19 July 2019

By portermathewsblog

via news.com.au

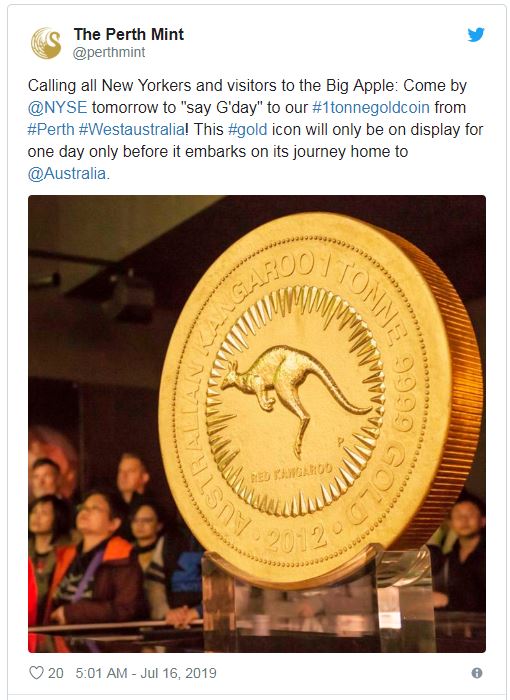

The world’s biggest, heaviest gold coin was made here in Australia but it’s been sent to the Big Apple for a day.

The world’s biggest coin was crafted in Australia. Picture: Twitter/Perth MintSource:Twitter

The world’s biggest, heaviest gold coin, which was crafted by the Perth Mint, has been delivered to the New York Stock Exchange to promote physical Australian gold being made available to US investors.

The colossal one tonne gold coin is 99.99 per cent pure gold and measures 80cm wide and 13cm deep.

It is recognised by Guinness World Records as the largest coin ever created.

It was worth $A50 million when it was cast in 2012 but its value has risen to more than $A60 million given the soaring price of the precious metal, which recently has been hitting all-time highs of more than $2,000 an ounce against the Aussie.

The coin is being displayed outside the stock exchange on Wall Street to mark the official launch of the Perth Mint Physical Gold Exchange Traded Fund, which will trade under the code AAAU from tonight.

Perth Mint chief executive Richard Hayes will ring the bell to signal the end of the trading day.

“Every AAAU share is backed by physical gold stored in our central bank-grade vaulting facilities in Perth, so at any time investors may choose to exchange part or their entire holdings for a delivery of physical gold to their door,” he said.

Its inscription reads: AUSTRALIAN KANGAROO 1 TONNE 9999 GOLD and the year-date 2012.

The other side of the coin portrays the Ian Rank-Broadley effigy of Queen Elizabeth II and the monetary denomination of one million dollars.

“The colossal coin is a magnificent Australian icon symbolising one of the Mint’s most extraordinary accomplishments since it was established in 1899,” the Mint’s website states.

The coin was issued as legal tender under the Australian Currency Act 1965.

Prior to the coin’s visit to the NYSE, it made an exclusive trip across Europe and Asia in 2014 and has mostly been housed at the Mint’s Gold Exhibition.

Comments (0)

30 May 2019

By portermathewsblog

via finance.nine.com.au

Australia’s housing market downturn is coming to an end, with leading economists predicting a spike in house prices as soon as July.

Property prices fell one per cent nationally in January, with CoreLogic data showing a smaller decline of 0.5 per cent in April – a result tipped to be repeated for May.

It comes after Commonwealth Bank’s incoming, home loan applications jumped to a 10-month high and strong predictions of interest rates cuts.

Expect to see a whole lot more of these in the coming months. (AAP)

Expect to see a whole lot more of these in the coming months. (AAP)

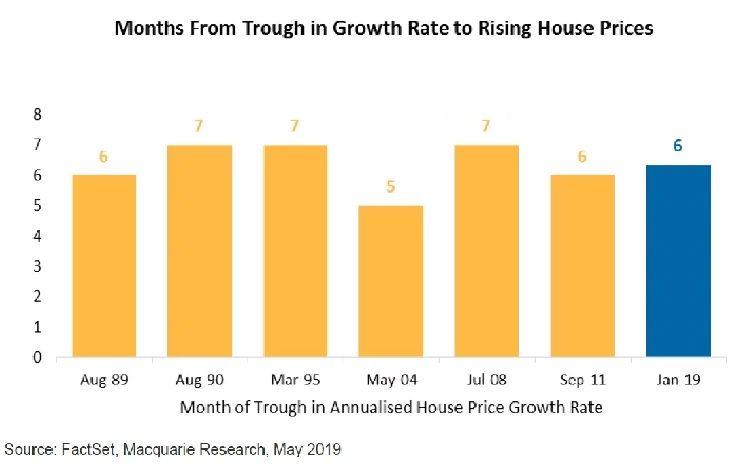

“Australia’s house price growth reached its worst on an annualised basis in January. Prices have continued to fall since then, but the rate of decline has slowed,” the bank wrote in a statement.

“If you look at prior cycles, an increase in house prices occurred five to seven months after the trough in the annualised growth rate. Using the average of six months, prices could rise by July.”

The bank said in every Australian house price cycle since 1989, price growth followed within seven months after the monthly annualised price decline bottomed.

Graph showing the trend repeating over the past 30 years. (Supplied)

Graph showing the trend repeating over the past 30 years. (Supplied)

Macquarie’s prediction extends further than past performance, with the bank also attributing looming interest rate cuts, relaxed lending conditions and the recent election result to its positive outlook.

“With the surprise Coalition election win, APRA’s policy change and an expected June RBA rate cut, we are more confident Australian house prices could rise within months,” the note read.

“This should flow through to better growth in housing finance and building approvals.”

AMP Capital chief economist Shane Oliver shares similar sentiments.

“The combination of the removal of the threat to property tax concessions, earlier interest rate cuts, financial help for first home buyers and APRA relaxing its 7 per cent interest rate test points to house prices bottoming earlier and higher than we have been expecting,” he said in a note.

“We now expect capital city average house prices to have a top to bottom fall of 12 per cent— of which they have already done 10 per cent — rather than 15 per cent and to bottom later this year.”

A swing in property prices has been supported with the Commonwealth Bank saying last week it saw the highest level of home loan applications in ten months.

This also coincides with CoreLogic data from the same period showing median home prices in Sydney and Melbourne increased by 0.3 per cent and 0.1 cent, respectively.

Prime Minister Scott Morrison’s victory has helped the market, economists say. (AAP)

Prime Minister Scott Morrison’s victory has helped the market, economists say. (AAP)

Nine finance editor Ross Greenwood said the threat of changes to the tax treatment on Australian housing created a lot of uncertainty in the market, but since Scott Morrison’s victory this has shifted to a “sense of immediate euphoria”.

“It is actually good news if people kind of feel OK about things,” he told Today.

“But the one thing about this is it now comes back to the old-fashioned leaders of the economy – what the Reserve Bank does, whether we get tax cuts.

“These are the things that put cold hard cash in people’s pockets. At the end of the day, that’s the thing that counts.”

Greenwood added tax cuts would have a bigger impact long-term on household budgets and finances than a decline in interest rates.

“The problem is because one-third of families have a mortgage, whereas two-thirds of families are trying to save for a mortgage to own their home and they have savings in the bank,” he said.

Comments (0)

22 November 2018

By portermathewsblog

Great news for the Western Australian economy, read the article below.

If we can be of help or offer advice on selling & leasing give us a call on 9475 9622!

By Josh Zimmerman Via: https://www.perthnow.com.au/business/housing-market/house-price-rise-on-cards-as-economy-confidence-improving-says-wa-premier-mark-mcgowan-ng-b881023908z

PREMIER Mark McGowan has this message for West Australians: buy a house now because the good times are coming back.

Exactly one year after The Sunday Times heralded early signs of life for WA’s stagnant economy, the results are in — and they are conclusive.

Data released on Friday showed the State’s domestic economy expanded 1.1 per cent in 2017-18, a remarkable turnaround after plummeting 7.1 per cent in 2016-17 and four consecutive years of decline.

This week another big step was taken towards WA reclaiming its AAA credit rating when Federal Parliament enshrined in law the hard-fought $4.7 billion GST reform package, which The Sunday Times has campaigned for since 2014.

Nearly every month this year has brought news of renewed activity in the mining sector. Rio Tinto, Fortescue Metals Group and BHP have all announced new workforce-hungry iron ore projects and the State now boasts seven lithium mines, with a second $1 billion lithium processing plant on the way near Bunbury.

