments (0)

06 July 2018

By portermathewsblog

popsugar.com.au

Image Source: A House in the Hills

If there are rules that you as a renter must follow, make it these 10 commandments. Because, while paying your rent on time is important, so too is making sure your place is personalised and stylish. Working within the boundaries of your landlord, it’s little things like a new light fixture that will make an impact without costing a lot of time or money. And, the best part about this entire list is that you’ll leave with your security deposit intact once it’s time to move up and on.

- Thou Shalt Add Storage

Let’s get real, custom cabinetry is not an option if you don’t own the place. Since rentals usually lack storage, add your own with affordable Ikea bookcases, simple shelves, or these organising solutions.

- Thou Shalt Change the Hardware

Rental hardware is basic . . . your style, not so much. Switching out cabinet pulls and bathroom hardware will make a huge difference. Just remember to keep the original pieces to swap back in before moving out.

- Thou Shalt Ditch Vertical Blinds

Image Source: Dana Miller for House*Tweaking

They are the ultimate decorating sin! To prevent your space from looking like a hospital room, take them down or hide them under curtains. Again, don’t toss — they’re essential if you want your security deposit back.

- Thou Shalt Line Cabinets

This might seem trivial and a bit annoying, but lining your cabinets is a must. Not only will it make your kitchen look clean, but also it will mask worn and grungy cabinets without having to paint. Adhesive liner works, but a softer grip liner is better because it’s easy to install; it will also prevent glassware from chipping.

- Thou Shalt Accessorise Like Crazy

It’s true, and that’s the only way you’re going to get a truly personal space. Go to town with throws, pillows, and accents that reflect your style.

- Thou Shalt Avoid Wallpaper

Well, in most cases. Sure it’s stylish, but in all honestly, wallpaper is really inconvenient to remove, especially if you won’t be in your place for long. If you love the patterned look, consider the removable wallpaper seen in this studio or these alternative wallpaper ideas.

- Thou Shalt Hang Art

Image Source: Love Grows Wild

No excuses — get your art on the walls! Patching up a tiny hole come move-out day is nothing compared to the impact it will make on your space. No need to create a full-blown gallery wall either. Try hanging one statement piece and resting photos on a mantel or shelf, similar to this home.

- Thou Shalt Invest in Rugs

Especially if your place has carpet! Rugs are an easy way to cover up that not-so-cute carpet and can be packed up with you come your next move. Rugs are also a necessity to keep noise down, especially in older apartments with wood floors.

- Thou Shalt Emphasise Lighting

Image Source: POPSUGAR Photography

This is another trick that many renters often overlook. Take it from HGTV stars Anthony Carrino and John Colaneri who suggest you use lighting to set the tone and make an impact in a rental. Get creative with floor and table lamps that can easily be moved from place to place.

- Thou Shalt Make the Most of Plants

No yard? No problem. Pots are a great way to achieve the bohemian jungalow look or even have your own urban garden. The best part is you won’t have to fret about leaving any of them behind.

Comments (0)

02 July 2018

By portermathewsblog

via reiwa.com.au

When it comes to winning big in real estate, many turn to property investment. But achieving success takes time and patience, with only a handful making it past their first investment.

When it comes to winning big in real estate, many turn to property investment. But achieving success takes time and patience, with only a handful making it past their first investment.

To ensure you don’t fall into the property trap, we spoke to the experts from Momentum Wealth to discuss seven of the most common mistakes property investors make.

1. Don’t buy in an overheated market

Momentum Wealth Research Advisor Shaun Strickland said many investors see reports of unprecedented growth in one area and assume this must be the next ‘boom’ suburb.

“If you are reading about a boom in the media, chances are it is already too late to be buying in the suburb. Instead, investors need to be identifying areas that are likely to outperform in the long-term, which is where the advice of a professional buyer’s agent could prove invaluable,” Mr Strickland said.

2. Not doing enough homework

The property market is always changing, and you will never know EVERYTHING there is to know about real estate. But, doing your homework nonetheless is essential and studying the suburb you wish to buy in will make it worth your while.

Mr Strickland believes research is the cornerstone to a successful property investment.

“Identifying high-performing properties requires analysis of demand and supply, knowledge of the local demographic, consistent market monitoring and awareness of other key growth factors,” he said.

“Once investors have narrowed their search to a specific suburb, they will then need to assess the potential of individual streets and properties.”