Mr McGowan said he had not felt more confident about WA’s economic prospects since sweeping to power early last year.

“Every day you are seeing good signs,” he said. “The confidence is back in WA. You can feel it, you can see it and certainly it is an improvement on where it was.”

Mr McGowan tipped a turnaround in the long-declining property market and a jolt to stagnant wages would follow hot on the heels of renewed business investment.

Andrew Worland, the CEO of Rosslyn Hill Mining, and WA Premier Mark McGowan.Picture: Richard Hatherly

Andrew Worland, the CEO of Rosslyn Hill Mining, and WA Premier Mark McGowan.Picture: Richard Hatherly

“It is actually a good time to buy (a house),” he said.

“I would encourage people. Prices are low yet economic activity is picking up and so that will inevitably be followed by (demand for) housing.”

The Sunday Times joined Mr McGowan in Wiluna on Thursday to visit the oft-maligned Paroo Station lead mine, where a $US150 million investment in world-first processing technology is set to bring the operation back to viability while eliminating environmental issues previously associated with transporting lead concentrate.

The Rosslyn Hill Mining venture has just received environmental approvals to expand and build an advanced hydrometallurgical facility, which will convert lead concentrate to bars without the traditional smelting process.

Lead is among the suite of minerals abundant in WA that Mr McGowan hopes will catapult the State into global leadership in the renewable energy sector.

To that end, his Government has set aside $5.5 million for a future battery research centre, but recognises that WA-made batteries are a long way off. “That would be a longer-term initiative,” Mr McGowan said.

Comments (0)

15 October 2018

By portermathewsblog

via reiwa.com.au

Affordability in Perth’s residential sales market improved during the September 2018 quarter, with house and unit prices softening marginally.

Affordability in Perth’s residential sales market improved during the September 2018 quarter, with house and unit prices softening marginally.

REIWA President Damian Collins said there was excellent opportunity for buyers and investors to take advantage of current market conditions to secure their next home or investment property.

“While the worst of the market downturn appears to be behind us, the results of the September 2018 quarter reveal conditions are favourable for buyers and investors,” Mr Collins said.

Median house and unit price

reiwa.com data shows Perth’s median house price should settle at $505,000 for the September 2018 quarter.

“This is 1.9 per cent lower than the June 2018 quarter median and one per cent lower than last year’s September quarter,” Mr Collins said.

“While quarterly median figures can be more subject to stock composition changes, the fact that the annual change is only one per cent lower suggests that we are at or near the bottom.

“It was a similar story for the unit market, with the median expected to settle at $395,000, which is 1.3 per cent lower than the June 2018 quarter and 2.5 per cent lower than the September 2017 quarter.”

While the overall market experienced a decline in median house price during the quarter, 57 suburbs across the area bucked this trend.

“The top performing suburbs for median house price growth were Swan View, East Cannington, Como, Hillarys and Cottesloe.” Mr Collins said.

“In the unit market, Maylands, Midland, Tuart Hill, Fremantle and Claremont were the suburbs with the strongest price growth.”

Sales activity

There were fewer sales in the September 2018 quarter than there were during the June 2018 quarter.

Mr Collins said reiwa.com data showed 6,428 sales for the quarter, which was 4.9 per cent lower than last quarter.

“It’s not uncommon to experience a decline in sales during the September quarter, with West Australians typically less inclined to search for property during winter. We tend to see activity slow during the winter months before increasing again as the weather warms up,” Mr Collins said.

The share of house sales in Perth has increased, with reiwa.com data showing houses now comprise 74 per cent of all sales, compared to 65 per cent at the same time last year.

Perth’s top selling suburbs for house sales during the September 2018 quarter were Baldivis, Canning Vale, Morley, Dianella and Gosnells, while the suburbs to record the biggest improvement in house sales activity were Cooloongup, The Vines, Alexander Heights, Mirrabooka and Wattle Grove.

“It’s a good time to buy, which is reflected in the fact a higher proportion of houses are now being sold. This shift in the composition of sales (houses, units and land) indicates buyers are more inclined to purchase a house than they might have otherwise been. This can be attributed to housing affordability improving across the metro area, which has made buying a house a more attainable property purchase,” Mr Collins said.

“We’ve also seen an increase in activity between the $350,000 and $500,000 price range during the September quarter, which is pleasing as it indicates first home buyers remain an active component of the Perth market.”

Listings for sale

There were 13,850 properties for sale in Perth at the end of the September 2018 quarter.

Mr Collins said stock levels across the metro area had declined 3.7 per cent during the quarter.

“It’s pleasing that, although there were fewer sales this quarter, listing stock continues to be absorbed.

“This is the third consecutive quarter we’ve seen listings for sale decline, which is a positive step forward in the market’s recovery,” Mr Collins said.

Comments (0)

01 October 2018

By portermathewsblog

via reiwa.com.au

Author: REIWA President Hayden Groves

Real estate transactions are complex. For many West Australians, it can be a challenge to determine their individual rights and responsibilities when it comes to dealing with property issues.

Real estate transactions are complex. For many West Australians, it can be a challenge to determine their individual rights and responsibilities when it comes to dealing with property issues.

REIWA launched a public information service in 1992 to assist buyers, sellers, tenants and landlords navigate their property journeys. This valuable service allows members of the WA public dealing with a REIWA agent to find answers to their real estate queries and concerns.

Last financial year more than 20,000 phone calls were placed to the REIWA Information Service (2,000 more than the previous financial year), with West Australians seeking clarification and assistance from the Institute on a wide range of real estate matters.

As the WA market has slowed these past few years, the REIWA Information Service has seen call volumes increase. Residential property management continues to be the most common topic the public ring about, with 70 per cent of all phone calls for the year to date received from tenants and landlords. The remaining 30 per cent of calls have generally related to residential sales.

When it comes to WA tenants, they most commonly call REIWA to discuss the early termination of their rental lease. They also want to know what rights their landlords have to enter their property while tenanted and what rights they have with regards to repairs and maintenance.

Landlords, on the other hand, most commonly call to seek information on a tenant’s obligation to pay rent, to find out how the court system works in order to claim damages and to clarify their rights around abandoned goods.

In the residential sales market, buyers who call the REIWA Information Service generally do so to get information about their obligation to obtain finance approval within a period of time. They also commonly call to clarify their rights for the pre-settlement inspection. While WA sellers most frequently ring to find out about the settlement process, satisfying contractual conditions and to discuss buyer requests which are not addressed in the contract for sale.

The REIWA Information Service team is comprised of two full time staff members and 70 local REIWA agents who give three hours of their time every few months on a voluntary basis.

When you call up, you are given direct access to these local property experts who can educate you on areas you’re unsure about and help resolve any tricky property matters you might be facing.

If you are dealing with a REIWA agent and have a real estate query you want answered, I’d highly recommend contacting the REIWA Information Service on 9380 8200 for assistance.

Comments (0)

17 September 2018

By portermathewsblog

via therealestateconversation.com.au

The property industry is continuing to drive the Australian economy according to the latest economic growth data.

The Australian economy grew by 0.9 per cent in seasonally adjusted terms in the June 2018 quarter National Accounts released last week, with annual growth of 3.4 per cent.

Investment in new dwellings increased 3.6 per cent for the quarter, with strong results in Victoria and South Australia.

The construction industry grew by 1.9 per cent for the quarter.

Construction within the residential property sector grew by 3.1 per cent and non-residential property sector by 1.3 per cent over the quarter.

The ABS noted that the recent pickup in new dwelling investment reflected strong approvals in early 2018 which are now flowing through to commencements.

“The property industry is helping to propel economic growth to its highest level since 2012, highlighting its importance as a driver of jobs and economic prosperity,” said Ken Morrison, Chief Executive of the Property Council.

“Our national economic well-being depends on a strong property industry, supported by smart investment in vital public infrastructure for our growing cities.”

“The benefits of growth are overwhelmingly positive, but must be locked in and supported by good planning and smart infrastructure investment to ensure all Australians reap the gains,” Mr Morrison said.

Comments (0)

10 September 2018

By portermathewsblog

via therealestateconversation.com.au

Malcolm Gunning, President of the Real Estate Institute of Australia (REIA), and Leonard Teplin, Director of Marshall White debate the potential implications the most recent leadership spill could have for the residential property market.

It feels like we’ve had more leadership spills than seasons of The Bachelor, and some industry leaders are worried that Australia’s reputation for changing Prime Ministers at the drop of a hat is having negative consequences across the property market.

Director of Marshall White, Leonard Teplin says the constant change of leadership in Australia is driving residential buyer sentiment to an all-time low, and it’s the Australian public who are left to sit back and watch the fallout, again and again.

“There are no real winners, only losers. The Australian public must once again sit and watch while the effects ripple across our economy and property market,” Mr Teplin said.

“It’s no secret that every time there is an election, market sentiment drops, people delay purchases and put off big decisions until the new leader has been decided, and election promises turn into policies.

“In real estate, this sentiment is reflected in weaker conditions as buyers cautiously await the inevitable policy changes and market overcorrections that are sure to follow suit.

Industry leaders are concerned about the potential implications the leadership spill could have on the property market. Image by Adz via WikiCommons

Industry leaders are concerned about the potential implications the leadership spill could have on the property market. Image by Adz via WikiCommons

“As Scott Morrison gets set to take over as the nation’s leader, property purchasers both locally and abroad will be questioning what this change in direction will mean for them and their investments,” Mr Teplin told WILLIAMS MEDIA.

But Malcolm Gunning, President of the Real Estate Institute of Australia (REIA) doesn’t believe the leadership spill will have a drastic impact on the property market.

“I don’t think there will be any change because Scott Morrison was really the architect of the current economic policy,” Mr Gunning told WILLIAMS MEDIA.

“Tougher lending criteria introduced by the APRA, and the banking royal commission is what’s really having the biggest influence on the market at the moment.”

Jock Kreitals, CEO of the REIA agrees.

“In terms of the recent changes of Prime Ministers and Ministers, I do not see any impact on the market attributable to this. The policy of the Coalition regarding negative gearing and CGT remains unchanged.

“The PM as the previous Treasurer has reiterated the position a number of times. Further, the PM well understands the impact of changes in policy having worked in a policy role in the property sector,” Mr Kreitals told WILLIAMS MEDIA.

Real Estate Institute of New South Wales (REINSW) CEO, Tim McKibbin says the new Prime Minister should put good fiscal policy ahead of economically damaging, populist politics.

“Those advocating for removing the deductibility of expenses incurred in earning assessable income in the residential property market are damaging people’s ability to acquire a home,” Mr McKibbin told WILLIAMS MEDIA.

“This is adversely impacting the property industry – Australia’s biggest employer – and playing petty politics in the misguided belief it will promote their personal brand.”

Potential implications for foreign investment revenue

Mr Teplin believes the latest leadership spill could impact international investment revenue.

“A stable government is a pillar of optimised liveability and one of the main reasons Australia has enjoyed a consistent influx of foreign investment into the real estate market, in turn driving the delivery of new infrastructure and economic progress,” Mr Teplin said.

This recent setback could be detrimental for Australia’s international investment revenue, “which serves a much-needed portion of the market that drives new residential supply and delivers stock to the rental market,” Mr Teplin continued.

Mr Gunning told WILLIAMS MEDIA the message the government is sending to overseas investors is what worries him the most.

“Our government seems to be very stable – and I’m not talking about leadership changes – but both parties are reasonably well aligned in policy. What sends the discouraging message is the tightened immigration and the taxing of foreign investors,” Mr Gunning said.

“Chinese investment into Australia’s residential property market has stopped, and I can say with conviction that the message this sends back to China is that they’re not welcome. So it’s more about the message it sends by the government rather than the changes in leadership.”

“It will take investors out of the market”

If Labor were to win the next election, as it appears they will, Mr Gunning says the rental market will suffer.

“Labor is absolutely rusted on to negative gearing. They are of the opinion that it will help affordability, which is completely incorrect. What it will do is drive up rents because there will be fewer people buying investment property,” Mr Gunning said.

“There has been 13 per cent growth in rent over the last five years, which is historically low and below inflation. If Labor gets in, it will take investors out of the market which will hinder supply – up goes the demand and the cost of rent.”

Mr Kreitals told WILLIAMS MEDIA that if Labor were to be elected, the current market falls would be “exacerbated”.

“Labor has on many occasions, including recently, reiterated the position that it took to the 2016 election to change negative gearing and CGT arrangements. In the lead up to the 2016 election, a number of studies were undertaken to examine the impact of such changes. In short, housing prices will fall and rents will go up.

“SQM Research, for example, forecast that in the first year of the policy, prices would fall by up to 3 per cent, and by up to 8 per cent and 4 per cent in the following two years.

“It needs to be remembered that at the time of the 2016 election, property prices were rising. Introduction of Labor’s measures would exacerbate the current market falls and flow on to the construction industry and economic growth,” Mr Kreitals said.

Industry leaders debate the implications the leadership spill could have on the property market. Image by Maxmillian Conacher via Unsplash.

Industry leaders debate the implications the leadership spill could have on the property market. Image by Maxmillian Conacher via Unsplash.

And if stability is the cornerstone of sound investment, Mr Teplin says buyers will look to take their money elsewhere for more predictable returns in safer markets.

“As sentiment plummets and the population continues to grow faster than new stock can be delivered to meet the market, now more than ever we need a strong, stable, united government to help rebuild the real estate market and deliver stock to where it is most needed,” Mr Teplin said.

“Political in-fighting isn’t just bad for business on a global scale – its effects are felt right across the property market long after party room vengeance has been executed.”

Affordability improving for renters, first home buyers

The June quarter 2018 edition of the Adelaide Bank/REIA Housing Affordability Report found that affordability has improved for renters and the number of first home buyers increased during the second quarter of 2018.

The number of first home buyers increased to 28,401 – an increase of 7.3 per cent during the quarter and an increase of 20.6 per cent in the June quarter of 2017.

First home buyers now make up 17.8 per cent of the owner-occupier market, compared with 14.3 per cent at this time last year.

Rental affordability improved in New South Wales, Victoria, Queensland, South Australia and Tasmania, remained steady in Western Australia and declined in the Northern Territory and the Australian Capital Territory.

New South Wales remains the least affordable state for renters, where the proportion of income required to meet rent repayments is 28.8 per cent – 4.7 percentage points higher than the national level.

Scott Morrison admitted last year that Australia has a housing affordability problem and announced a number of measures in the May budget.

“There are no silver bullets to make housing more affordable. But by adopting a comprehensive approach, by working together, by understanding the spectrum of housing needs, we can make a difference,” Mr Morrison said at the time.

Mr Kreitals told WILLIAMS MEDIA it’s worth considering the importance of property to the economy, highlighted by the latest GDP figures.

“For the quarter, the economy grew by 0.9 per cent and 3.4 per cent for the year, which is the fastest rate of growth since the September quarter 2012.

“The property industry is continuing to drive the Australian economy with investment in new dwellings increasing 3.6 per cent for the quarter. The construction industry grew by 1.9 per cent for the quarter and 5.5 per cent over the year,” Mr Kreitals said.

Comments (0)

04 September 2018

By portermathewsblog

via therealestateconversation.com.au

Jon Bahen, director of Abel Property – Cottesloe told WILLIAMS MEDIA about building inspection reports in Western Australia, including what they are, why you need one, and what they cover.

What is a building inspection report? And do you need one?

For most people purchasing a property is one of the biggest financial decisions they will make in their life and it is always important to ensure due diligence on the home has been done. A building inspection report can be part of this process and is a great way to protect your interests and peace of mind.

In most circumstances, a building inspection report is included as a condition of the Contract for Sale. The investigation for this report needs to be carried out by a qualified building inspector, surveyor or builder and the cost for this report is borne by the buyer.

There are a number of different types of building reports with different cost structures. For example, a basic structural inspection can be obtained for $280 for a single level three bed, two bath, brick and tile/metal home with slab on the ground, while a premium inspection which is usually used is around $495. This expenditure is a wise investment considering the potential cost of buying a property that needs extensive unexpected restoration and repairs.

What does a building inspection report look like?

The report will include photos and address of the property, name of the applicant, the time and date and the age of the home. It also lists the name, contact details, and qualifications of the inspector, including their WA Builders Registration number.

Next, a summary of the significant findings will be highlighted to ensure the prospective buyer can easily see what necessary or immediate repairs are required.

The report will contain explanations of the definitions used by the inspector to record the condition of the property and any disclaimers and information about what is not reported on.

The remainder of the pages will contain photos and detailed room-by-room information on the condition of the floors, walls, ceilings, doors, and all fixtures including bathroom and kitchen appliances.

What does a building inspection report cover?

The inspection covers a visual assessment of the property and provides an opinion regarding its general condition. An estimate of the cost to repair the defects is not within the scope of the Australian Standard and does not form part of a report. If the property is part of strata or company title, the inspection does not cover common property, only the immediate interior and exterior.