Another common mistake investors make is that they tend to only research properties within five kilometres of their current location.

Mr Strickland also said “whilst it’s a natural reaction for investors to look in areas they are most familiar with, this could result in them missing out on key investment opportunities elsewhere.”

3. No backup cash

According to Momentum Wealth Finance Team Leader Caylum Merrick, many investors fall into the trap of not saving up a sufficient cash buffer once they’ve actually acquired a property, which could leave them in a disadvantaged position should unexpected scenarios arise such as property repairs, rises in interest rates or tenants leaving a property.

Mr Merrick advises investors to set aside a cash buffer to cover unexpected costs for each property in their portfolio.

“We also advise investors to work with an experienced property manager to understand any of the potential costs that could occur for their particular property,” he said.

4. Cross-collateralisation

This is when more than one property is used as security for a loan or multiple loans.

“Cross-collateralisation can significantly reduce an investor’s ability to borrow in the future, so it is especially important to seek the help of a mortgage specialist who fully understands their financial needs and long-term investment goals.

“Choosing the right loan strategy from the start can significantly maximise an investor’s borrowing capacity and give them more flexibility moving forward,” Mr Merrick said.

5. No plan, no gain

All property investors have one goal – to build a lucrative property portfolio. However getting there without a plan or goal will backfire. As the old saying goes, if you fail to plan you plan to fail.

You need to have an end vision of where you want to end up and then follow a strategic plan to get there.

6. Thinking with your heart not your head

With the Perth property market starting to show signs of recovery and stabilisation, interest will grow from property investors, meaning buyers need to act fast to secure their ideal property.

An investment should be look at as a business decision. Making an ’emotional purchase’ is to be avoided at all costs. A decision driven by your heart can lead you to over-capitalise rather than prioritise the best outcome for your investment goals.

Base your decision on facts, statistics and research.

7. Choosing to self-manage

Seeking the advice of a professional can help you avoid making simple mistakes, and they can also play a vital role in helping investors identify opportunities to maximise rental returns.

“Property investment experts can assist investors in identifying properties with the highest growth prospects that a single investor may not be able to discover or analyse on his or her own,” Mr Strickland said.

It can be very daunting trying to handle all aspects of property investment on your own, especially if you have a portfolio of more than one or two properties.

Momentum Wealth Asset Management Advisor Clare Christiansen said property managers play an important role not only in the day-to-day running of properties, but also in supporting an investor’s overall investment strategy and protecting their long-term wealth.

“Property investment doesn’t stop at the acquisition of a property,” she said.

“Savvy investors will also realise that smart asset management is key to their long-term wealth strategy.”

Comments (0)

02 July 2018

By portermathewsblog

via houzz.com.au

An interior designer reveals the essential rules for achieving a perfectly balanced interior.

Have you ever walked into a room and it just felt right, but you couldn’t put your finger on exactly why? Chances are that proportion was a key factor – whoever designed the room would have paid careful attention to getting the size and scale of the furniture and accessories just right for the space.

We talked to Rohan Smith, senior interior designer at Coco Republic Interior Design, to find out how you can create beautifully proportioned rooms in your own home.

Why does proportion matter?

Why does proportion matter?

Because furnishing a room is more involved than simply placing a few pieces of furniture in a space – some fundamental rules of design need to be considered, one of the most important being proportion. You need to consider not only the proportional relationship between the pieces themselves, but to the space that contains them.

A room looks and feels right when the proportions are good, and there’s neither too little nor too much furniture. If furniture is too big, the flow of the room can feel awkward. If it’s too small, the space won’t feel cosy or inviting.

What are the most common mistakes people make?

Having all the furniture and furnishings in a room the same height, colour and style. The room ends up looking dull and static. This is easily rectified. A tall floor lamp, for example, can add some height to a corner, while providing a lovely ambient light source. A tall cabinet or bookcase can add visual interest as well as handy storage.

How do you assess proportion?

One of the easiest ways to assess whether a sofa, dining table or bed will suit the size of your room is to map it out with newspaper and lay it on the floor. This will give you a sense of how much floor space the piece will take up. Living with this template for a few days will give you a definite feel for how it will be to live with the piece.

A more technical method would be to use the Houzz Sketch tool or an app such as Magicplan. You simply take photos on your smartphone, which the app then translates into a plan of the space. You can then add objects, annotations and attributes to create a complete plan of your room.