The electrical and plumbing systems are only checked for basic functioning. If the buyer requires a more detailed report on these systems, they will need to employ licensed professional plumbers or electricians.

Comments (0)

20 August 2018

By portermathewsblog

via www.therealestateconversation.com.au

Reaching the 25 million population milestone should be the catalyst for the creation of productive, vibrant and liveable cities that will underpin Australia’s future prosperity.

Source: Reiwa

Source: Reiwa

Australia’s future rests overwhelmingly with our cities and their ability to become high amenity, high liveability engines of our economy,” said Ken Morrison, Chief Executive of the Property Council of Australia.

“Our population is growing strongly and most of that growth is occurring in our cities. We need to redouble our focus on policies that support investment, planning and collaboration to create the great Australian cities of the future.

“Population targets, decentralisation policies or adjusting immigration rates can’t allow us to take our eyes off the main game which must be our ability to create great cities for current and future generations of Australians.

“The growth of our cities is part of an international trend for cities to be a magnet for people, business, investment and economic and cultural activity.

“We’re not alone in needing to plan, invest and manage for change as the worldwide trends towards urbanisation gathers pace in this ‘metropolitan century’,” Mr Morrison said.

The drivers of urban growth were set out in the ‘Creating Great Australian Cities’ research published by the Property Council earlier this year.

It highlighted the growing economic importance of cities around the world, and set out a series of principles and recommendations based on the experience of other fast growing cities of similar size to Australia’s. These cities are capturing an expanding share of business, immigration, visitors, talent and capital flow.

The report found that Australian cities had strengths, including their economic performance investment attraction, higher education and natural environment but they were performing poorly in several key areas critical to success in the metropolitan century, including issues such as transport congestion, fragmented systems of governance, infrastructure investment and limited institutions at a metropolitan scale to manage growth.

“Our cities are at the heart of Australia’s economic, social and cultural life, attracting people, investment and services that drive innovation, creativity and enterprise,” Mr Morrison said.

“Any population policy that doesn’t strengthen Australia’s ability to create great cities of the future is completely missing the mark.

“Our cities are already a great competitive advantage for Australia, bringing together the people, services and infrastructure to drive our economic competitiveness.

“We need to keep investing in the right infrastructure, plan for a growing future and put in place smarter systems of metropolitan governance to capture the full potential of the metropolitan century while sustaining the quality of life and access to services that Australians value.

“We need to take on both the challenges and opportunities of the ‘metropolitan century’ and not run away from the reality that growing cities can be successful cities and great places for people to live and work.

“With the right planning, policies and ambition, we can create truly great cities for a growing Australia,” Mr Morrison said.

Comments (0)

13 August 2018

By portermathewsblog

via therealestateconversation.com.au

As we head into 2018, I believe this year will be one of market transition across the country.

It will also be a year of finance, with those who can secure it likely to be the ultimate winners. It’s no great surprise that Sydney and Melbourne are transitioning out of the strong price growth they’ve experienced over recent years.

However, that doesn’t necessarily mean they’re going backwards. Instead, their growth may fall back to one or two per cent annually. That market transition will be driven by reduced consumer confidence, which is a reflection of the price of money as well as how easy it is to secure finance. Confidence also usually wanes when the media starts speculating about softer market conditions.

It’s clear that Sydney’s market has already come off the boil and Melbourne’s is likely to follow suit but in a more moderate way.

Positive transition

It’s important to realise that transitions happen in both directions, with some markets slowing while others are strengthening. I believe this will certainly be the case for Brisbane, which is on track to transition to stronger market conditions.

That said, Brisbane is a city of different markets with the inner-city in the midst of it’s well-publicised new unit oversupply. It is Brisbane’s outer suburbs that represent good value and cash flow, as well as attractive lifestyle drivers, that will experience the most improvement in my opinion.

Of course, there are already increasing numbers of interstate migrants into Queensland given it’s housing affordability as well as it’s many attractive lifestyle opportunities.

SA and WA back in the game

I also believe it will be a year of positive transition for South Australia and Western Australia. South Australia always seems to lag behind other capital cities and by the time most investors realise what’s happening it’s too late. The truth is that South Australia’s transition is already happening.

In Adelaide, however, it’s only the 15-minute ring around the CBD as well as areas like Christies Beach that are worth considering. We all know WA has been woeful over recent years, but this could be the year it finally turns a corner. The State Government has been concentrating on jobs growth, with employment numbers reportedly starting to improve. If locals start spending money because they’re more confident about their livelihoods, then, that in turn will stimulate the market.

However, when I say WA, I mean Perth and select areas within the city as well. If interest rates increase, even if only by a blip, those green shoots of confidence might evaporate as fast as they appeared. Tasmania will continue to percolate until cash flow doesn’t look as attractive as other areas, such as Brisbane. I remain skeptical about Tasmania’s growth because it’s mainly being driven by investors chasing investors purely because of affordability.

Owner-occupiers aren’t the ones who are pushing up prices.

I believe it may lurch from under-supply to over-supply pretty quickly – and then you’ll probably have 10 years of no price growth at all.

A question of money

We’re now into our third calendar year of lending restrictions and I don’t believe they’re going anywhere anytime soon. Investor numbers have only recently started to slow so there will need to be more evidence before APRA loosens it’s grip on investment lending. Banks might want more flexibility but it’s unlikely to happen. So 2018 will be a year of market transition but it will also be a year of finance. The price of money remains cheap but it’s availability continues to be constrained.

That’s why I believe it will be the sophisticated investors who know which markets are transitioning to the positive – and who can secure finance – who will be the property victors by the end of the year.

Comments (0)

07 August 2018

By portermathewsblog

via https://www.therealestateconversation.com.au

Property prices in Perth have strengthened during the June 2018 quarter, according to fresh research from the Real Estate Institute of Western Australia (REIWA).

Simon McGrath, principal of Abel McGrath in Perth told WILLIAMS MEDIA now is the time to “be strategic and make a committment to securing a property in that location you’ve always wanted”, as data from the Real Estate Institute of Western Australia reveals property prices in Perth are strengthening.

REIWA President, Hayden Groves told WILLIAMS MEDIA the data indicates Perth’s median house price would settle at around $520,000 for the June 2018 quarter, which was up one per cent compared to the March 2018 quarter and two per cent compared to the June 2017 quarter.

“In addition, Perth’s median unit price is expected to lift by 4.9 per cent to $419,500 for the June 2018 quarter, which is 2.3 per cent higher than the same time last year,” Mr Groves said.

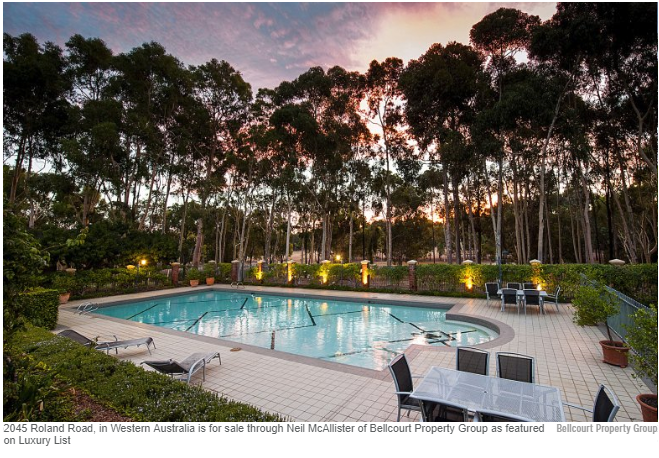

2045 Roland Road, in Western Australia is for sale through Neil McAllister of Bellcourt Property Group as featured on Luxury List

2045 Roland Road, in Western Australia is for sale through Neil McAllister of Bellcourt Property Group as featured on Luxury List

“After declining during the March quarter, it is pleasing to see prices rebound strongly this quarter. With the worst of the market downturn appearing over, the improvement in house and unit prices this quarter suggests buyer confidence is returning which should bode well for sellers as we move into spring,” Mr Groves said.

Mr McGrath’s advice to those looking to enter the market is to act now.

“At times like these, properties become available that would generally not be available. That is the big gift in this market,” McGrath said.

Overall, Mr McGrath says the market is “okay, but not great”.

“Perth is nothing but a big mining town. The flow-on effect from the mining industry affects Perth’s real estate market, so you’ve got a real upswing. Behind the scenes there is plenty of optimism.

“There is still plenty of caution in the market, prices aren’t shooting up. It is a very stoic market.

“We are seeing reasonable numbers at home opens, but it can be very spasmodic. Some home openings will be fantastic, others very quiet – there is no rhyme or reason to it,” Mr McGrath continued.

With 6,900 sales recorded during the June 2018 quarter, sales volumes declined during the June quarter. Mr Groves said the onset of winter likely contributed to subdued activity levels.

“It’s not uncommon for activity to drop off this time of year. Traditionally, activity tends to slow during the winter months before picking up again in spring,” Mr Groves said.

2045 Roland Road, in Western Australia is for sale through Neil McAllister of Bellcourt Property Group as featured on Luxury List

2045 Roland Road, in Western Australia is for sale through Neil McAllister of Bellcourt Property Group as featured on Luxury List

Despite the overall decline in sales, numerous suburbs recorded more sales this quarter than they did in the last quarter.

“The suburbs with the biggest improvement in house sales were North Perth, Queens Park, Singleton, Camillo and Beldon, while West Perth, Balcatta, Rockingham, Claremont and Mount Lawley had the biggest improvement in unit sales,” Mr Groves said.

“Good quality family homes attracting a lot of attention”

REIWA data shows the composition of sales shifted during the June quarter, with more house sales recorded in the $800,000 and above price range than in the last quarter.

“The June 2018 quarter continued the trends observed during the December 2017 quarter, with good quality family homes attracting a lot of attention in aspirational areas,” Groves told WILLIAMS MEDIA.

“As the Western Australian economy begins to regain strength and owner-occupier loans remain the most affordable they have been in decades, buyers are recognising there is good opportunity to secure a family home in areas that might previously have been considered out of reach,” Mr Groves said.

Listing stock has “hit the ceiling”

Mr Groves told WILLIAMS MEDIA stock levels across the metro area have declined 1.1 per cent during the June 2018 quarter.

“We certainly appear to have hit the ceiling as far as listing stock is concerned. Despite fewer sales being recorded this quarter, it is encouraging to see stock levels have continued to be absorbed,” Mr Groves said.

On average, it took 67 days to sell a house in Perth during the quarter, one day faster than both the March 2018 and June 2017 quarters.

2045 Roland Road, in Western Australia is for sale through Neil McAllister of Bellcourt Property Group as featured on Luxury List

2045 Roland Road, in Western Australia is for sale through Neil McAllister of Bellcourt Property Group as featured on Luxury List

Mr McGrath told WILLIAMS MEDIA that although the market is pretty tough, his area in the western suburbs of Perth have short supply.

“There’s no denying – it is pretty tough. The good news in the western suburbs is that we have got short supply, whereas in the greater Perth market there is oversupply in many places. The short supply in the western suburbs is ticking the value of buoyance.” Mr McGrath said.

Less vendors discounting their asking price

Data for the June 2018 quarter shows the proportion of vendors who had to discount their asking price in order to achieve a sale declined by five per cent.

“With reductions observed in average selling days and discounting, this is a good indicator sellers are listening to the advice of their agents and pricing their property in line with market expectations,” Mr Groves said.

Comments (0)

30 July 2018

By portermathewsblog

via The West Australian

The West Australian economy is “out of the woods”, one of the nation’s most respected forecasters has declared, with housing and wages finally gaining traction.

Amid warnings the Turnbull Government was making the same mistake of the Howard government by spending a temporary revenue bump on expensive personal income tax cuts, Deloitte Access Economics said the outlook for WA was definitely brightening.

The State endured its worst year on record through 2016-17 while the domestic economy had been in the doldrums for the past four years. But a string of data, including job figures, point to an important turnaround.

Deloitte Access director Chris Richardson said it was now clear WA was recovering from the economic “wave” that was the end of the mining boom.

He expects a lift in retail sales, population growth, wages and housing construction will all improve through this year and accelerate into 2019-20.

Wage growth alone is tipped to more than double the insipid 0.6 per cent growth endured by private sector workers last financial year. “WA’s economy is out of the woods, but it isn’t quite yet out of the doldrums,” Mr Richardson said.

“The good news is that WA’s economy is gradually making its way on to a more settled and sustainable path. The State is restructuring and rebalancing and looking for non-mining related sources of growth.”

While most focus has been on the collapse in engineering spending by the mining sector, Deloitte Access highlighted the step-up by the State Government to fill the void.

It said the first stage of the $3 billion Perth Metronet, which includes 72km of rail line and 18 stations, would give a needed boost to the local economy. The situation is a little different for the Federal Budget, with Deloitte Access concerned that recent tax cuts are built on a mirage of improved tax revenues.

Mr Richardson said tax cuts were built on an increase in tax revenues that was likely to be transitory. The Budget was also expecting to absorb the cuts while it was still in deficit.

He said a gradual slowdown in China would eat into the better tax collections from the resources sector while a tightening of credit would hit east coast property markets. “Oz has repeated an old mistake: spending a temporary revenue boom on permanent promises,” he said.

Comments (0)

23 July 2018

By portermathewsblog

via therealestateconversation.com.au

Real estate in Perth is at its most affordable on record, as falling prices give first home buyers their best chance of stepping onto the property ladder, according to the Housing Industry Association (HIA).

37 Marita Road, Nedlands, Perth under offer with Michelle Kerr from Abel McGrath as featured on Luxury List. Abel McGrath

37 Marita Road, Nedlands, Perth under offer with Michelle Kerr from Abel McGrath as featured on Luxury List. Abel McGrath

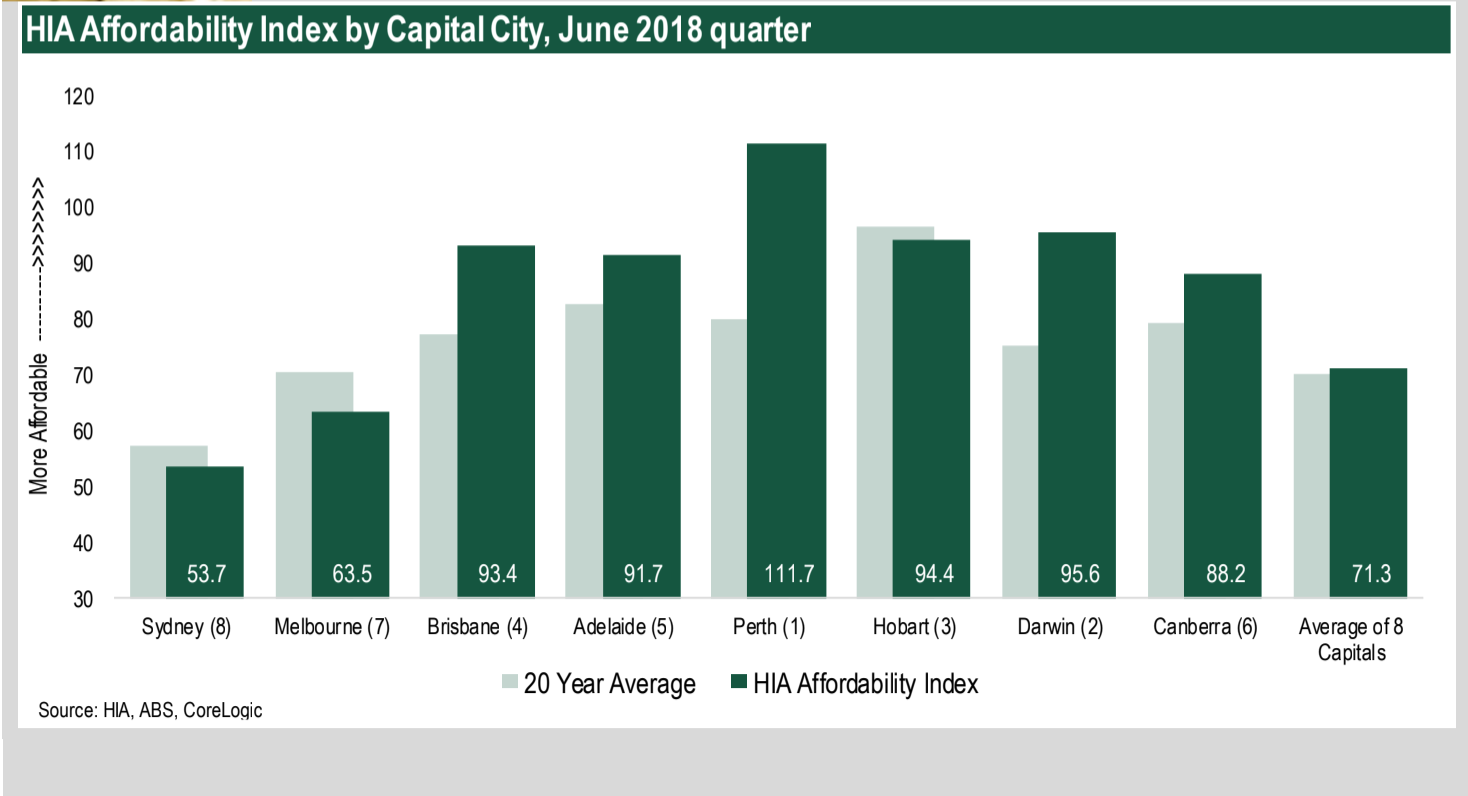

Figures from the Housing Industry of Australia (HIA) Affordability Index show Perth is the most affordable of the nation’s capital cities.