What proportions do you need to consider for a living room?

Living rooms can be tricky to get right, especially in open-plan spaces.

If the room is your main television viewing space, then you’ll need to factor in technology as well as furniture. Is the TV too big for the room? Is the entertainment unit balanced with the size of the TV, and the room as a whole? A common mistake is to have a small entertainment unit with a large TV – it should be the other way around. Also, consider whether the sofa is the correct distance from the TV for viewing comfort. It should be about 2.5 times the screen width in distance away, and no more than 5 metres. The centre of the TV should be about 1 to 1.1 metres from the floor.

A large sofa and a small rug also look unbalanced.

For living rooms, the furniture arrangement should be conducive to conversation. Two sofas facing each other or a U-shaped arrangement are ideal. The coffee table should also be the right height for the sofa. You should be easily able reach the coffee table from a seated position so you can rest a cup of tea or a glass of wine.

What about a bedroom?

One of the main considerations in the bedroom is the size of the bedside table in proportion to the bed. For a king-size bed, go for a large-scale beside table of about 70-90 centimetres in width, depending on the size of your bedroom. For a queen-size bed, a bedside table of around 50-60 centimetres is ideal.

Bedside lamps should also sit proportionally with the bedside table and bedhead. Again, for a king-size bed, a larger lamp will work best.

Are there any golden rules for hanging pendant lamps?

When pendant lamps are hung too high or low, they can look completely out of place in a room. You need to consider the size and style of the pendant, the ceiling height, and the space in which they will be hung.

Despite these variables, there are still a few hard-and-fast rules that can help when hanging pendants. For kitchen benches, hang lights around 70-80 centimetres above benchtops. This height allows the pendants to provide a useful light source for working, without intruding on the line of sight from the kitchen to the adjoining living or dining room.

For your dining table, sit pendants at 75 centimetres above table height to create an intimate and cosy dining space. For entries and hallways where people will be walking beneath the pendant lights, space allowing, the ideal hanging height is 240 centimetres from floor level.

What about hanging art?

Choosing artwork that is the wrong scale for a room is a common mistake, with most people erring on the small size. Checking to see whether a gallery will allow you to bring a piece home on approval is the best way around this. If you fall in a love with a piece that is too small for your room, have it re-framed with a larger mount.

Another common mistake is to hang artwork too high on the wall. If a piece is hung too high it will have no connection to the furniture below it, and if it’s above eye level it can ruin the look of a room.

Ideally, artwork should be hung so that the centre of the piece is at average eye level or about 150 centimetres from the ground. In a dining room you might want to hang the pieces slightly lower to factor in the seated viewing height.

Also remember that having some negative space is important. Leaving some walls bare not only puts more significance on the pieces you’ve hung, but creates a calmer feel in the room.

And rugs?

Rugs are a great way to bring a furniture grouping together. They provide a border for furniture to sit on and can help you create individual dining and living zones in an open-plan room where furniture has a tendency to ‘float’. Ideally rugs should sit under the front legs of the sofa and occasional chairs – this helps visually link the pieces together.

What about the proportions for colour in a room?

When making your selection, consider the 60-30-10 rule, which is a timeless decorating principle that can help you create a balanced colour scheme. Your 60 per cent is the main colour for a room, which anchors a space and provides a backdrop for the other colours. In a living room this would be walls, sofas and rugs.

Your 30 per cent is the secondary colour, which would encompass occasional chairs, bedlinen, window furnishings and occasional furniture. It should support the main colour, while being different enough to set it apart and give the room interest.

The final 10 per cent is your accent colour. For a living room, this would include scatter cushions, decorative accessories and artwork. For a bedroom, think throw pillows and artwork.

Do the rules of proportion apply to the little details too?

Keeping an eye on the proportion of decorative accessories is another important consideration. One large bowl on a dining table might be all you need in that space to create drama. Conversely, combining small objects with other similar objects can create just as much impact. A collection of ceramic pots makes one big statement, whereas a few pots scattered about will look disconnected and out of proportion.

Lamps should not overshadow the table on which they are placed. A large lamp on a slender table, for example, would appear top heavy. Too much variety of scale can cause visual chaos in a focused area, such as a bookshelf. Instead, group items of similar type and scale together, and line up like-sized books for a balanced look.

Comments (0)