In the June 2018 quarter, the Housing Industry of Australia (HIA) Affordability Index registered 74.9, up by 0.4 per cent over the quarter and up by 0.8 per cent compared with a year earlier when affordability had reached its poorest level in nearly six years.

The HIA Affordability Index is designed so that a result of exactly 100 means that precisely 30 per cent of earnings are absorbed by mortgage repayments.

Higher results signify more favourable affordability – those above 100 signify that mortgage repayments account for less than 30 per cent of gross earnings, whereas scores below the 100 mark mean that more than 30 per cent of average earnings are absorbed by mortgage repayments.

According to HIA’s analysis, Perth is the most affordable capital city to buy a home in with an affordability rating of 111.7, closely followed by Darwin (95.6), Brisbane (93.4), and Hobart (94.4).

37 Marita Road, Nedlands, Perth under offer with Michelle Kerr from Abel McGrath as featured on Luxury List.

“Perth continues to present good opportunities for buyers, especially in the more affordable end of the market,” President of the Real Estate Institute of Western Australia (REIWA) Hayden Groves told WILLIAMS MEDIA.

In news that will surprise approximately no one, Sydney remains the least affordable capital city to purchase in, with a miserable affordability rating of 53.7.

Key findings from the HIA Affordability Report

- Easing price pressures are driving the improvements in housing affordability

- Housing affordability improved in five of Australia’s eight capital cities for the June 2018 quarter – Hobart, Melbourne and Adelaide were the only capital cities to see a deterioration

- Perth is now Australia’s most affordable capital city, followed closely by Darwin and Hobart

- Mortgage repayments account for 42.1 per cent of earnings in capital cities and 34.3 per cent in regional markets

HIA Economist Diwa Hopkins says affordability is hugely improving considering this time last year, affordability was at the lowest level in over six years.

“Easing house price pressures are providing some affordability relief for home buyers.

“Previous strong price increases were met by an unprecedented level of building which is now starting to come online. This is providing much-needed additional supply in key markets, helping to reduce price pressures and ultimately improve affordability for home buyers,” Hopkins said.

Source: HIA

Source: HIA

But the current plunge in house prices is unlikely to last for long, Hopkins warns.

“With an even balance in overall housing supply and demand in these key markets, the current downturn in dwelling prices is unlikely to be prolonged or severe.

“We could expect this downturn in prices to play out like previous cycles. They typically last 12 to 18 months, with the size of the fall modest relative to the immediately preceding expansion,” Hopkins said.

Ongoing fallout from the resources boom and bust cycles to thank for price plunge

Both rent and dwelling prices have been falling in Perth and Darwn for the last five years, amid the ongoing fallout from the resources boom and bust cycles.

While this is great news for renters and buyers in a market previously notorious for poor housing affordability, Hopkins warns it may be symptomatic of wider economic problems and in particular slowing population growth.

The weak economic conditions in both of these cities are seeing more people leave for interstate than are arriving, Hopkins says.

In particular population growth has followed these cycles and currently both cities are seeing more people leave for interstate than are arriving, resulting in spare capacity in their respective housing markets.

New home building activity has also fallen sharply in both cities as a result of the price declines, which risks causing an undersupply to emerge over the longer term in Perth and Darwin.

Groves told WILLIAMS MEDIA buyers are cautious right now.

“Trade-up family home buyers are lamenting they didn’t buy six months ago when the bottom of the market was apparent. Sellers who’ve been considering selling over the past few years are now cautious about coming to market too soon in anticipation of selling for more in the short-term future, especially down-sizers looking to maximise their capital-gains-tax-free benefit.

“Investors are likely to remain cautious until they see tangible growth which is likely to be towards the end of this year,” Groves said.

The best suburbs in Perth to invest in

According to data from REIWA, the rental yield for the Perth Metro region for houses currently sits at 3.6 per cent based on the overall median house rent price of $359 per week and median house price of $512,500.

This means on average, a typical property investor can expect to generate a 3.6 per cent annual return on their house purchase price.

REIWA says the suburbs of Bullsbrook, Medina, Parmelia, Armadale, Cooloongup, Maddington, Stratton, Camillo, Warnbro and Merriwa are house rental hotspots, offering investors the best return on their investment.

9 Bates Way, Warnbro available for rent through Property Osborne Park, as featured on Thehomepage.com.au

9 Bates Way, Warnbro available for rent through Property Osborne Park, as featured on Thehomepage.com.au

“Whilst the Perth property market is showing signs of a recovery in 2018, buyers and tenants remain the beneficiaries of the current environment, with a good supply of housing and rental stock to choose from at the more affordable end of the property market,” he said.

“With our local market on the cusp of recovering, now is the time for buyers and investors to take advantage of favourable conditions before our local market becomes less affordable,” Groves told WILLIAMS MEDIA.

Chief Operations Officer for Professionals Real Estate Group in Western Australia, Shane Kempton agrees.

“In the vast majority of areas in Perth, property prices are very low and buyers should now move quickly to secure a property before the recovery in the market gains further momentum to avoid buyers regret,” Kempton told WILLIAMS MEDIA.

View the Housing Industry of Australia (HIA) Affordability Index here.

Comments (0)

16 July 2018

By portermathewsblog

via therealestateconversation.com.au

Be a smart investor and have a loan strategy.

You have saved away and have enough cash to consider purchasing property as an investment. Like any purchase, it is a huge one so having a strategy in place will keep you focused and ensure that you are doing as much due diligence as you can for a successful investment.

Not many successful investors became successful by accident – we recommend you start by seeking professional financial advice to really determine what your borrowing capacity is and how realistic your investment is.

Debt does not have to be scary, unless it is the wrong type of debt. In an ideal situation, you will want your debt to be productive and if you have planned how your cash flow will be affected, then you can have a clear understanding of how purchasing that next investment will affect your lifestyle. Productive debt in our eyes can be used as an advantage to buy an asset or generate income such as rental income.

Understanding your loan strategy

If you are looking to invest in multiple properties, we think it’s important to understand the short and long term perspective of property ownership. You have to think about how this next loan or investment is going to influence your life and your cash flow as well as what the situation might look like with your third or fourth investment. We say this as it can really make a difference in the type of property you purchase in the first place.

Think about how positively or negatively geared loans will affect what you purchase or how you live in the future. It may seem odd to be thinking so far in advance, but we think it is important to really understand your financial situation and also the results you would like to achieve as a property investor.

This is where we think it is important to be surround by the right advice. The right financial advisor for you will be able to help you plan the various scenarios to suit your end goal – after all everyone has different goals in their lives.

Comments (0)

25 June 2018

By portermathewsblog

via therealestateconversation.com.au

Many investors steer clear of vacant land because they mistakenly believe they can’t claim interest repayments on it.

In fact, the biggest thing that most accountants get wrong when advising clients on vacant land is that the interest component on it isn’t tax deductible.

I’ve had many arguments with many accountants about this topic over the years!

The key component is the clear intent to build a property within a reasonable timeframe. If the investor was audited, the investor would need to prove that the timeframe – whether it’s a few weeks or months – was necessary to enable to construct the investment property.

I’ve heard this ‘non-advice’ so many times over the years and that’s why it’s so important that you get advice from a property accountant with a strong understanding of the relevant legislation.

Which land is best?

With vacant land, there are a number of different strategies that you could implement.

The first one is residential land that is being carved up by a developer, but you buy before the titles for each individual block have been registered. Effectively, you’re buying land off the plan, but it’s important to understand that there are pros and cons to this strategy.

The pro is that if it’s in a high-demand area and you’ve bought during the early stages of development, you tend to make some money. You also generally only need to put down a few hundred or thousand dollars as the deposit. Naturally, because you are very much dependent on how fast the developer can register each block, you’re at the whim of the market, which can be a con. For example, in my portfolio, I once bought 18 blocks of land that were not yet registered.

In fact, registration wasn’t supposed to happen for another two years. However, it happened in just eight months and I wasn’t ready. So all of a sudden I had 18 parcels of land that I had to settle on, but I didn’t have my finance organised.

After discussing it with the developer, I ended up settling on four of them and he released the other 14 back to the market, which worked out well for him because the market had improved.

So, if the land is registered well ahead of time, you can be left scrambling.

On the other hand, if registration takes longer than expected, the market could have slowed down. Like any off-the-plan project, you only need one bad valuation to negatively impact

the entire subdivision or development. Plus, everyone will be building at the same time, which means you’re competing for trades and will likely be finished at the same time, too, and that means a strong likelihood of softer prices.

What about greenfield and infill sites?

When I say greenfield sites, I mean blocks of rural land that you intend to rezone for residential usage. Now this is a strategy for more advanced investors because there is more risk as well as a higher financial component required for earthworks and approval costs. Greenfield sites can be bought for an affordable price, but if you can’t get the subdivision approved you need to have the money behind you to fight all your way up to the Environment Court if necessary.

A better strategy is to target infill sites within already established residential areas.

In this scenario, you buy a larger block of land, usually with a house on it, to carve off the land at the back or the side to sell as vacant or with a new property on it.

The other option is to subdivide, then construct a new dwelling and then keep both. Infill developments can also lean towards knocking the old house down, splitting the block into two and selling the vacant land, or building two houses or even multiples. It must always come back to whether there is a market for your project and whether the numbers add up, because you must take into account all of the costs on the way in and on the way out.

That way you can make an educated decision whether to keep holding long term or take your profits to invest elsewhere.

Whichever strategy you choose, you must do your figures on the worst-case scenario to see if it adds up. That’s because land generally has a lower, or no yield to start off with, which means your holding costs can be higher than with a house, for example.

At the end of the day, vacant land as a strategy, does work. You just need to have your eyes wide open to ensure your figures are correct and you must understand that it might be a while before income rolls in.

Finally, it goes without saying that you must get tax advice from a specialist accountant who understands property. If you don’t, you could end up with pockets just as vacant as the land you’re investing in.

Comments (0)

18 June 2018

By portermathewsblog

via therealestateconversation.com.au

Buying and selling property in WA has traditionally been by way of a conventional private treaty arrangement, however buyers and sellers are missing out on a more pure form of transaction, and that’s the auction.

Granted, auctions are becoming a more accepted selling method and the numbers of weekly auctions in WA has increased significantly over the past five years, but still lag a long way behind private treaty sales and the Eastern states. So why is that we’ve been slow to jump on the auction bandwagon?

Firstly, WA’s law for property transactions using the current “Offer & Acceptance” method protect both buyer and seller and in the majority of cases are easy to follow. The system works effectively for all parties to the transaction including the buyer, seller, settlement agent/conveyancer and banks. The downside of this system is that is can be time consuming and in many cases is conditional upon buyers obtaining finance, property inspections, having to sell their current home, etc.

More importantly, the system has a major flaw in it and that’s the asking price is disclosed and typically buyers knock the price down to where they feel comfortable – so it’s not good for sellers.

So why should we look to auctions? The auction system is the most pure form of selling and buying as there are no “secrets” surrounding price or selling terms; all terms are provided in the marketing campaign and the buyers set the price on where they see value. Selling by auction in most cases is quicker than private treaty. And the seller has three bites of the cherry; sell before auction day, on auction day or usually within 30 post auction day.

There are two main misconceptions surrounding auctions:

1. They cost too much. The cost of the auction is merely the auctioneer’s fee for calling the auction and working with the seller, buyer and agent to achieve the desired result. Typically, an auctioneers’ fee is in the vicinity of $700 to $1000. All other costs are associated with the marketing campaign to promote the property.

2. Auctions only “work in expensive areas”. That’s just a suburban myth. There’s many examples of properties below the current Perth median price of $510,000 selling at auction.

WA is one of only two states, the other being Tasmania, that don’t have a cooling off period in our property contracts. A cooling off period allows the buyer to “break” the Offer to Purchase usually between 2 to 5 business days after the offer has been signed. In other words, if the buyer changes their mind for whatever reason they can legally break the offer and walk away for a very small consideration to the seller, usually between 0.2% – 0.25% of the purchase price.

As WA doesn’t have cooling off provisions in our property contracts, this makes it far too easy for sellers and agents to default to Private Treaty transactions. If cooling off provisions were introduced to our property contracts, I’d predict a huge increase in the number of property auctions taking place in WA.

Finally, too few real estate agents embrace auctions and the auction process with vigor. They lack confidence and in some cases, the ability to explain the different marketing options available to sellers and automatically default to Private Treaty. This is a marketing injustice to sellers and the sooner we can demystify and legitimise the auction process for both buyers and sellers, the better.

Comments (0)

06 June 2018

By portermathewsblog

via reiwa.com.au

The latest REIWA Curtin Buy-Rent Index for the March 2018 quarter has revealed it’s the best time to buy in Perth since 2013.

The latest REIWA Curtin Buy-Rent Index for the March 2018 quarter has revealed it’s the best time to buy in Perth since 2013.

The Index, released quarterly, assesses whether it’s better to buy or rent in Perth based on past and current trends in the economic and property market climate.

REIWA President Hayden Groves said the March 2018 quarter index showed the annual rate of house price growth required over 10 years to break even in the Buy-Rent Index had declined from 3.3 per cent to 3.1 per cent over the quarter, suggesting an improvement for prospective homebuyers weighing up the decision.

“To put that into perspective, Perth’s annual house price growth rate has been 5.9 per cent for the last 15 years. Based on the March 2018 quarter Index, house prices in Perth would only need to grow by more than 3.1 per cent annually for buying to be considered more financially beneficial than renting,” Mr Groves said.

“This improvement in buying conditions can be attributed to the Perth median house price softening by 1.9 per cent during the March quarter, while the median house rent price increased $5 to $360 per week. We also saw the 10 year average mortgage rate drop to 6.43 per cent, which means home owners are paying less on their mortgage repayments.

“This is the most affordable buying environment we’ve seen in Perth for some time, so if you’ve been weighing up whether to buy, now is the time to take advantage of favourable market conditions,” Mr Groves said.

Mr J-Han Ho, a Property Researcher and Senior Lecturer in the School of Economics and Finance at Curtin University, said the data indicated a continued improvement for the home buyer in the near future.

“Our analysis shows home buyers gaining an advantage, largely due to the low interest rates for home loans, home ownership costs continuing to be affordable and the median rents stabilising,” Mr Ho said.

View the March 2018 quarter Buy-Rent Index.

Comments (0)

21 May 2018

By portermathewsblog

via reiwa.com.au

First home buyers are active in Perth’s property market, with data for the March 2018 quarter revealing an increase in sales for properties priced $500,000 and below.

First home buyers are active in Perth’s property market, with data for the March 2018 quarter revealing an increase in sales for properties priced $500,000 and below.

REIWA President Hayden Groves said after observing subdued first home buyer activity during the December 2017 quarter, it was pleasing to see the lower end of the market strengthen early in 2018.

“The final quarter of 2017 saw the composition of the Perth market shift. Last quarter there were significantly more sales in the higher priced end of the market and less in the first home buyer price range. It’s been a different story this quarter, with the balance of sales shifting back to the lower end of the market,” Mr Groves said.

Median house and unit price

Perth’s preliminary median house price is $510,000 for the March 2018 quarter.

Mr Groves said once all sales settle, this figure was expected to increase to $517,000, which would put the March 2018 quarter median marginally lower (by 0.6 per cent) than the December 2017 quarter.

“Although Perth’s median house price experienced a minor adjustment during the March 2018 quarter, the median house price is up 0.4 per cent when compared to the same time last year, which shows prices are stable,” Mr Groves said.

Perth’s preliminary median unit price is $401,000 for the March 2018 quarter.

“This is expected to lift to $410,000 once all sales settle, which would put it equal with the December quarter median.

“These results are in line with REIWA’s 2018 forecast, which expects stable conditions throughout the remainder of this year, with moderate price growth during the next 12 months,” Mr Groves said.

Sales activity

Preliminary Landgate data shows there were 5,865 dwelling sales during the March 2018 quarter.

“We expect around 6,603 sales for the quarter overall, which is marginally lower than volumes recorded during the December quarter,” Mr Groves said.

There was a 5.7 per cent increase in house sales in the sub-$500,000 price range during the March 2018 quarter.

“Increased activity in the lower end of the market is usually a sign first home buyers are active. We are fortunate the dream of home ownership is more attainable for West Australians than it is on the east coast. After seeing activity drop off last quarter, it’s good to see first home buyers are increasing their presence in the market,” Mr Groves said.

Listings for sale

There were 14,413 properties for sale in Perth at the end of the March 2018 quarter.

Mr Groves said listings had increased 10.2 per cent over the quarter, but were down 2.9 per cent when compared to the March 2017 quarter.

“While it is pleasing listings have declined on an annual basis, the increase over the quarter is not cause for alarm. With overall sentiment in WA improving and all signs indicating the market has begun to turn, sellers are feeling more confident than they have been and therefore more inclined to put their property up for sale.

“We’ve also seen a sharp decline in rental listings over the past year which has had a flow-on effect to the established market. With some investors choosing to sell their rental property instead of lease it, this has contributed to the rise in the number of properties for sale in Perth,” Mr Groves said.

Average selling days

It took 67 days on average to sell a house in Perth during the March 2018 quarter.

Mr Groves said although average selling days increased over the quarter, it was still two days quicker to sell than it was during the March 2017 quarter.

“With more listings on the market, buyers now have more choice, which has had an impact on the time it takes to sell. It’s very encouraging though, that on an annual basis, we’re seeing average selling days decrease,” Mr Groves said.

Comments (0)

14 May 2018

By portermathewsblog

via reiwa.com.au

With steady rents, declining listings, improved leasing figures and faster leasing times, data for the March 2018 quarter reveals Perth’s rental market is leading the charge in Perth’s property market recovery.

With steady rents, declining listings, improved leasing figures and faster leasing times, data for the March 2018 quarter reveals Perth’s rental market is leading the charge in Perth’s property market recovery.

REIWA President Hayden Groves said the first quarter of 2018 showed Perth’s rental market had strengthened, with improvements recorded across all key indicators.

“Perth’s rental market appears to be building on the momentum of the latter half of 2017, which is very encouraging – not just for the rental market, but also for the overall property market. Historically, the sales market follows the rental market during a recovery,” Mr Groves said.

Median rent prices

Perth’s overall median rent price is $350 per week for the March 2018 quarter.

Mr Groves said this was the twelfth straight month of stable rent prices, with no changes recorded since April 2017.

“All sub-regions experienced stable median prices except for the South West sub-region, which saw its overall median rent price increase $10 to $330 per week during the quarter,” Mr Groves said.

reiwa.com data shows there was a $5 per week increase to both the median house and median unit rent during the March 2018 quarter.

“The median house rent increased to $360 per week, while the median unit rent increased to $325 per week,” Mr Groves said.

“It bodes well for landlords that the house and unit median rents are improving simultaneously.”

Leasing activity

There were 14,112 rental properties leased in Perth during the March 2018 quarter.

“Leasing volumes for the March 2018 quarter are up 4.2 per cent compared to the December 2017 quarter,” Mr Groves said.

“Four out of the five sub-regions saw an improvement in leasing volumes, with the Central sub-region (up 7.7 per cent) and North East sub-region (up 6.1 per cent) the stand-outs.”

At a suburb level, reiwa.com data shows East Cannington, St James, North Fremantle, Ellenbrook and Booragoon saw the biggest growth in leasing activity levels over the quarter.

Listings for rent

Rental listings declined 4.5 per cent during the quarter, with 8,508 listings recorded at the end of March 2018.

Mr Groves said there had been a substantial reduction in the number of rental properties available in Perth over the last 12 months.

“Compared to the March 2017 quarter, listings for rent are now 18.6 per cent lower than they were at the same time last year. This can be attributed to an increase in population growth to the state and fewer new dwelling commencements occurring in the metro area,” Mr Groves said.

Average leasing time

It was two days faster to lease a property during the March 2018 quarter than it was during the December 2017 quarter.

“It took 47 days on average for landlords to find a tenant during the March quarter, which is two days faster than the December quarter and three days faster than the March 2017 quarter,” Mr Groves said.

“With stock levels declining and leasing activity increasing, the Perth rental market is finally starting to re-balance. For tenants, now is a good time to secure a longer-term lease before rents rise.”

Comments (0)

23 April 2018

By portermathewsblog

via domain.com.au

In Australia’s perpetually crowded rental market, the odds of securing any sort of home – let alone one that ticks all your boxes – can seem daunting.

Fast-increasing prices and the advent of so-called “rental bidding” further complicate the picture. And during the summer months, fluctuations in stock can create wildly variable conditions from week to week.

But there is reason to be optimistic. Despite perceptions that the rental market is somehow rigged – particularly in large cities such as Sydney and Melbourne – agents and advocates say that ordinary Aussies stand a good chance of renting in 2018.

Consider house-hunting in early January when there is less competition. Photo: Edwina Pickles

Consider house-hunting in early January when there is less competition. Photo: Edwina Pickles

If you understand what landlords are looking for, are willing to take care during the application process and choose the most appropriate month to search, you might be surprised by what you can secure.

1. Always write a cover letter

Few agents ask for one, but including a cover letter with your application can dramatically improve your chances of securing a rental.

Crucially, a one-page cover letter can find its way to the landlord, who is almost never present at inspections but has final say over who is granted the lease.Making a personal connection with the landlord through a cover letter can be very valuable.

Make sure you have all your documentation ready before the inspection. Photo: Pat Scala

Make sure you have all your documentation ready before the inspection. Photo: Pat Scala

“Make it a good story,” says Eileen Carroll, sales director of Ray White Glebe. “Tell us why you’re the best person for the property. A little story about yourself will help your cause.”

2. Gather everything you’ll need – and then some

While some agents do not require additional documentation such as proof of ID and written references to be supplied at the time of application, Carroll says prospective tenants should submit these documents anyway.

“Have it all ready, so if you are accepted, you can actually secure the property,” she says. “If I’m chasing people for these documents before they’ve even signed the tenancy, alarm bells start to ring.”

Agents may move on to the next applicant if you don’t have your deposit ready. Photo: Dan Soderstrom

Agents may move on to the next applicant if you don’t have your deposit ready. Photo: Dan Soderstrom

Providing ample references and other documents from the outset can also give you an advantage over less organised applicants.

“If someone submits an application with just a payslip from a month ago and a passport, it’s not really that interesting to me,” Carroll says. “But if the application has a covering letter, two current payslips, a personal or work reference and they’ve completed their 100 points of ID, I’m impressed.”

3. Apply online if you can

Scanning your hard-copy documents and completing an online application form may be irksome and time-consuming, but for agents it’s a godsend.

Even if a property is popular, don’t be tempted to pay more than the advertised price. Photo: Eddie Jim

Even if a property is popular, don’t be tempted to pay more than the advertised price. Photo: Eddie Jim

“I had eight properties open two weeks ago and I leased all of them,” explains Carroll, “so the paperwork was miles long. Online applications make my life easier.”

Most online application forms also include a section for additional comments, so make sure you use it. “The standard form we use actually asks applicants to explain why they like the property in question, and I find that really helpful,” Carroll says. “It’s the first thing I go to now in the application because it gives me a better indication of who we’re dealing with.”

4. Think carefully before offering more than the listed price

Australia’s chronic shortage of inner-city housing has led to an increase in so-called “rental bidding”: offering more than the asking price in order to beat out the competition.

Leo Patterson Ross, advocacy and research officer at the Tenants Union of New South Wales, concedes that this strategy can be effective for those who can afford it. But he cautions that rental bidding can set a dangerous precedent.

“It’s pushing up prices not only for others but for yourself,” he says. By indicating a willingness to pay more than advertised, tenants may increase the likelihood of further rent rises in future, which could ultimately make the property unaffordable.

5. Be ready to pay your deposit

Having your application approved does not guarantee that the agent will hold the property for you. “If I call someone in the morning, tell them their application has been approved and ask for their deposit, and they say, ‘Oh, I’ll pay it later this afternoon’, I automatically go to the next application,” says Carroll.

“If they’re going to pay it later that afternoon, that tells me they’re waiting on the outcome of another application or they can’t afford my property.”

Carroll says delaying payment of your deposit by even a few hours can be risky. “I don’t want to lose my other applicants waiting for a deposit to be paid. Waiting a day for the deposit could mean my other applicants have moved on to other properties.”

6. Choose the most suitable month to apply

Unlike most of the year, when the number of properties on the Australian rental market is relatively stable, the months of January, February and March vary wildly in terms of volume.

According to Domain data, rental listings are at their lowest levels between late December and late January, when much of the country is on holiday. But some rental properties are open for inspection during this time.

Carroll says house-hunting in quiet early January can mean less competition and a better chance of striking up a relationship with a rental agent.